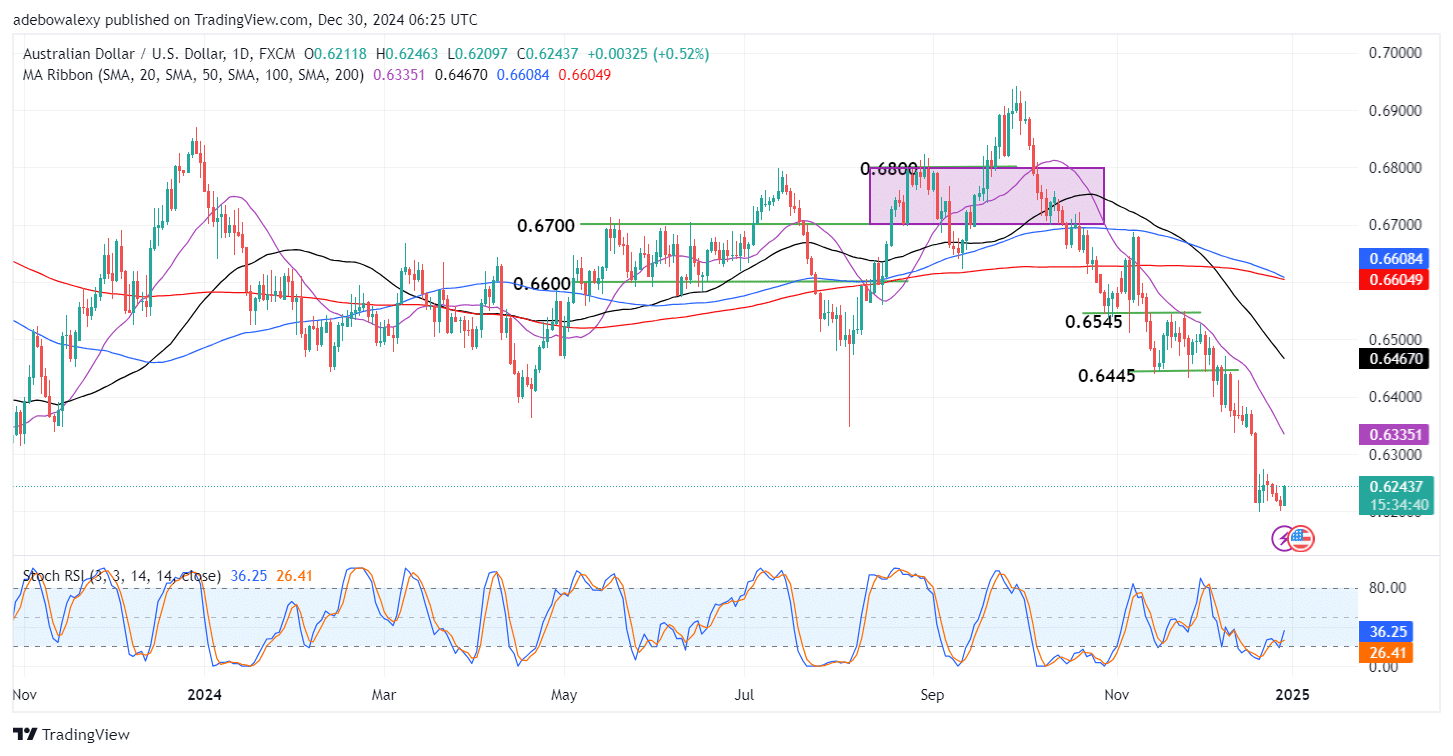

The AUDUSD pair has been under considerable bearish pressure for quite some time now. The pair started the new week on a positive note, with the ongoing session appearing green even though price action lies below important technical landmarks. Also, the anticipation of fewer interest rate cuts by the Fed supplies some upside momentum to the US dollar. As such, this may exert more downward pressure on price activity in this market.

Key Price Levels:

Resistance Levels: 0.6300, 0.6400, 0.6500

Support Levels: 0.6200, 0.6100, 0.6000

AUDUSD Sees Moderate Gains

As mentioned earlier, the AUDUSD pair has seen a moderate price increase today. This appeared as price action rebounded off the support at the 0.6200 price level. At the time of capturing the market data, the last price candle on the chart is bullish. This suggests that price action as of then is under little downward pressure.

However, given the position of price action below all the Moving Average (MA) lines, it’s only a matter of time before the session gets compressed. The Stochastic RSI lines are also keeping an upward trajectory just above the 20 mark of the indicator as of the time of writing. Nevertheless, price action is still vulnerable and may fall lower.

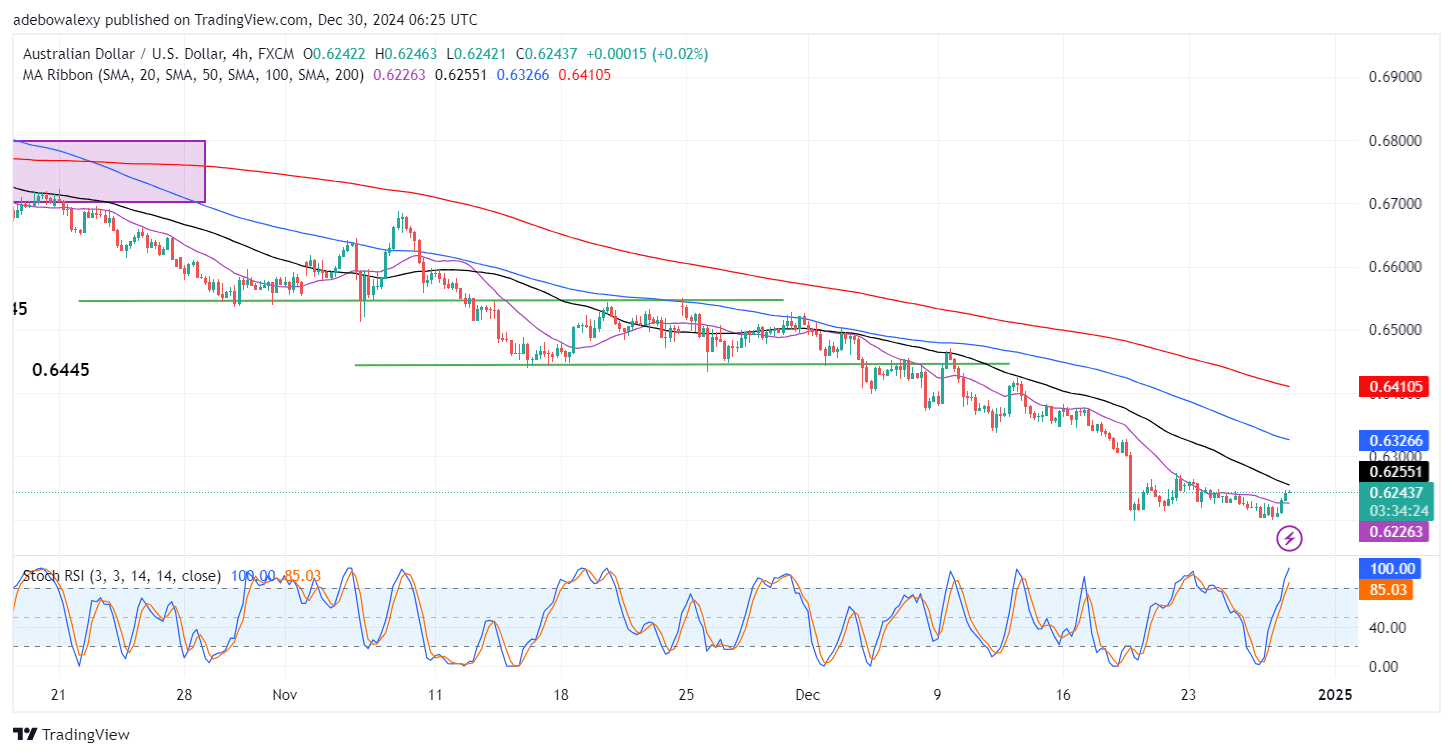

AUDUSD Keeps Recording Minute Gains Above the 20-Day MA

By extending the AUDUSD market price analysis to a 4-hour market timeframe, it could be seen that price action has risen past some notable technical landmarks. Price action in this market can now be seen appearing just above the 20-day MA line.

Furthermore, a new session has begun as the last price candle appears as a small price candle above the 20-day MA but below the 50-day MA line. Also, the movement of the RSI indicator seems too exaggerated for such price increases. Consequently, it seems price activity remains under the control of headwinds, and traders can still brace for a retest of the 0.6200 price level.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply