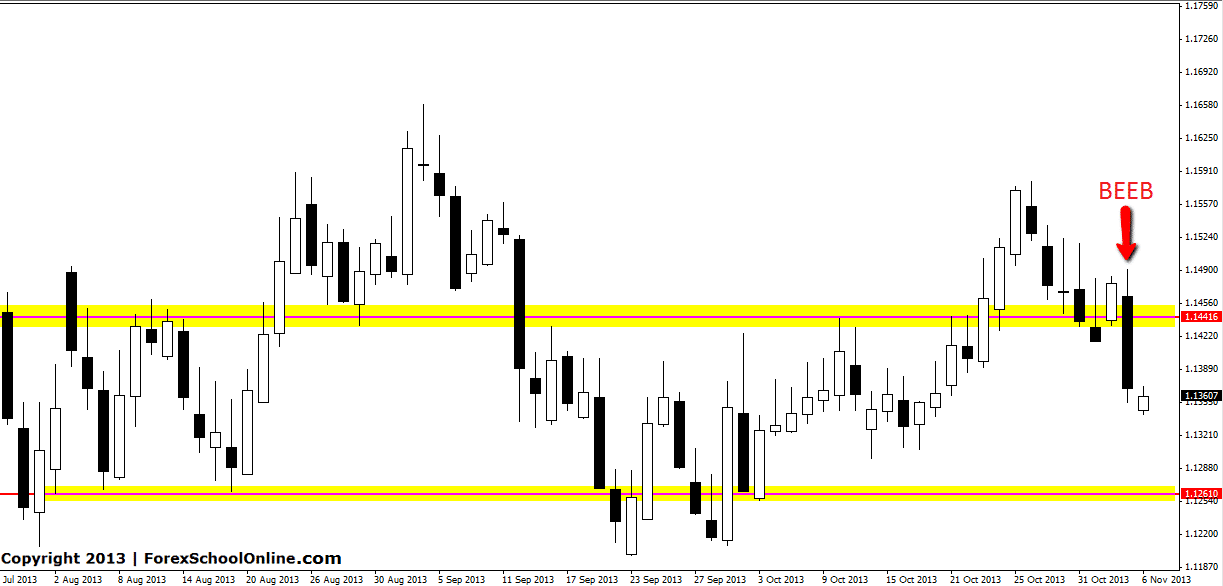

The AUDNZD has formed a bearish engulfing bar (BEEB) on the daily price action chart. This BEEB is a large and is engulfing the previous two candles. This engulfing bar was formed when price moved higher to test the key resistance and then slammed lower when the bears gained full control and took price well lower. Price ended closing well lower and near the daily lows.

If price can get a move on and break lower the next important support level comes in around 1.1260. This level is not the near term lows and also not the range low, but it is the next support in line if price breaks lower. If price breaks higher and wants to test higher prices, the very key level that the engulfing bar is rejecting is the first resistance standing in the way. When markets range like this market is, price can often bounce in between key levels and if price moves higher it would not surprise to see it test this key resistance. Traders can watch both these support and resistance levels for how price reacts and whether price breaks and closes above or below them as to whether they will break or hold.

AUDNZD Daily Chart

IMHO, this article not giving you advice to enter or making a trade but it tells you “story” of the price, how it moves, reacts….etc….

Exactly; this is a commentary of where this pair is currently at, and commenting on that an BEEB had formed breaking through the key level, rather than saying the BEEB is a quality EB to short. I personally think it would it would not be surprising to see price move higher to test the resistance that the EB is breaking through where short trades could be hunted.

price had moved higher before heading down…high point of that is the swing high… this morning price has formed a pin bar and may retest the resistance level rejected by the engulfing bar

To me the BEEB has not formed at a swing high… I’m confused I thought this was a golden rule?

if the BEEB forms at a swing high, it would be a huge opportunity to grab some money…