The AUDUSD pair has continued to generate profits despite the arrival of improved non-farm payroll data on Friday. Ordinarily, this ought to have impeded upside progress, but it seems that the Australian dollar is the victor on fundamental fronts. Let’s take a closer look at this market for more insight.

Key Price Levels:

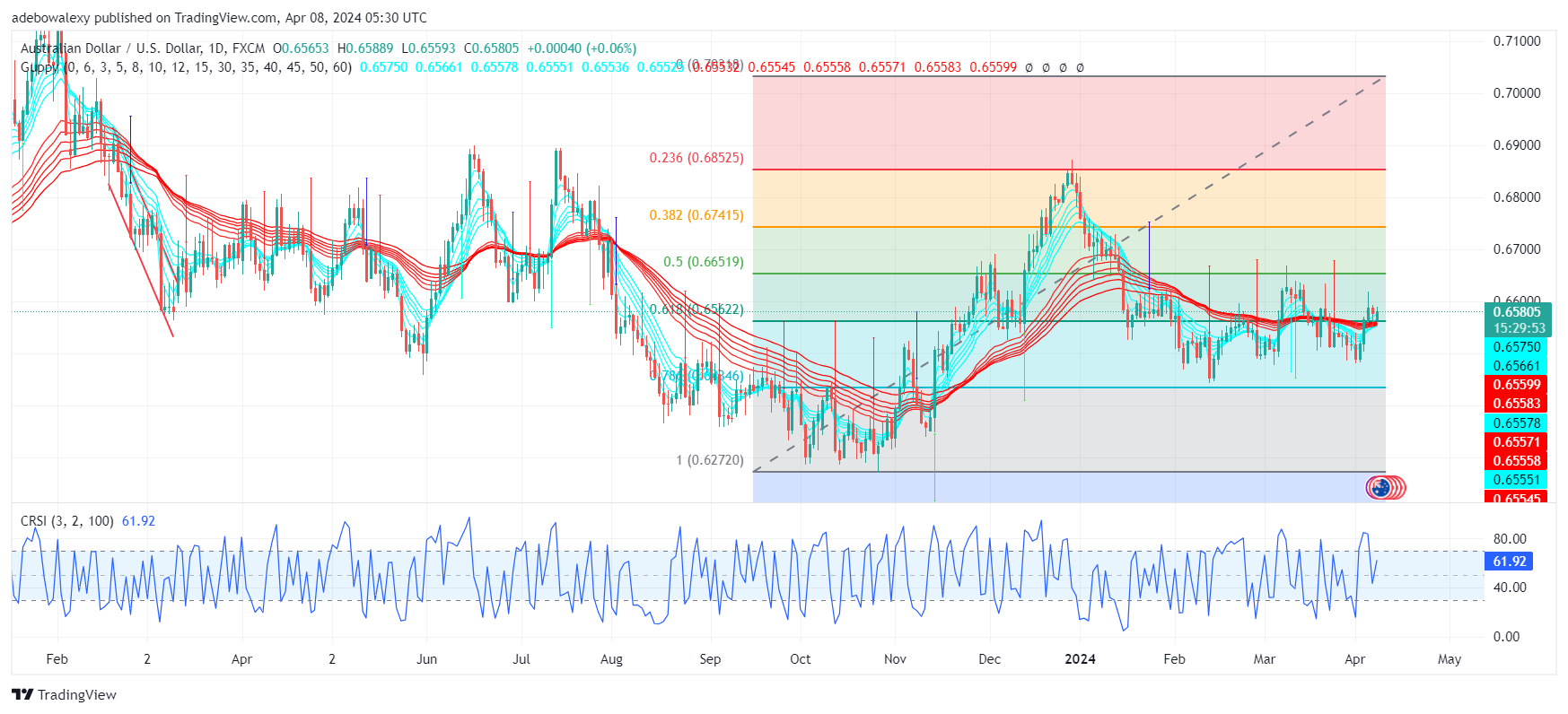

Resistance Levels: 0.6581, 0.6600, and 0.6700

Support Levels: 0.6550, 0.6500, and 0.6450

AUDUSD Leaps Off the 0.6562 Support Level

The release of US non-farm payroll data had an immediate effect on the AUDUSD pair, causing the market to deviate slightly from its upside path. However, the USD fundamentals failed to maintain their influence as the market bounced back with more significant momentum.

Additionally, it can be observed that the corresponding price candle for the ongoing session seems to have found support at the 61.80 Fibonacci Retracement level. Likewise, the Commodity Relative Strength Index (CRSI) indicator line now has an upward trajectory. Moreover, there seems to be some consistency between the CRSI and the price movement, indicating that the trend may be strong.

AUDUSD Market Faces a Minor Rejection

Meanwhile, the AUDUSD 4-hour market suggests that price movement may be facing rejection at the moment. An inverted hammer-like price candle has appeared for the ongoing session, revealing that headwinds may be building up in this market. However, the price candle can be seen to have appeared just above the Guppy Multiple Moving Average curves.

Similarly, the Stochastic Relative Strength Index (SRSI) indicator lines have converged in the oversold region. Consequently, this suggests that the resistance staged by headwinds may not hold. Also, the Australian dollar seems to be stronger on a fundamental basis as of now. Therefore, traders may want to continue using bullish crypto signals in this market, as the market may head towards the 0.6650 mark shortly.

Do you want to take your trading to the next level? Join the best platform for that here

Leave a Reply