Price activities in the AUDUSD market took a bearish path toward the close of last week. This resulted from the positive United States data (PPI and CPI), which helped boost the dollar. With no fundamental expectations from both sides of the market on Monday, it appears that the bearish market is set for the meantime.

Key Price Levels:

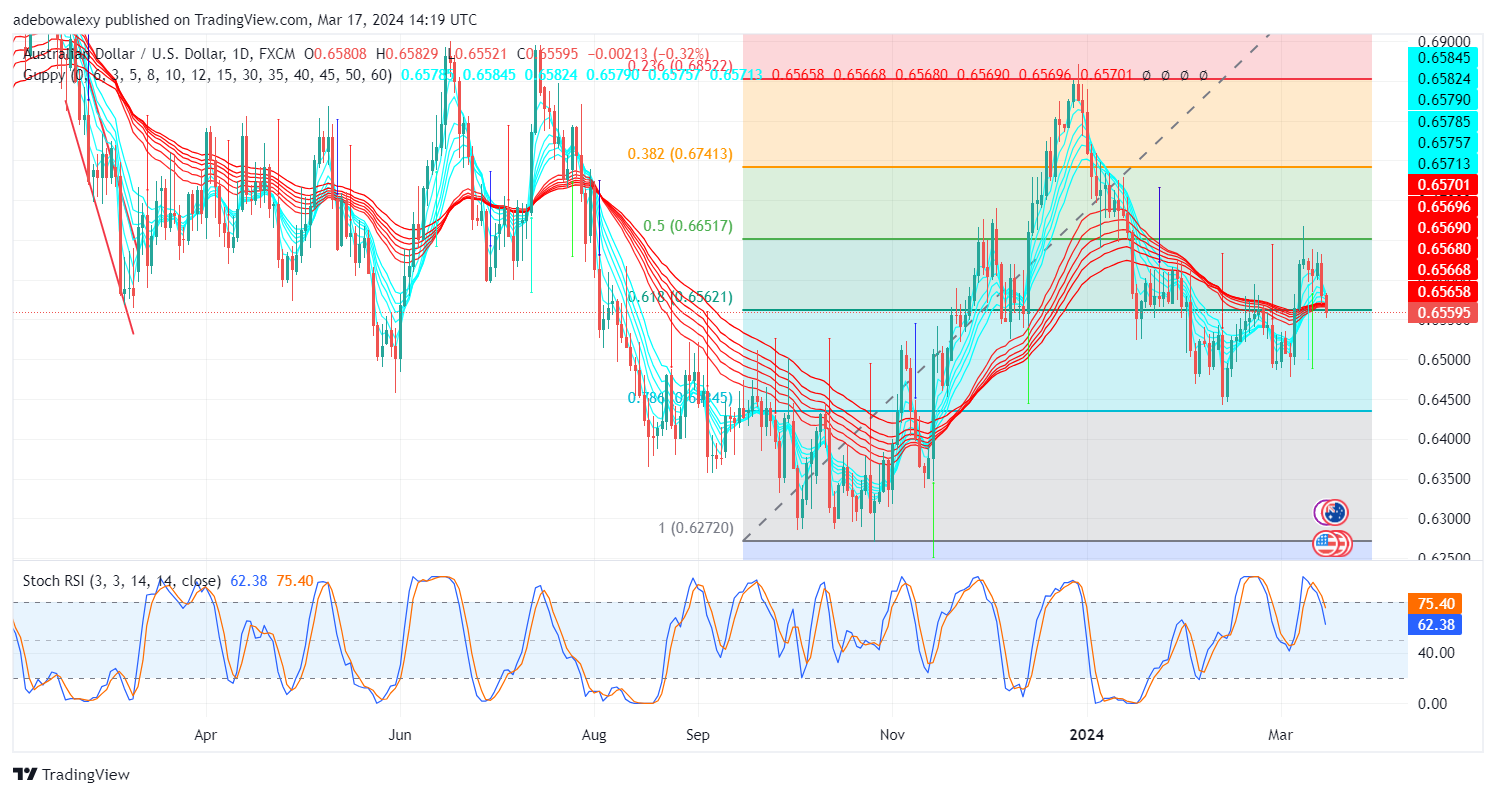

Resistance Levels: 0.6560, 0.6600, and 0.6700

Support Levels: 0.6500, 0.6400, and 0.6300

AUDUSD Market Heads South

Price movement in the AUDUSD market took a strong bearish tone on Thursday. This was on the arrival of the US dollar data. The market had maintained its momentum until Friday when the market closed for the week. At that price, action has poked through the support formed by the Fibonacci Retracement level of 61.80.

Also, price action could be seen to have fallen below the Guppy Multiple Moving Average (GMMA) lines. Meanwhile, the Stochastic Relative Strength Index (SRSI) lines are falling sharply towards the oversold region. Consequently, this signals that bears are in control at this point in this market.

AUDUSD Maintains a Bearish Outlook

While the AUDUSD market has a strong bearish tone on the daily market, the 4-hour market shows that market forces are trying to resist the overpowering headwinds. This could be seen through the appearance of a tiny green price candle below the Fibonacci Retracement level of 61.80.

Furthermore, with such a minor increase, the SRSI indicator lines can be seen rising upwards and out of the oversold region more significantly. This shows that the momentum is weak and may fail. Consequently, it appears that the best Forex Signals to use in this market are bearish ones, as the market may approach the 0.6500 mark ahead of further impetus.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply