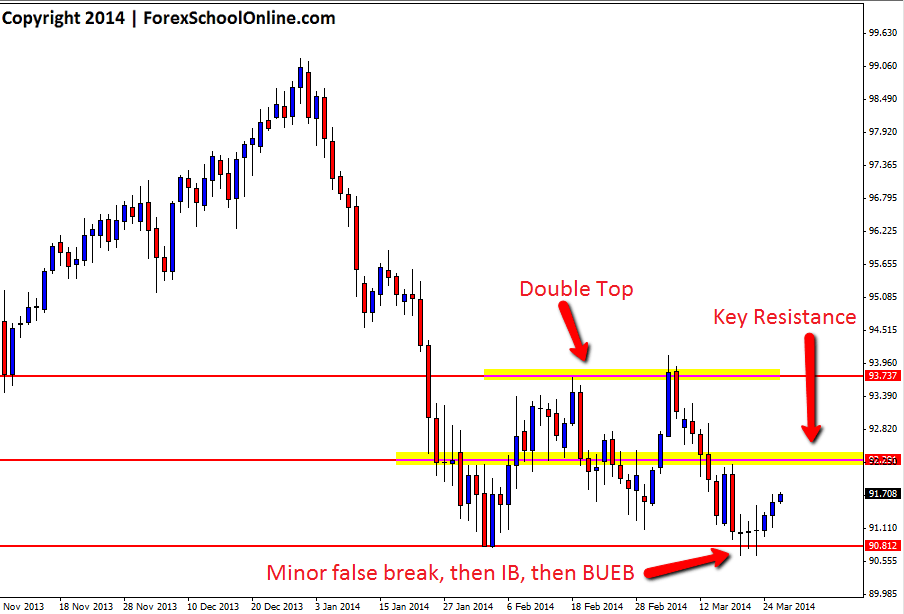

Price on the CADJPY daily price action chart has produced a minor false break of a double low that could now send price higher and back into a key resistance level. Price is currently stuck in an overall larger box that has price trading in consolidation. Price had formed a double top that sent price moving lower and back into the recent lows to test support.

At this support level, price made the minor false break before consolidating in the form of an inside bar (IB) and then forming a bullish engulfing bar (BUEB). Price has now started what could be a climb higher into the key resistance level which is in the middle of this overall box.

This overhead resistance has been a major support level in time gone past, that traders on their daily charts will be able to see if they zoom their daily charts out. If price does move into this level it could act as a very solid area for price action traders to hunt for short trades on both their daily and intraday charts. For any potential trades, high probability price action would need to present such as the setups taught in the Forex School Online Price Action Course.

CADJPY Daily Chart

Hello Jonathan,

Thank you very much. It cleared my doubts now. =)

Regards,

Gary

Hello Gary,

there is a difference between what makes a valid engulfing bar (an engulfing bar that meets all the criteria) and a engulfing bar that is what a trader deems tradeable (i,e large, at swing point, closes in last 1/3 etc) All these other things are needed for high probability trades, but they are not needed for an engulfing bar to be a valid engulfing bar.

Johnathon Fox

Hi Jonathan,

Thanks for your great articles.

May I ask why would you consider the candle bar on the 21 March to be "Engulfing" the previous inside bar? I read from your article that the bar must be "big and obvious", does that refer to the whole candle or do we need the body of the candle to be big and bullish?

I would interpret this as another indecision of the market, but this is my ignorant view.

Thanks for pointing out the key resistance level too, I never zoom out that far to see that level, as I just drew the near term S/R level which are the other 2 levels you have in your chart.

Thanks again for the always insightful articles. I really learnt a lot from you.

Regards,

Gary

Hello Gary,

there is a difference between what makes a valid engulfing bar (an engulfing bar that meets all the criteria) and a engulfing bar that is what a trader deems tradeable (i,e large, at swing point, closes in last 1/3 etc) All these other things are needed for high probability trades, but they are not needed for an engulfing bar to be a valid engulfing bar.

Johnathon