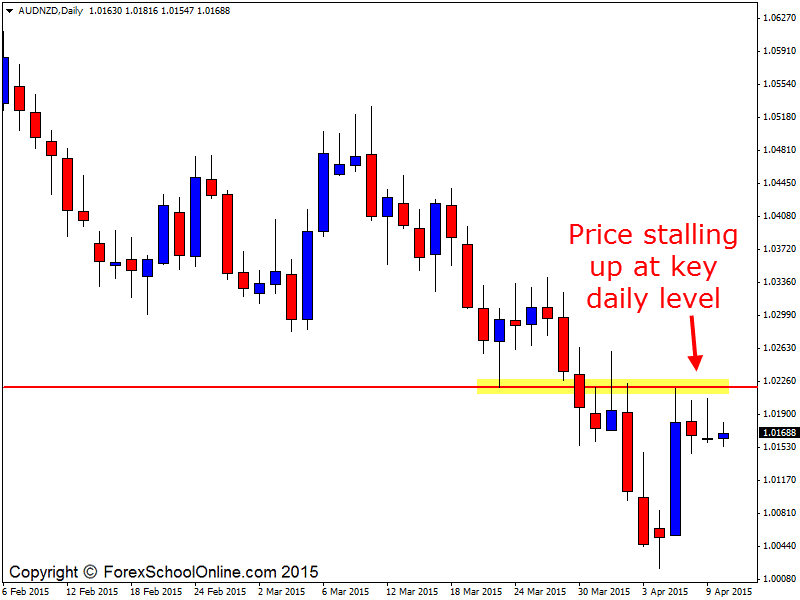

The AUDNZD is starting to stall at a key daily resistance level as I write up this blog post on the daily price action chart. You can often tell when price is starting to stall because the price action will make a retracement or pull-back and then start to move sideways.

Often times price will wind-up into a tight range when it is going into the stall and form price action like indecision candles for example the inside bar (IB). The reason for this is because price is looking for the next major order flow price action push to come into the market and until it gets this, price can stall and tend to move sideways.

As we can see on the daily charts of the AUDNZD below; this stall or pause that is happening is at a daily resistance level. What is interesting about this level is that whilst it is a key daily level and a great level to hunt for short trades, it is not a long-term level that has been tested multiple times.

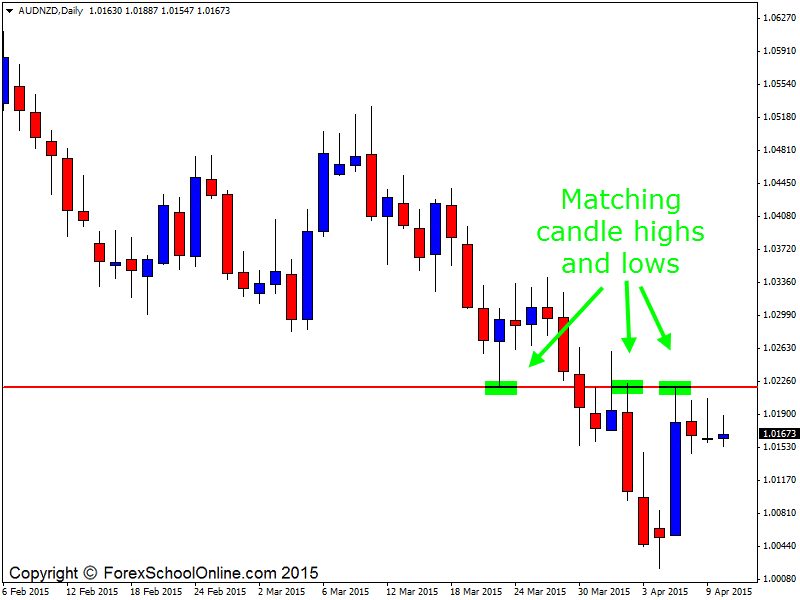

The reason this is such a strong level to look to take short trades from is because of the recent strong trend lower. Taking short trades from this level would be trading inline with the recent trend and momentum lower. The other major reason is because of the matching candle highs and lows. Matching candle highs and lows on higher time frames are what make major support and resistance levels on smaller time frames.

As the second daily chart shows below; there are candle highs and lows on the daily AUDNZD that are showing us that this level has been respected. Whilst on the daily chart these are only seen as matching highs and lows. If we are to jump to a 1 hour chart, this exact same level as the daily chart is now a major support and resistance level that price has moved to and away from on multiple occasions.

We can use matching highs and lows in a lot of ways. Once you understand them they are going to help you as another part of reading the overall price action story. They will also help you with your normal price action technical analysis, such as; picking paths to manage your trades, working out where the best entry points are and when to skip trades because there is a matching high/low level in the way.

Have an awesome weekend!!

Johnathon

AUDNZD Daily Chart

AUDNZD Daily Chart

Related Forex Trading Education

– Make Money Just One Price Action Setup at a Time ~ A True Story

Leave a Reply