CAD/JPY increases as the JPY is weakened by the Nikkei’s rally. As you already know from my analyses, the Japanese Yen is expected to depreciate when the Japanese stock index grows. We have a positive correlation between CAD/JPY and Nikkei.

Surprisingly or not, the Japanese Yen drops even if the Japanese data have come in better than expected today. The Unemployment Rate dropped from 2.9% to 2.8%, the Prelim Industrial Production dropped only by 1.5% versus 2.4% expected, the Housing Starts registered a 9.9% growth, while the Consumer Confidence was reported at 36.7 points versus 36.1 forecast.

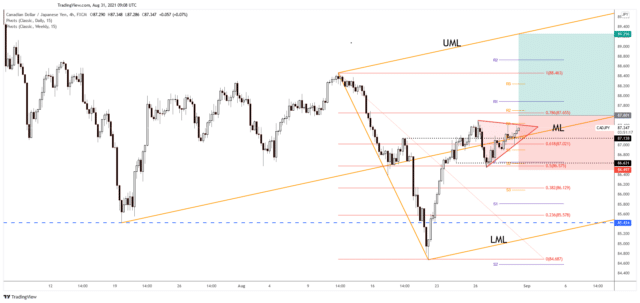

CAD/JPY Technical Analysis!

CAD/JPY has managed to come back above the median line (ML) signaling strong buyers. It’s trapped within a triangle pattern, a valid breakout from this pattern could signal an upside continuation.

Also, making a new higher high, jumping and closing above 87.49 could activate further growth. Technically, the short term decline was expected after its previous swing higher. Now, it has moved sideways trying to accumulate more bullish energy before jumping towards fresh new highs.

The next major upside target is seen at the ascending pitchfork’s upper median line (UML). CAD/JPY could move towards this dynamic resistance as long as it stays above the median line (ML).

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply