Day trading is a very popular strategy in the Forex markets.

When day trading you are looking to make profits from the small price movements either higher or lower during the days trading.

Unlike scalping where you can be in many trades and are only holding them for minutes at a time, when day trading you are normally holding your trade and then closing it before the end of the session.

In this post we look at exactly what day trading is and how you can use it in your trading.

Why Day Trade Forex?

Similar to scalping, day trading is a short-term trading strategy.

However; when day trading you are normally looking for one trade and then holding it until the end of the session.

When scalping you can be in many trades at the same time and can be in and out of trades in minutes.

On the flip side swing traders can often be holding trades for days or weeks.

Day trading offers a perfect balance between holding trades for long periods and making many trades incredibly quickly.

Day trading is perfect for the Forex market because you gain access to leverage, a market open 24 hours a day and many different trading opportunities.

Day trading also might suit you if you like being able to assess your trades at the start of the session, but then have them closed before you log off.

It may also be for you if you want to have clarity each day on if you made or lost money and can then switch off without any open positions.

Simple Day Trading Strategies

Two of the simplest and most popular day trading strategies involve using trends and breakouts.

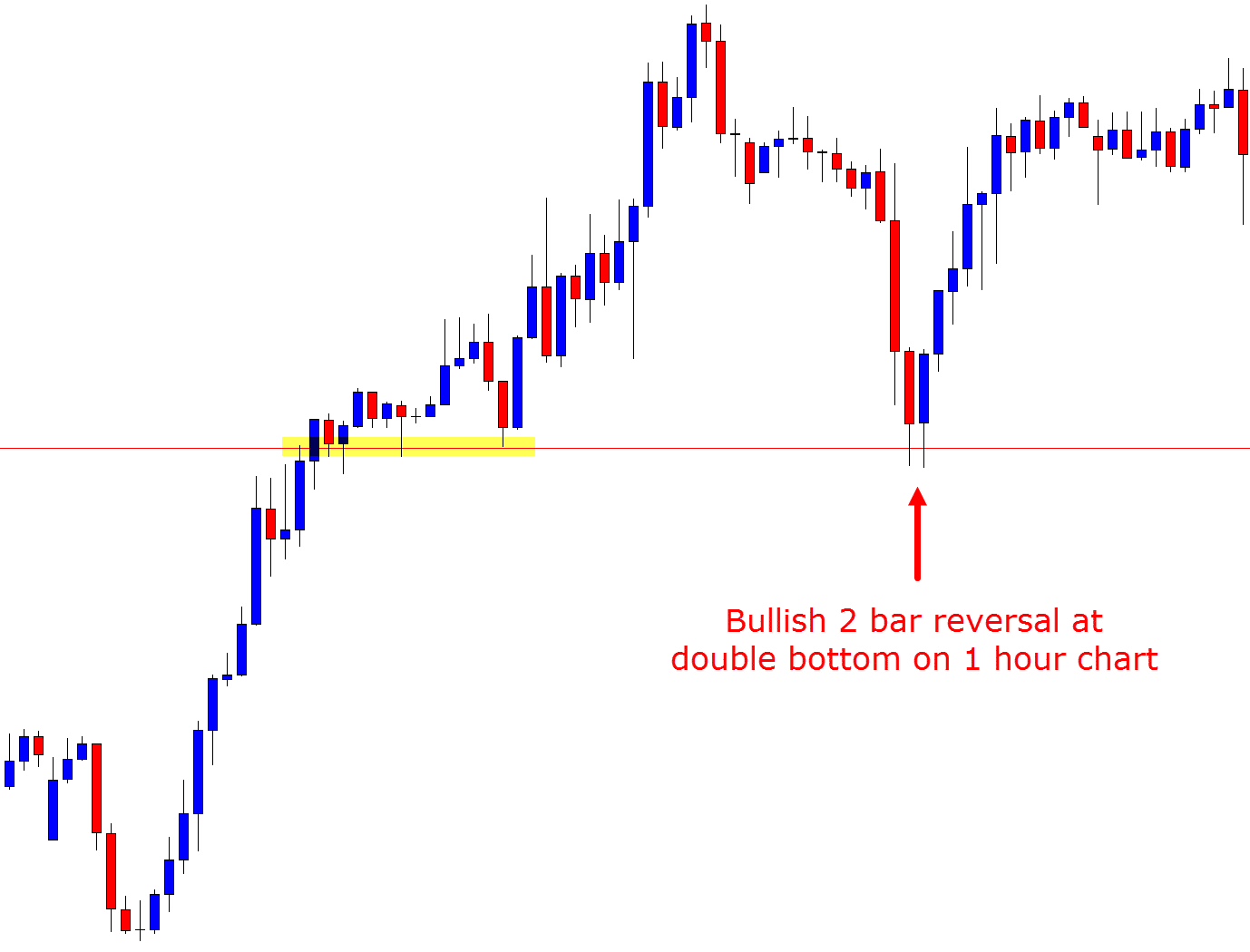

In the example strategies below I have used a 1 hour chart. The reason for that is because the 1 hour chart provides the perfect happy medium time frame. You can analyze and find many trading opportunities and then also have your trade open and closed in one session.

Day Trading Trends

When day trading trends you are looking to trade a trend in a very similar way that you would on a higher time frame.

You are first looking to identify the obvious trend.

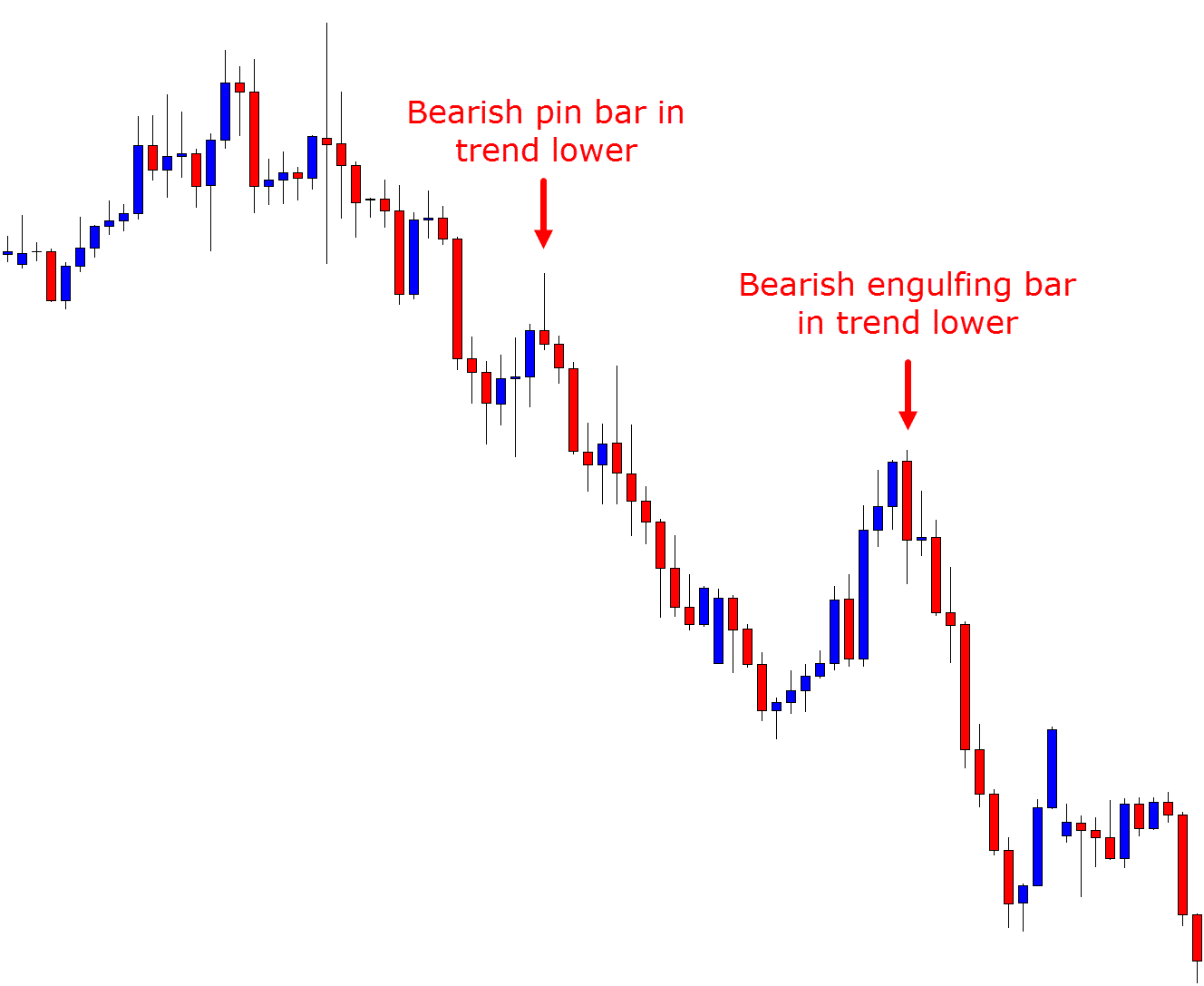

In the example chart below there is a very clear and obvious trend lower.

Once the trend lower is identified we can begin looking for potential trade setups.

As the example shows below; potential trades in this trend to get short could have been from the bearish pin bar or bearish engulfing bar.

Read about how to trend trade here.

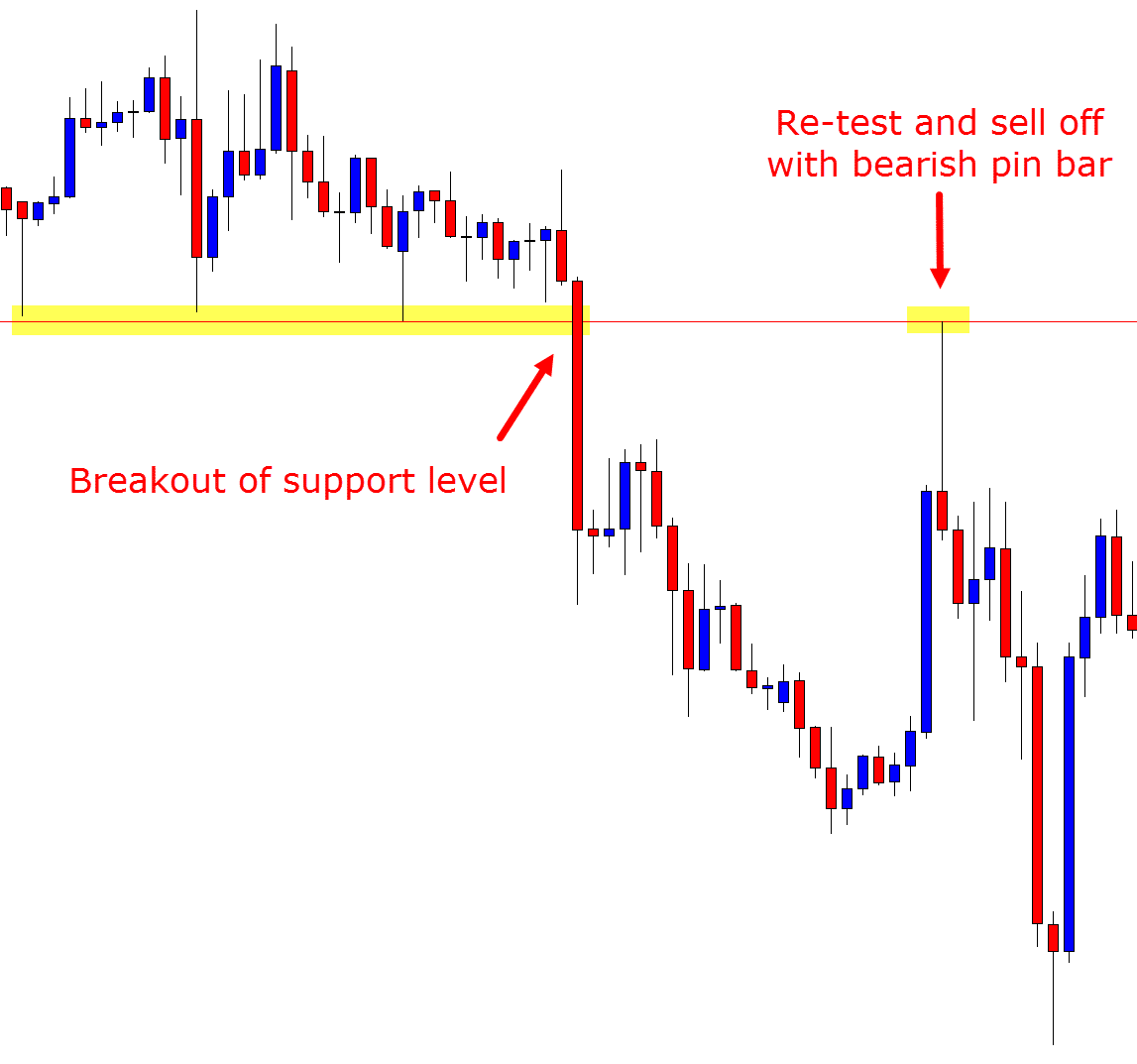

Day Trading Breakouts

Day trading breakouts is an extremely popular strategy to day trade.

The reason for this is because breakouts on the smaller time frames can often be explosive and lead to large risk reward winning trades.

Below is an example of a potential breakout trade on a 1 hour chart.

There are two potential ways to play this breakout. The first is to enter when price first breaks out. The second is to look for price to breakout and then make a re-test of the old support and new resistance area.

Lastly

Day trading is not for everyone. You may be better suited to swing trading or scalping.

The best thing you can do is test different trading strategies and see what suits your trading personality the best.

Leave a Reply