Every trader who comes to the markets has the same question; “can you get rich trading Forex?”

In this trading guide we look at the answer to that question as well as the strategies you need to start using if you want to start making money trading in the Forex markets.

Is Forex Trading Profitable?

The quick and simple answer to this question is; yes, Forex trading can be very profitable.

The longer and more thorough answer is that it depends a lot on what and how you are doing it.

FXCM ran a study looking at millions of closed trades that had been processed. What they found was extremely interesting.

More than half of the trades that were opened were closed out in profit.

On some pairs like the EURUSD, profitable trades had been made 61% of the time.

However; these stats don’t show the whole story. Whilst it is clear trading Forex can be very profitable, the average trader is losing money. The reason for this is because whilst these traders may be making winning trades, their losing trades are bigger than their winners.

In other words; they hold onto their losses and they cut their winning trades short which in the end makes them unprofitable.

Profitable traders do the exact opposite. If they are in a losing position they cut it quickly and get out. When they find themselves in winning trades they maximize them and squeeze out as much profit as possible.

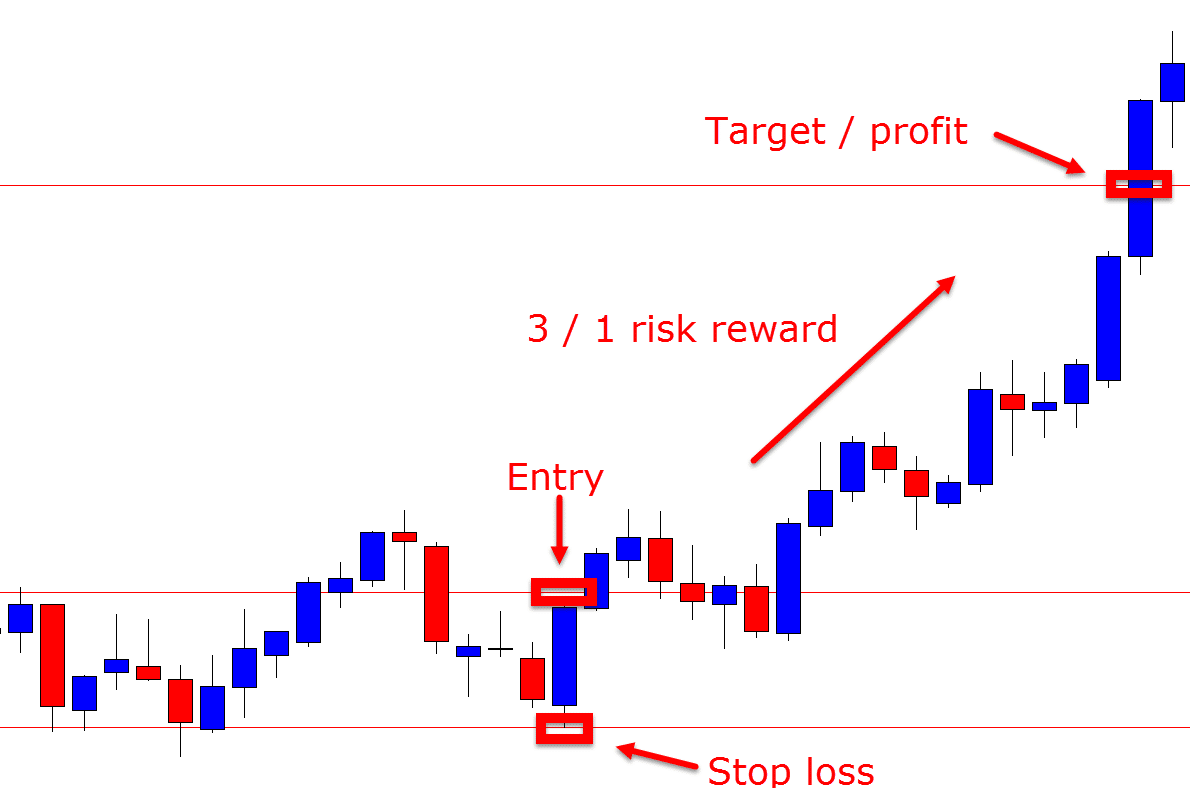

Checkout the example below. With this type of simple trade the trader stands to make a potential three times what they are risking. This means that if they are risking $100 and they lose, then they will only lose $100. If however the trade wins, then they will make three times what they risked or $300.

With this very simple trade management strategy you only have to win one in every three trades to be profitable.

Can You Make a Living Trading Forex?

If you have a profitable trading strategy that you can regularly pull profits from the markets with, the next question you will start asking yourself is if you can make a living from trading.

The answer to this question is very dependent on your own personal situation.

The amount of money you will need to make a living from the markets will be very specific to your situation.

For example; do you live in a very expensive country? Do you have four kids and a partner to provide for, or are you single?

How much you need to make each month and year from your trading will be very specific to your own situation and something you can easily workout.

The next thing to keep in mind is your account capital. Do you have a large amount of trading capital and will only need to make a few percent each month to make your required amount to live on?

Or, do you have a small capital base and will be trying to achieve huge returns every single month?

The amount of capital you have has a huge impact on your trading and mindset.

If you are trying to achieve huge results every month you will be looking for trades when they are not there to make and trying to push the markets.

If you only need to make a few percent a month or year, then you can pick and trade only the very best trades you find.

How to Get Rich Quick Trading Forex

The reason the Forex market is so enticing to so many is because of the benefits it offers.

Anyone can become a Forex trader. You don’t have to have any special education or degrees to start making trades.

Once you have a trading account, you can deposit a small amount of capital and start using leverage to make quite large profits.

You must keep in mind that whilst leverage can help you boost your profits quite quickly, it can also expand your losses.

To get rich trading Forex you will need a very solid understanding of the inner workings of the markets, a great trading strategy and very sound money management systems.

As we discuss below; there are many strategies you can use, but there are some major mistakes you need to avoid.

How Much Do Forex Traders Make a Day?

If you are looking to day trade or even scalp the markets, then you have the ability to make a lot of profits in a very short space of time.

The key to day trading is keeping your risk levels low and letting your winners run into large profitable trades.

For example; if you are looking to make five trades per day you only want to be risking 1% on each trade.

Using this style of management will mean your losses will be capped, but the amount of profit you can make day trading will be uncapped.

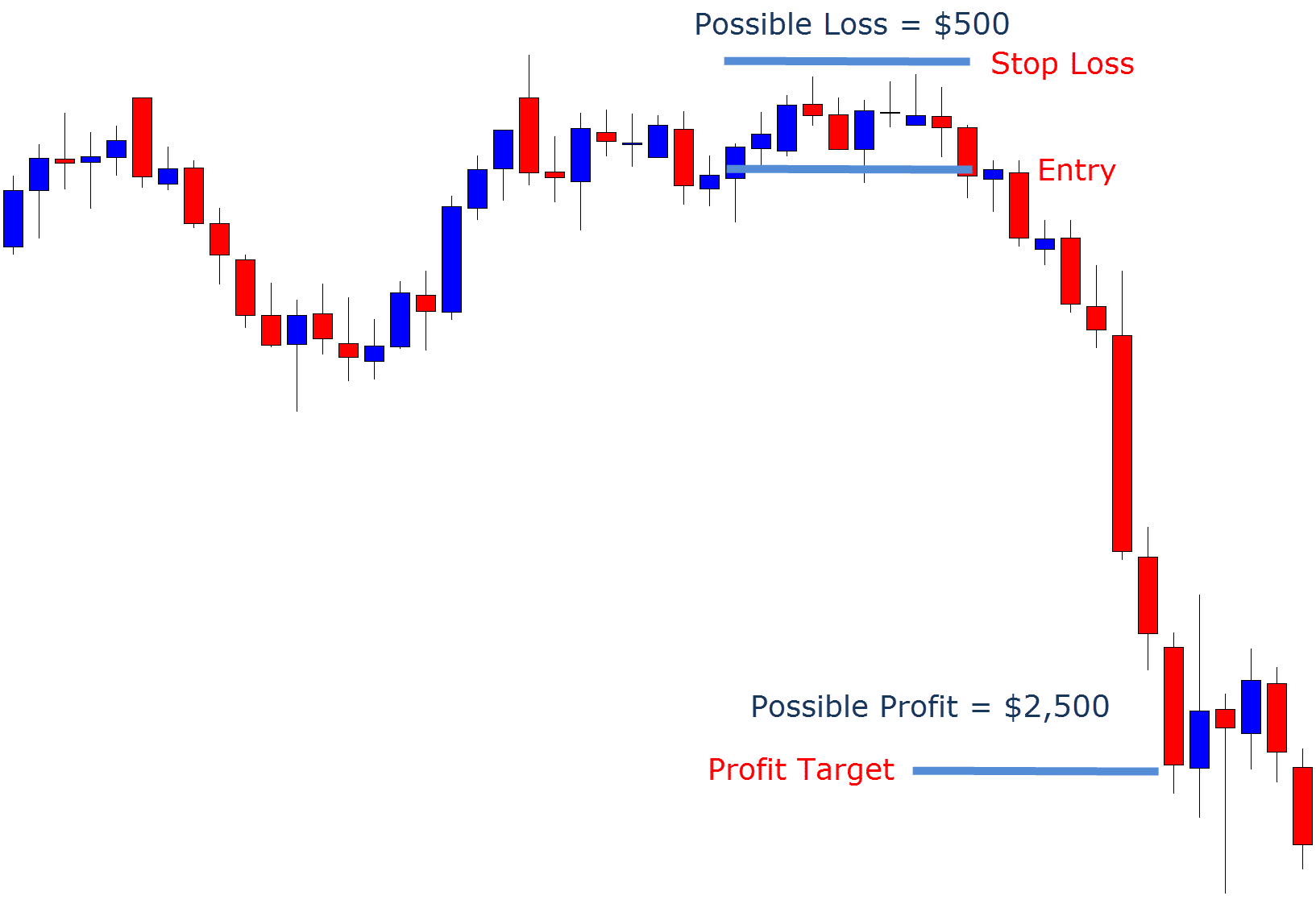

An example day trade is below. In this example you risk losing $500 if the trade loses. If the trade wins, then you make $2,500 profit.

You may only be risking $50 and making $250 when you win, but that will very quickly pile up.

How Many Pips Do You Need to Make a Living Trading?

This is a huge mistake many make when they first think about either trading for a living or becoming rich trading Forex.

If you calculate your profit and loss from pips, then you will have no real idea if you are making money or not.

The only factor that matters is if you are making profits in real money.

It is very possible to make thousands of pips profit, but be losing in real money. And it is possible to be negative in pips, but be profitable.

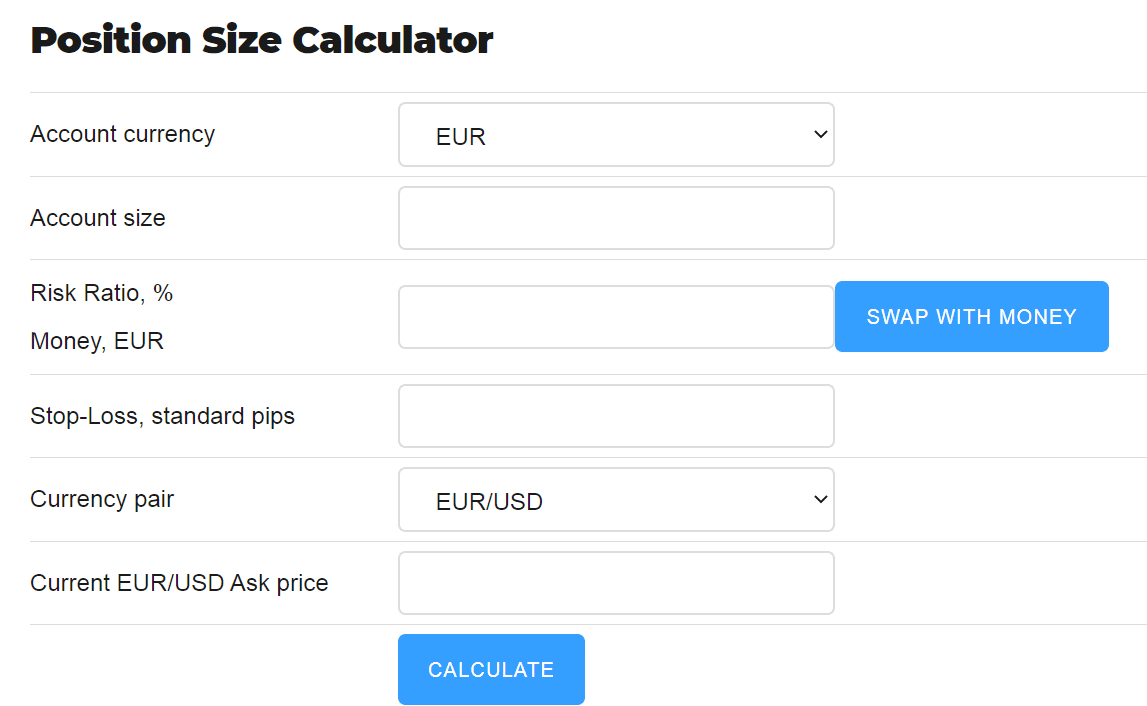

Before making any trade, you should be calculating the correct size that each trade needs to be. Why? Because you should always be risking the same amount of your account each trade, for example 2%.

If you are placing the same size trade every trade, then your risk is going to be widely different. Not every trade will have the same size stop loss or trade parameters and without working out how much you should be entering with you risk either making far less profit, or losing far more than you thought.

You can easily and quickly workout your trade size here.

Three Biggest Mistakes of Traders Trying to Get Rich Trading

There are some very common mistakes that are made time and time again by traders trying to get rich in the Forex market.

Make sure you are not making these same mistakes in your own trading.

#1: Using far Too Much Leverage

The easiest thing to do when trying to get rich trading the Forex market is to use a huge amount of leverage.

The bigger the leverage, the more you can risk and the bigger the potential win.

However; whilst you could quickly make a lot of money, you could just as quickly blow your whole trading account.

If you want to become a long-term successful trader, don’t use huge leverage on your trades.

#2: Risking Too Much on Just One Trade

No one trade is any better than any other trade. The next trade may look perfect, but it could always lose.

The quickest way to lose a large chunk of your capital is to risk far too much on one trade.

This goes hand in hand with chasing your losses. After you make a loss, you can at times want to quickly get back into the market to get back what you have just lost.

Professional traders make trades if and when they see them. They don’t ‘load up’ on one single trade and they definitely don’t chase their losing trades.

#3: Not Having Enough Education or a Solid Strategy

If you are trading in the markets with a very minimal amount of knowledge or without a good trading strategy, it is only a matter of time before you lose your money.

The crucial factor for all successful traders is their trading knowledge and the strategy they use.

The strategy you use will help you find profitable trades and also cut your losses to a minimum.

You can get access to our advanced trading course to get a trading strategy you can use in all markets and time frames.

Lastly

Forex trading is not a get rich quick scheme.

If you are looking for something that you will not have to put a lot of effort into and it will make you a ton of money, then Forex is not for you.

If you are willing to learn new skills and committing to becoming a success, then you can become a profitable Forex trader and make a lot of money.

Leave a Reply