Q: What is the one thing that can help you make big improvements in your trading and also help you quickly spot when errors or mistakes are creeping in?

A: A trading journal of course.

A surprising number of traders either do not have, or do not correctly use, a solid trade journal and are missing the major benefits that this could bring to their trading and performance.

Forex trading is a business and the more you begin to take your trading seriously and treat it as the business it is, the quicker you will begin to see results.

Quick Note: At the bottom of this article I have attached a trading journal for you that is set out as a spreadsheet and also a PDF. You can use it in your own trading, as I am about to teach you in this lesson. This has everything you need to include in your own journal.

I have not locked this journal and it is an EXAMPLE ONLY. It has been created this way so you can take it and add to it, making it your own with your own style and trading rule set. Feel free to make any changes to suit your own personal style.

This lesson is to give you the push and an 85%-complete base journal, to help you do the rest, or make your own..

What is a Trading Journal and Why is it so Important?

When I talk about a journal, my thoughts and teachings are a little different to what others are doing. A journal in the historic sense of the word is something you write your notes in. The way I look at a journal for Forex trading is along the same path. However, we need it for a couple of major purposes.

The first thing I look for a journal to be is a ‘Trade Tracker”, tracking each of our trades’ profits or losses. The reason I look to the journal to do this job is because this is where all our major lessons, all our major insights and all our personal push and pull is going on. We don’t want separate documents or software or books and we MOST DEFINITELY do not want to journal about our trades ‘later’.

It’s when our trade is about to be played, during the trade or when we have just taken a big loss or winner that we are at our very best or worst – and when we are going to learn the very most about ourselves! This is when the journal is going to teach us a lot.

That is where the second part of the journal comes in. Whilst the first part is a tracker, the second part is journalling in the traditional sense of the word. We are journalling how we feel about the trade beforehand and making remarks on both the setup and our decision making process, as well as how it was we can up with the trade.

Once the trade has won, lost or broken even we are recapping the trade, and importantly the decisions that were made during the process. Whilst it doesn’t seem important at the time, when we review the journal, we are going to be reviewing the decisions and thought process. In other words, why did we do that and at that time. Could we have done it better?

Do you see why having these two processes (the tracker and analysis) together bring about such an important and powerful Forex trading journal to improve results?

Making Improvements & Noticing Errors/Mistakes

A well thought out and detailed trading journal is a massive help for serious traders who regularly look back on their trading performance to make improvements. Without a journal you have no idea how you have performed over time. You will remember the last few trades, but a well-kept trading journal will be able to show you many things you would never pick up without it.

With a journal you can review your trade remarks, your decision-making progress, you can see how far you have come and you can see exactly where you are going wrong. Pure numbers or profit/loss statements just do not show this.

The other major thing that your journal can do for you is to potentially help you spot errors creeping into your trading or help you change with the market. As you review your journal you may notice over time that something isn’t working well, or notice an area in your trading you need to assess.

Many traders without a trading journal will simply up and change something about their trading that they think or assume will give them better results. When you have a well-kept trading journal you will be able to look back and make well thought out and assessed changes to improve your trading, knowing exactly what part of your process is not up to scratch. You will also be able to then look back after making the changes and see if your performance has improved, or if different changes are still needed.

What Should my Trading Journal Include?

Your trading journal needs to include all the boring things that are not much fun to input, but are necessary for a business.

There are also other bits of information however that can massively increase the effectiveness of your trading journal and the improvements you get out of it.

Just a few of the basic inputs your journal should have are;

- Date of entry and exit

- Trade entry/stops/targets

- Trade risk

- Trade size

- Trade result

Apart from the basic trade details, every trade journal should have a few other things that will really increase the benefits of the journal. The first addition should be trade entry and exit remarks.

After filling out all the facts of the trade you should take a few moments to write down exactly why you are entering this trade and how you feel about it, INCLUDING the decision making process. This includes things like: why you are making the trade; how you decided on this entry; and how you have decided on the stop loss level and the target levels etc. Are you confident of price getting to a certain level, or do you have any sort of doubts? Put this all down.

Why? Because when you go back to look at it (whether in a week, 4 weeks or a year’s time), you will not remember the moment you entered the trade, so the more you write down what your exact mindset is at that very moment, the more it will really help you!

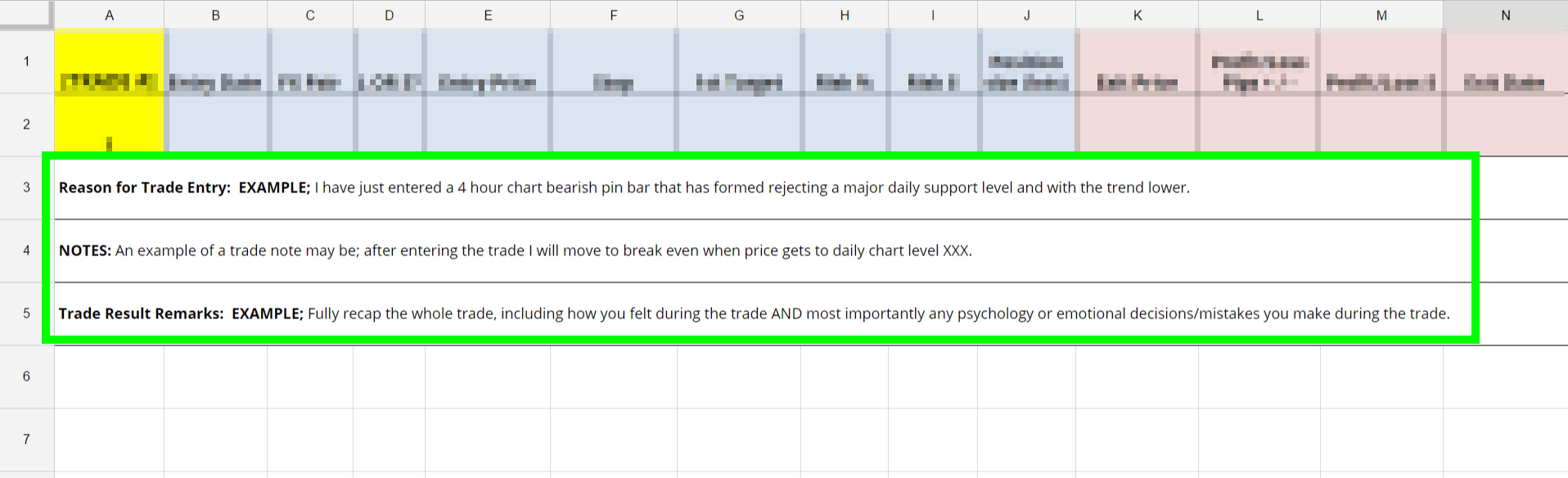

In the trade journal you can download for free at the bottom of this lesson, there are three boxes. 1: Reason for Entry, 2: NOTES: and 3: Trade Results Remarks. The Reason for Entry is where you will do your analysis about the trade. The notes section could include your mindset and decision making progress and anything else you wanted to include.

Lastly, the Trade Results section is the recap of the trade, but also need to include things like how you managed the trade, did you follow your plan? Did not following your plan cost you money? Did you mentally struggle from something or need to work on something which would help? etc.

After writing down your thoughts for many trades you will be able to look back and see how you felt on the very best and worst ones and what the differences were.

You will be able to learn what mindset you were in when you placed the best trades. From this you will be able to work out how you should trade in the future. Should you not trade when feeling a particular way? Should you only trade when you have certain factors met? These are all things you would only be guessing about without having the trade journal to look back on.

Saving Chart Picture

Side Note: The other thing most traders don’t add into their journals is pictures before entry and after exit. Not only will this help when looking back and trying to remember what the actual trade was that you placed, it will help you identify trades you should not have played or how you incorrectly managed a trade.

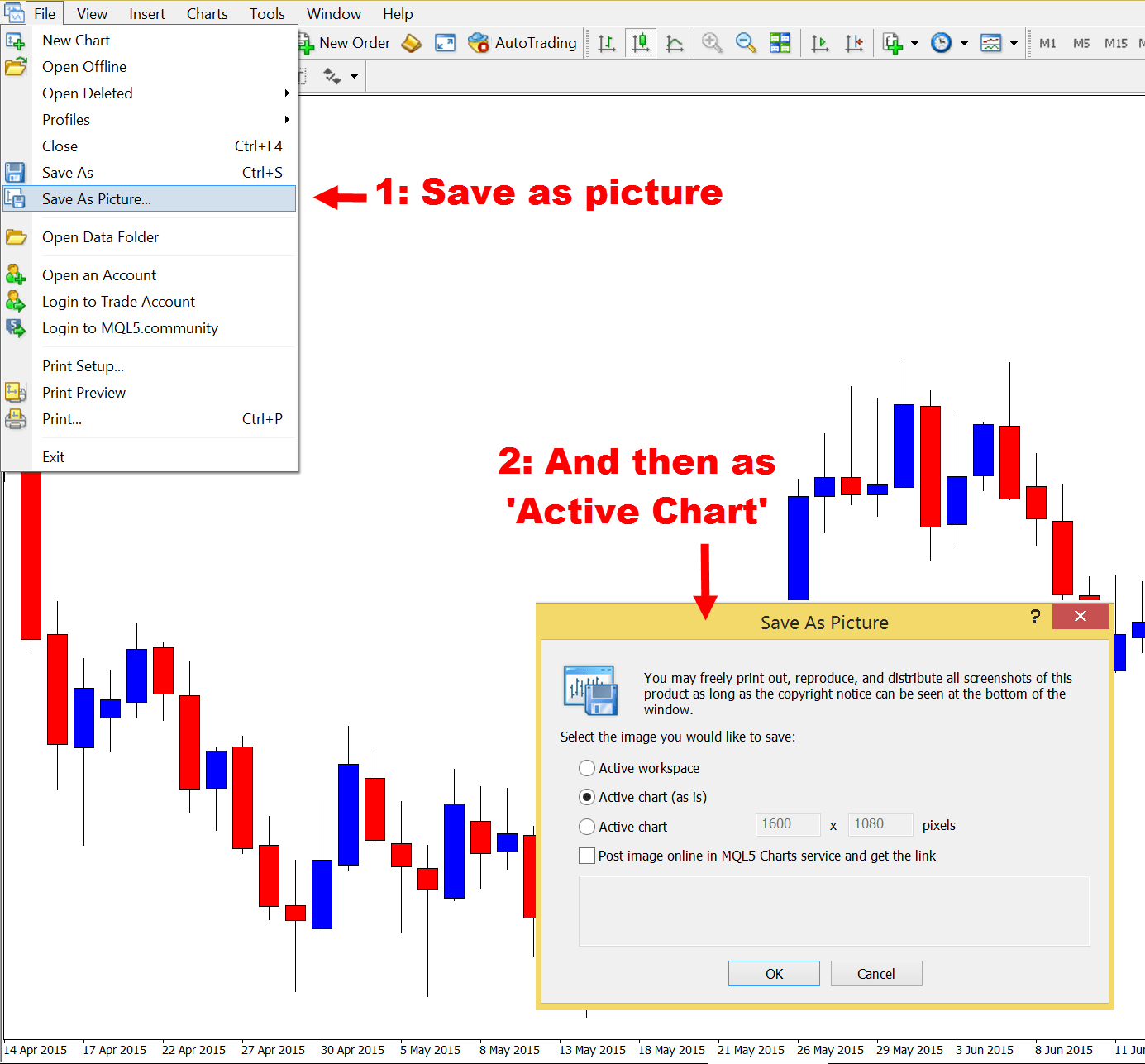

The really simple, fast and easy way to do this is go into your PC and create a new folder that will store all of these images. I am going to show you this example using MT4 platform.

In your MT4, hit the “File” >> “Save As Picture” button which will bring up the chart that you currently have up (so make sure you have the chart you want to save). Make sure to hit the “Active Chart”, but un-select the “Post Image Online in MQL5” box.

Hit the “OKAY” and then when given the option to save, make sure to save into the new folder you have created. TIP: Make sure when saving you add the Pair or market name you are trading but also the date so that when you want to go back and there are 40 EURSUD images, they are very easily separated by date.

Build Your Journal into Your Routine

In previous articles we have spoken about just how important it is that you have a trading routine that you follow each day. The best traders in the world are the traders who are consistent and who make the same great decisions time and time again. To create consistency in your trading results you need to have consistency in your routine.

To some traders filing out a journal before and after each trade is a real chore. Some would rather pull teeth than do ‘boring paperwork’, even though it will directly benefit their trading results. A way around this is to incorporate the data input and journal recap into your routine so it becomes part of normal life.

For example, you could make a rule that the last Sunday of every month is the day that you will sit down and go through your trading journal to recap and look for any improvements or errors that are possibly creeping in.

NOTE: Make sure however, you don’t put off the filling out of the trade entry remarks section when you enter the trade. This is important because if you are looking to make a trade, the mindset you are in at that very moment, the thoughts you are having or potential doubts you are feeling are all in that moment.

If you put this off to a later time, for example later than night, then you will be feeling completely different. The trade would have moved and confirmed the doubts and crushed them by becoming a nice winners and all of a sudden your emotions and what you would write is 180 degrees opposite. DON’T PUT THIS OFF – It is designed to help you improve you, your decisions and your trading.

I hope you have enjoyed this article and will start using a trade journal from now on.

You really do only get out what you decide to put in, so set aside some time and start treating your trading like the business it is.

FREE TRADING JOURNAL DOWNLOAD

I have created a FREE trading journal for you that you can download in both Excel spreadsheet format and also a PDF format. This journal does everything we have discussed in this lesson and will not only help you input the basic trade details so that you can track your trades, but also has areas to input information like “Trade Entry Remarks” – “NOTES” and “Trade Exit Recap”.

I have left the Excel Spreadsheet so you can edit and play with this to create it to suit your own trading. The PDF can be printed and filled in with a pen as you go along. If you have any questions on any of this just post below in the comments section.

Leave a Reply