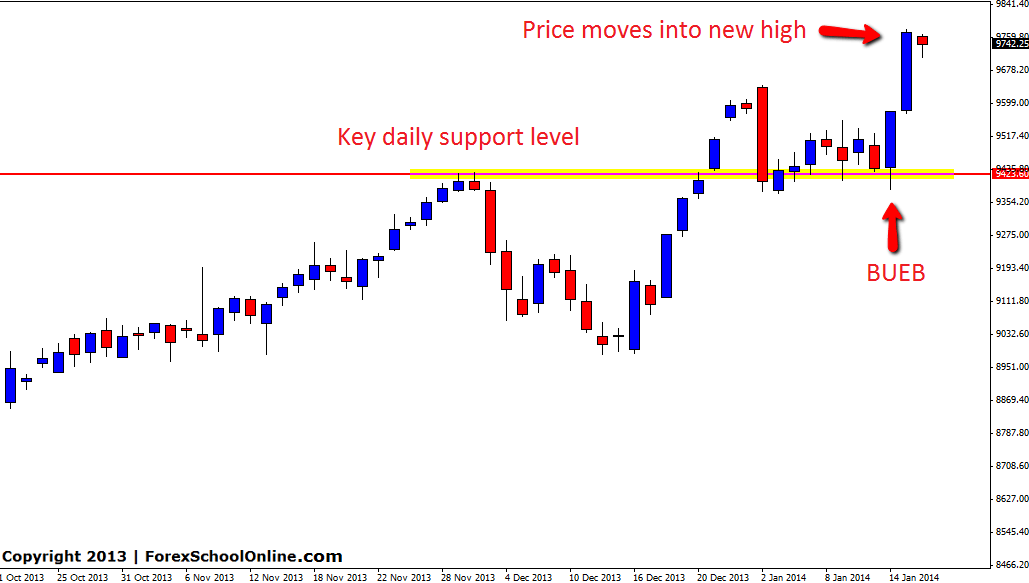

The Dax30 has moved into a new all time high on the daily price action chart after breaking the high of a Bullish Engulfing Bar (BUEB). The Dax30 is blue chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. Price on the daily chart has been in a really obvious up-trend of late and as I discuss in the trend trading tutorial here: How to trend trade price action, the best way to make trades in clearly trending markets is to wait for price to make a pull-back into a high probability value area and then look to jump aboard with a solid price action setup.

Price did rotate back lower within this up-trend and it moved back into the key support level known as a “Kill Zone“. It was at this level price fired off the BUEB. Once price confirmed the BUEB by breaking the high, price raced higher and has since gone on to make a new all time high and in doing so continued the up-trend. Whilst this up-trend stays in place and price continues making higher highs and higher lows, traders can look for very similar types of trades. Traders quite often make the mistake of thinking the trend is over when the price action is clearly showing that the trend is still in place and the only reason the trader thinks the trend is coming to and end is because the trend has gone for a long time and “surely it has to reverse soon”. This is costly thinking. Keep trading exactly what the price action is printing on the charts and if the market reverses and gives clues that it has turned, then look for the reversal, but not before because you “think” it should happen.

DAX30 Daily Chart

Leave a Reply