Wow, a lot has been happening and is happening in the markets.

I have been flat out and if you are someone who wants to learn to trade, then over the next little while you are in luck because I have a ton of stuff for you.

CADCHF High Probability Pin Bar Reversal on 4 Hour Chart

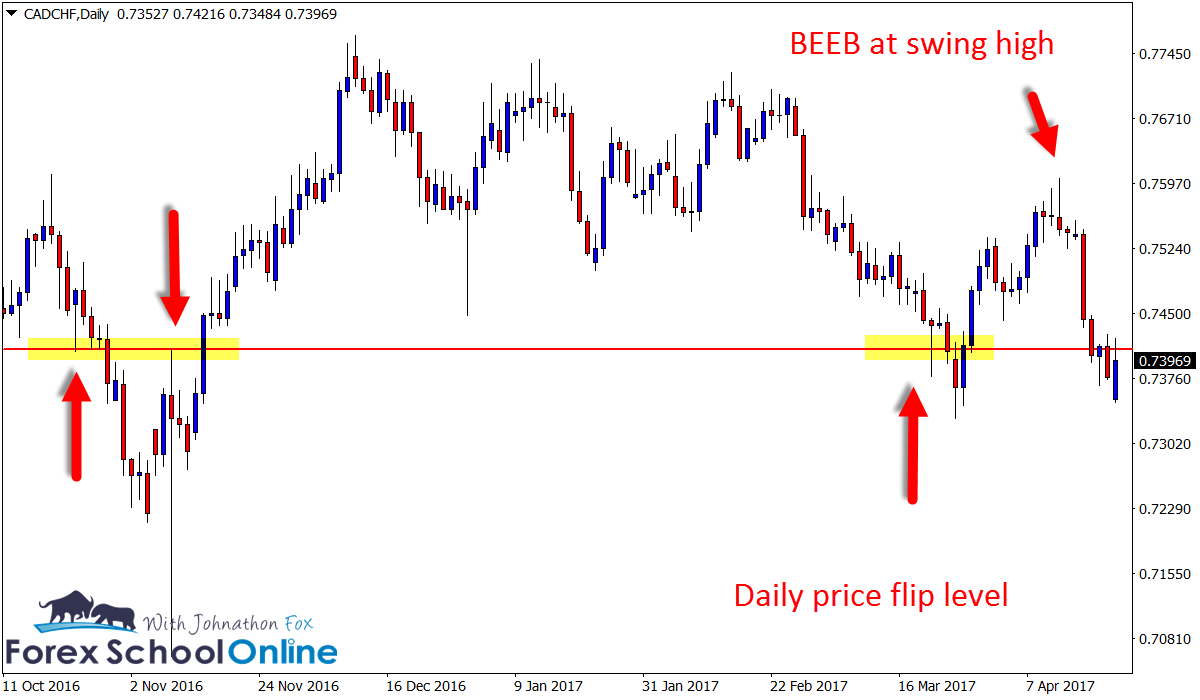

Price action on the daily chart of this Forex pair has made a large move lower, straight down and through a strong daily support level after forming a Bearish Engulfing Bar = BEEB.

As we often discuss, we want to try to trade with or have in our favor as much as possible either the trend or the strong momentum when looking to make trades.

Sometimes this can be tricky, especially in situations such as these when we are taking a trade on an intraday chart using a daily marked level.

I explain this in the lesson that contains a video for you and how you should hunt high probability trend trade setups at;

High Probability Trend Trading

You will notice that whilst the daily chart has no momentum at all, on the 4 hour chart price is at the beginning of what could be a potentially strong move lower and whilst it is not a trend lower as yet, we are below the major daily level and trading at the major resistance, and ticking boxes in our favor.

Daily CADCHF Chart

4 Hour CADCHF Chart

Will Price Rotate Higher Back Into Major Resistance On Coffee Chart?

This is a market I do not normally discuss in the public charts in focus summary. However; it is becoming more and more stable as the weeks go by as you can see just by looking at the price action for yourself.

It is respecting its major levels, and the ‘gaps’ are becoming less frequent.

This is making it easier to trade, however; in saying all of that… it is still a highly speculative market and it will still gap regularly and spike when you do not expect above/below your stop.

We have spoken before about how to select the markets and Forex pairs you personally trade and which ones you add to your watch lists.

The things you need to take into account are factors such as government intervention, which whilst it has not happened as regularly as it was a few years ago when the Japanese government was intervening in their currency price and we were seeing major price spikes, it is still something to keep in the back of your mind for the future.

You need to consider gaps in price and the risk you are willing to take.

You need to consider open times because you do not want to be trading individual stocks for example with the wrong method/system.

You need to also be aware of the different minimum order. For example; a lot of the futures / CFD’s have a min 1 standard contract 100,000 entry, however FXchoice.com allow smaller lots for a lot of these such as gas and oil.

Any other questions post them below.

I also discuss these in The major factors you need to look for when picking your New York Close 5 Day Broker and what you need and don’t need.

Daily COFFEE Chart

To make sure you do not miss any of the upcoming cool stuff we have coming in the next months, join the VIP email list if you are not on it. You will get premium lessons, and cool videos – info off limits to the public!

JOIN THE VIP EMAIL LIST RIGHT HERE!

Awesome Setup Sir,

Keep it up Good work