Over Trading

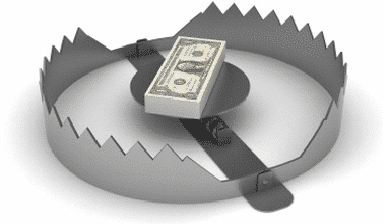

Without a doubt at all, the biggest trading account killer in the world is OVER TRADING. Over trading is a disease that has spread all throughout the trading world and held many accounts hostages. This is by far the biggest mistake traders make throughout the world.

Over trading basically involves trading too much and without a solid setup. One of the main reasons over trading is so common is because of the thoughts people come to trading with. Many come to trading hoping to make it rich overnight. When they find trading they think that the more trading they do, the more money they will make. The truth is professional trader’s trade a lot less than amateurs.

Professional traders will only enter the market to trade when the market has met their key criteria for them to place a trade. The difference with amateur traders is instead of waiting for the market to form a setup that meets their criteria; they will look for any old setup to trade.

Over trading comes in many forms. It can be revenge trading trying to get money back that you have just lost or it can be making trades just to make yourself feel good. Whatever form a trader has, it is only a matter of time before it eats a major part if not all of their trading account.

The time frame for over trading has nothing to do with it because I have seen traders commit over trading sins on every single time frame. Over trading is a mindset error and it happens because traders are looking for something that is not there. Whereas the professional trader will line up and hunt their trading setups, the amateur trader will go wildly into the market looking for anything they can make a play at.

Risking Too Much

This links in closely with over trading. Traders often think that more trading they do it will bring riches and they also think that if they risk more they will make more. Whilst it is true that by risking more you have the potential to make more, what normally happens is you lose more.

When a trader is risking too much their brain will become tense. They will be riddled and overcome with anxiety which will then lead to making bad decisions. There are a few key rules to know how much to risk per trade which are:

- Use the sleep test – Could you sleep at night if you lost a trade?

- Never risk money you cannot afford to lose

- Never risk money you need for other expenses such as food or rent

- Only trade with risk capital (money you could afford to lose)

The reason risking too much can hurt your results is because it creates fear. When trading with fear our brains will make bad decisions. To trade at our best we need to be free in the mind and in the zone. This can’t be achieved when risking too much!

Trading Without Education

Forex is one of the few jobs in the world where very smart people think they will make a bucket load of money without education! I am astounded at how often I meet super smart traders that would rather waste their money losing on a live account that is teaching them nothing, than pay to acquire the correct education that will help them become profitable. Every other job in the world requires some form of study or knowledge on the subject. An example of this is a lawyer. Before a lawyer can make money practicing law, they must first go to university and get their degree.

Forex works the same. To achieve the results that you wish, you need to have the education and knowledge. Before trading with a live account and blowing your money, make sure you have the education required to become successful!

Forex is the same as many things in life; You will get out of it, what you put in. If you are not prepared to study and do the hard yards that are required to be successful, then trading may not be for you. If you are however ready to study and commit to learning what is required, you stand a much better chance of carving out a successful trading career.