Biggest Forex Trading Myths and False Beliefs

When I first started trading I had a ton of false beliefs about what is needed to make money consistently in the markets.

I found these views and beliefs were incredibly common over the years and I was far from the only trader who started out with these ideas.

This post will explore some of these incredibly Forex trading myths and how you can fix them to become a successful trader.

False Belief #1: I Need to Watch the Market Every Single Moment – Especially When in a Trade!

This is why brokers created mobile phone trading app’s right?

This is a very common belief that many new traders find themselves falling into. Quite simply; trading does not have to involve long hours staring at the screen. Many traders actually find that once they begin to cut back their screen time their success rate climbs.

You need to identify when is the best time to place trades and then step away from the screen.

An example of this might be a trader that trades off the 4hr chart. They may choose to look at the charts and scan for trades during the US and UK sessions when the 4hr candle closes.

If they find a trade, they place it and set stops and targets and then turn the computer off until the next 4hr bar closes.

If there is no trade to place they simply turn the computer off until the next 4hr bar closes and they scan again for trades.

Watching the markets endlessly will not produce any more trades for you to enter compared to scanning at a set time. Continually watching the markets will wear you down and make you a lot more likely to over trade.

The feeling of wanting to be in a trade just for the sake of it is hard to fight when you are watching the market endlessly.

Once you have a solid routine worked out where you are waiting for the market to come to your kill zones, instead of you continually chasing the market, you take the drivers seat.

Set Up MT4/MT5 Alert to Never Miss Trades When Not at PC

False Belief #2: 95% of Traders are Losing Money

The Chinese whisper that passes from forum to forum that 95% of traders lose money.

From the statistics we can see that a lot of traders do make money. Being able to get accurate and up to date data on this is almost impossible, however there are some very interesting pieces.

We know for example that from the FXCM study carried out that over 50% of trades are closed out at a gain and on some pairs like the EURUSD this is as high as 61%.

A direct quote from their study is below;

Our data shows that 53 percent of all accounts which operated on at least a 1:1 Reward to Risk ratio turned a net-profit in our 12-month sample period. Those under 1:1? A mere 17 percent.

That is taking into account the 15 most commonly traded Forex pairs over 43 million trades.

We also know from previous stats that brokers have reported 30-45% of traders are posting profits. The short-coming on this last set of statistics is that they are only short-term and do not follow up over much longer periods of time.

For a trader losing money it is comforting to think that a lot of others are also losing money. It is not so bad if they are also losing money.

However; there are far more traders making money than what many are led to believe.

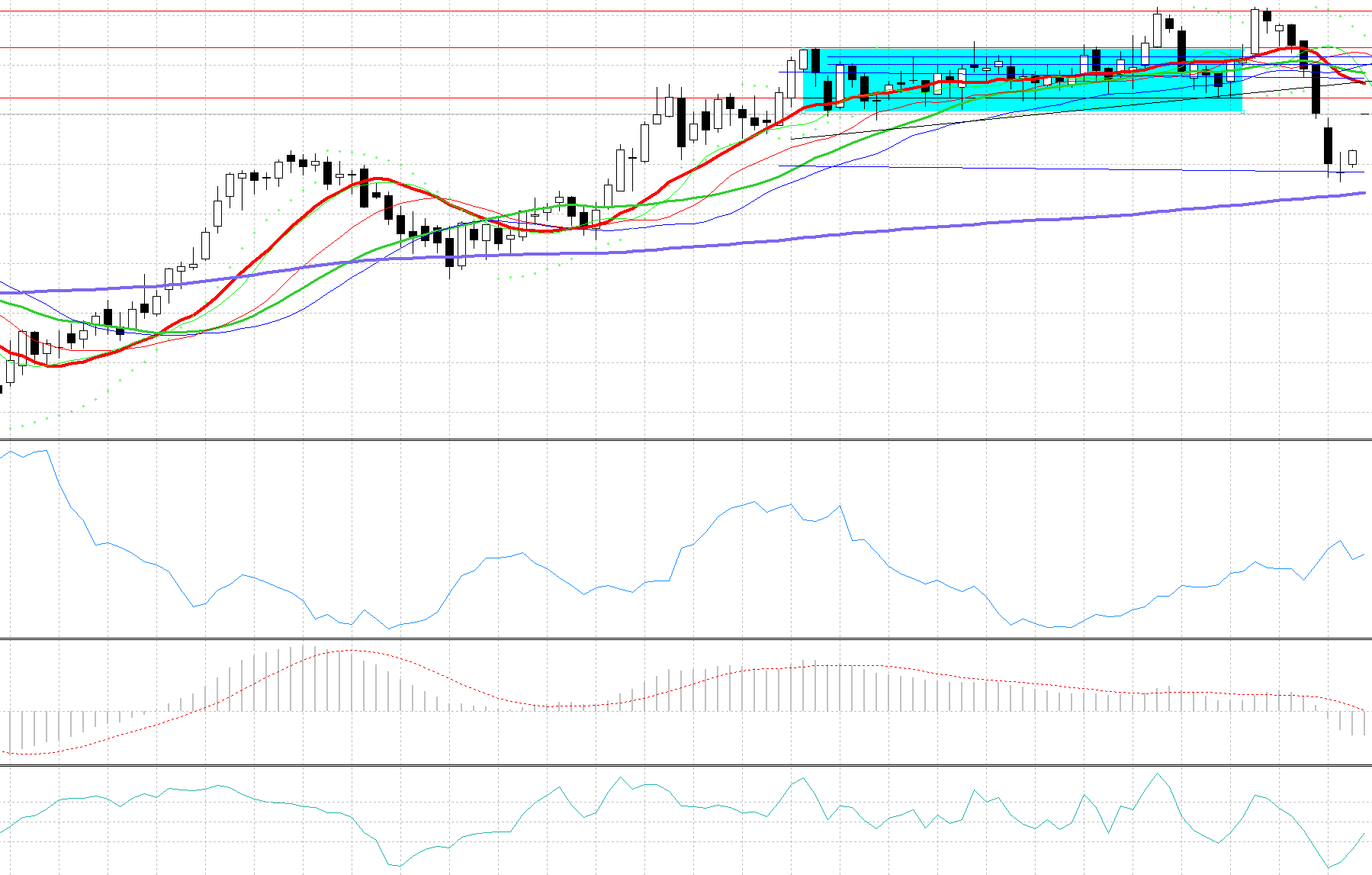

False Belief #3: If One Indicator Helped me Predict Price, Then 2,3,4… + Must Help Even More!

Many traders believe that placing indicators on their charts gives them a greater chance of picking the right side of the market.

The problem with this is that indicators are built off what price has done or from old price data.

The even bigger problem with this is that it becomes a super slippery slope.

A trader uses one indicator such as a moving average to begin with to help them find trades. They have some winners and some losers.

Before long the thought of ‘if one indicator helped, then adding one more must help even more’.

Two indicators become three and then it becomes a mess of contradiction with each indicator telling the trader to do something different.

All that’s needed to trade successfully and to consistently make money is simple price action. Price action is the key to all moves in Forex.

Price action is people’s behavior placed on a chart for a trader to analyse.

As all indicators are made up of old price information, it makes sense to use the current live price information to base our trading around.

False Belief #4: ‘Oh This Trade Is a Sure Winner’

Let’s start with the FACT that no method can be 100% profitable – ever.

Traders often look at trading as a matter of being right or wrong on each particular trade they take. I prefer to look at the market as a random event. I can never know for sure no matter how good the setup looks that it will work!

I try to take only the best setups, but does that mean they are all winners? No, the outcomes are random!

The key to making money consistently is having an edge over the market that produces more profits than losses over a span of time.

The trader who has an edge over the market may lose 3 trades in a row, but they know over 30 or 40 trades they will always be up. They know that their edge will play out.

Start forgetting and stressing over this trade and the trade that just went past. You are not right or wrong.

False Belief #5: I Need to Analyse and Know EVERYTHING Before Making a Trade

Whilst it is good to be a master at the method you trade with, you do not need to know about every little thing. People often come unstuck falling into analysis paralysis.

They can never believe that things can be simple and more than that, making things simple is the way to success and profitability.

SIMPLE is the way to go. Pick just one method to trade with such as price action and perfect it. Do not try to involve 100 methods with 10,000 indicators and just as many time frames! Keep it simple and perfect you’re one chosen craft!

Trading is not painting pictures and it is not creating perfection.

Trading is creating an edge over the market where over a set of trades you make more money than you lose.

You cannot understand and know every single detail, and if you strive to, you will forever be chasing the one perfect setup that will never arrive.

False Belief #6: The More Trades I Make, the More Money I Will Make

This is logical and can be incredibly hard to reconcile with.

It is obvious math that if you make more winning trades, you will make more money.

However; the key word in that sentence is ‘winning’ and this is why making more and more trades is not what we are always after.

More does not equal more in Forex trading. More trading for the sake of trading does not equal more profits. More rubbish trades equals more account losses.

We are after more high probability A+ trades that meet our trading rules and plan. We want as many of these as we can find, and only these.

Safe trading,

Johnathon Fox

There are a lot more; let me know the biggest myths you have come across in the comments below!

Thanks a lot for this article Sir. One of the difficult is to realise that an 80% accurate method can actually have the 20% failure rate happen in a row, and that may cause one to waver and change strategy.

Very accurately described and are very true. I’ve completely changed my trading strategy with a clean price action chart. I only look for peak high or low, wait for the A+ setup, pull the trigger and let it run. I am in a so much relaxed state of mind lately. It took some time to change my behaviour though 😉. Thank you J.

HI Prabhakar,

great to hear your progress!

Keep up the good work.

Johnathon

Hi Jonathon, great article!

Thank you for sharing!

Hope you and your family are all well!

-Bob

Thanks Bob and yours!

Johnathon

Info