What’s Better? Dealing Desk vs No Dealing Desk Forex Brokers

Before you choose a broker it’s important to understand and learn that not all brokers are the same.

There are different types of Forex brokers that run their business through different trading models.

When you trade in the Forex market you need to know who you are trading against and exactly where you order is going for execution as this will give you a solid understanding of how the Forex market works.

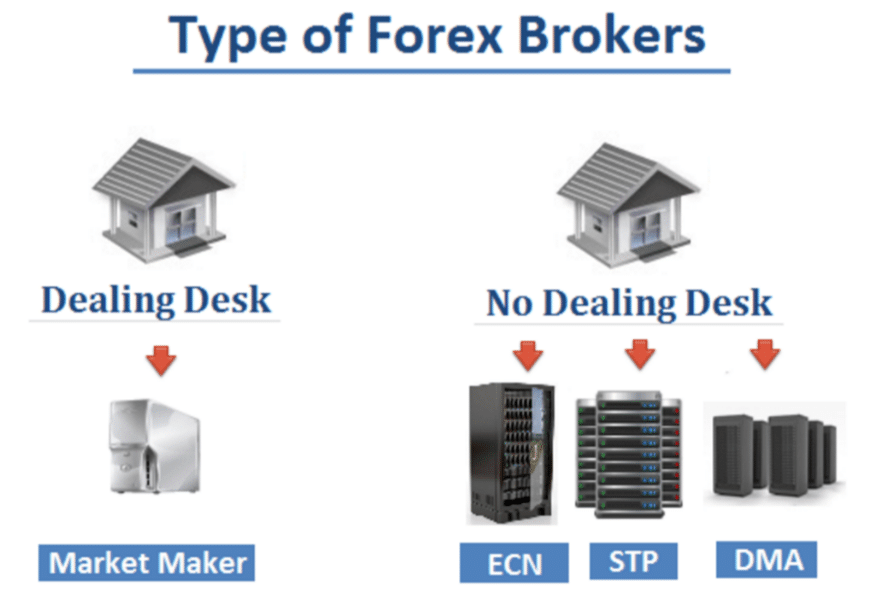

There are two different types of Forex Brokers:

- Dealing Desk Brokers;

- No-Dealing Desk Brokers;

Dealing Desk Forex Broker

A Dealing Desk broker is also called a market maker because they make the market for their clients providing them with the liquidity to execute their trades.

In this execution model when you trade profitably you make money off the dealing desk broker.

On the other hand, your broker profits from your trading losses. This also means that you trade against your broker and your order is not being sent to the real inter-bank market.

Since the Dealing Desk broker keeps your order in-house and does not execute it to the real market, it’s no wonder that Dealing Desk brokers have a conflict of interest against their clients.

In the figure below you have a representation of how a typical trade works using a Dealing Desk Broker:

No Dealing Desk Forex Broker

No Dealing Desk brokers provide immediate access to the interbank market.

Essentially the No Dealing Desk model comes from the fact that there is no human intervention when a client places a trade so everything is executed automatically.

The prices you see at your trading platform are live quotes from global banks which means that the price you have when you click is the final price for your position.

From a trader’s point of view there’s a number of advantages:

- Transparency

- No re-quotes

- An alignment of broker and trader interests

- Fast execution

- Deep liquidity

In the No Dealing Desk model there are three types of brokers:

- STP (Straight-Through Processing)

- ECN (Electronic Communication Network)

- DMA (Direct Market Access)

Usually, the ECN broker (acronym that stands for Electronic Communication Network), are the preferred broker style among retail traders.

The ECN model is an electronic trading technology where all market participants trade against each other by sending competing bids and offers into the system.

This allows your orders to interact with other trader’s orders with a great transparency.

Lastly

Whilst there are pros and cons to both types of brokers, there are some crucial standards that all brokers should meet. You can read about what to look for in a Forex broker at Recommended Forex Brokers and Charts.