Upward pressure still dominates both the higher and medium-term time frames.

It is very likely for AUDJPY to resume the bearish trend as the market is overbought.

AUDJPY Weekly Price Analysis – January 29

The AUDJPY pair is on the verge of more downsides. If the bears’ momentum should break down the $87.411 support mark, the Yen price may further drop to an $86.000 lower support value and this may invalidate any bullish signs.

AUDJPY Market

Key Levels:

Resistance levels: $95.000, $96.000, $97.000

Support levels: $91.000, $90.000, $89.000

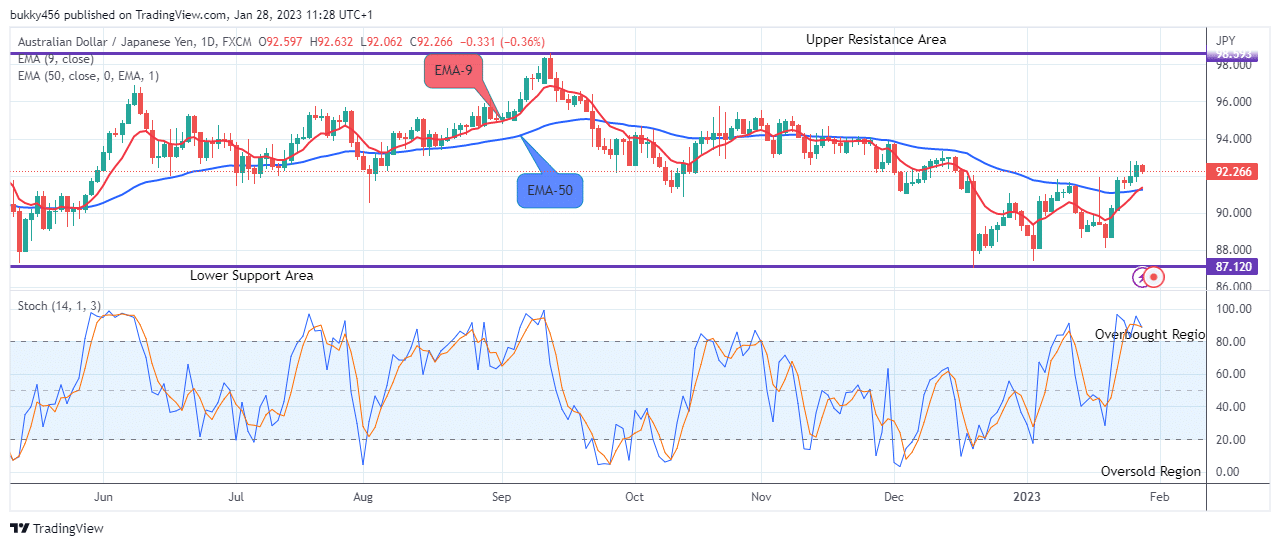

AUDJPY Long-term Trend: Bullish

On the daily chart, the AUDJPY pair is trading above the moving averages, which means that it’s in a bullish trend zone. The bulls’ pressure on the currency pair at the $92.813 supply value further led to an increase in the price of the Yen during yesterday’s session and sustained it.

The bears overrode the bullish momentum and drove the price of the Yen down to the $92.597 support level above the moving average lines as the daily chart resumes today.

Impulse move by the sell traders further dropped the price down to the $92.062 low value above the supply trend levels; this implies that the bears are returning to the market in a grand style to stage a play. If additional effort is added by the bears, the bearish trend will reach a psychologically key level at the downside.

Furthermore, it is very likely for the AUDJPY price to continue the drop as the daily stochastic signal is now pointing upwards in the overbought region, this means that the buying pressure is exhausted; we can then expect sellers to push the price down and the $86.000 lower support value might be the target in the nearby days in its long-term scenario.

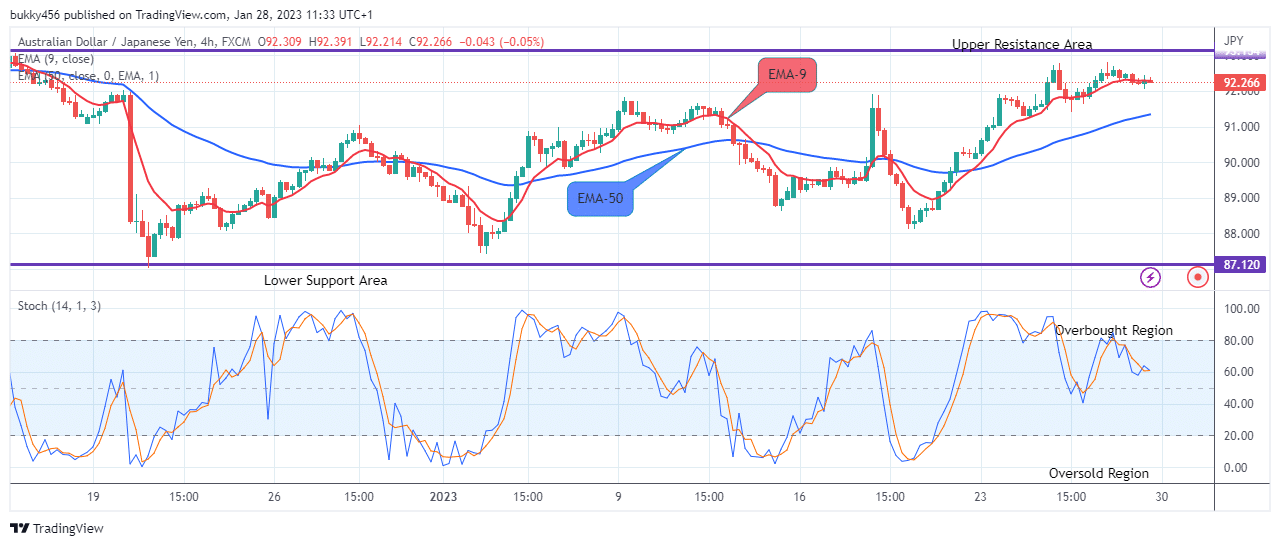

AUDJPY Medium-term Trend: Bullish

On the 4-hourly chart, the AUDJPY remains is in a bullish trend zone. The Yen’s price is trading above the two EMAs despite the moves from sellers.

Activities from the bulls at the $92.701 high value during yesterday’s session have led to their upward strength in recent times. Nevertheless, it seems the bears will take over the price of AUDJPY soon and push the price down as the market now trades at the overbought region.

Today’s 4-hourly chart opens with a bearish candle at the $92.156 support above the two EMAs.

Increase pressure from the short traders further dropped the price of AUDJPY down to a $92.214 low value above the moving averages, this implies that the bears are returning to the market to dominate and control the market prices soon.

In addition to that, the signal from the stochastic oscillator pointing downwards in the overbought region is an indication that the buying pressure has ended. This will draw sellers to continue the low-dips and in this case, the bearish correction phase may hit the $86.000 lower support mark in the nearby days in the medium-term perspective.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply