CAD/JPY dropped a little in the short term, but the outlook remains bullish. It could jump higher if the JP225 (Nikkei) resumes its growth. Technically, a temporary decline was somehow expected after its most recent leg higher.

The pair has found temporary resistance and now it has slipped lower. It could only test and retest the immediate support levels before jumping higher. Later, the BOJ Gov Kuroda Speaks could bring life to this pair. Tomorrow, Japan is to release its Retail Sales, Prelim Industrial Production, and the Housing Starts.

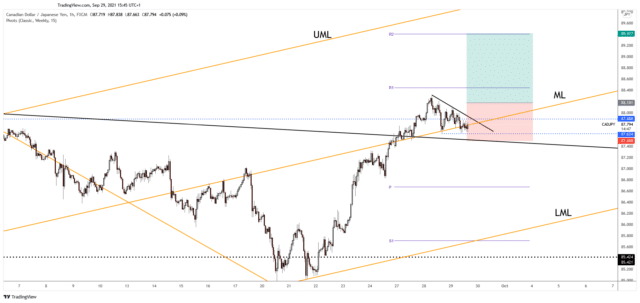

CAD/JPY Technical Analysis!

CAD/JPY dropped but is fighting hard to stay above the ascending pitchfork’s median line (ML). It could start increasing again as long as it stays above 87.62 former low. The immediate downtrend line is seen as a dynamic resistance.

Jumping above it and stabilizing also above the median line (ML) could signal further growth ahead. Personally, I believe that only a valid breakdown below 87.503 could really invalidate the bullish scenario and the upside continuation.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply