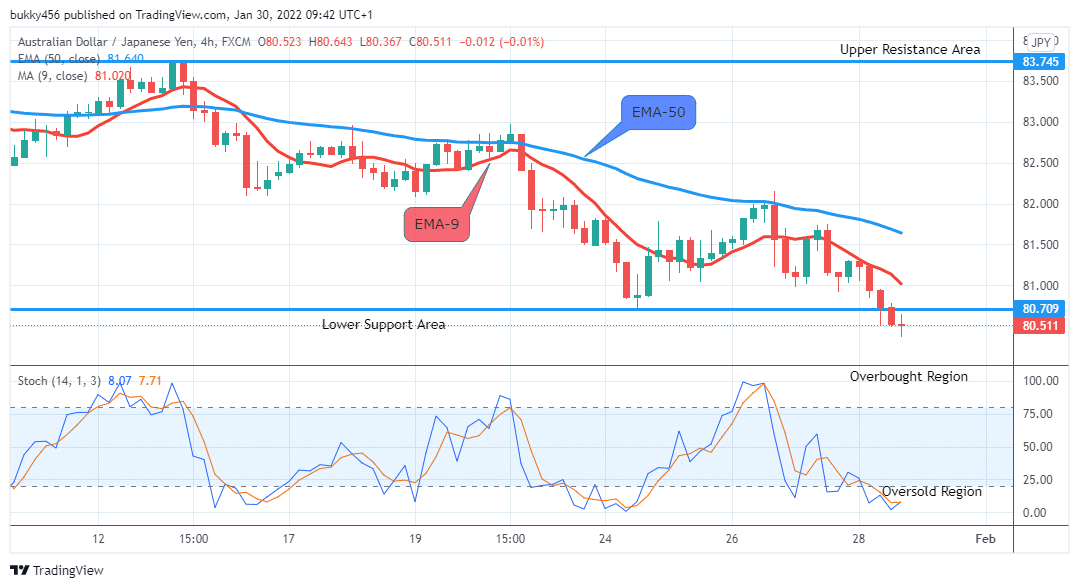

The price bars are below the moving averages which makes it capable of falling to the downside.

Selling may be considered at the key areas.

AUDJPY Weekly Price Analysis – January 30

Further increase in the bear’s pressure may break down at $80.271 level and this may decrease the price to $78.887 and $78.785.

AUDJPY Market

Key Levels:

Resistance levels: $83.760, $83.860 $83.960

Support levels: $79.900, $79.800, $79.700

AUDJPY Long-term Trend: Bearish On the daily chart, the AUDJPY currency pair is trading below the moving averages, which is a bearish trend zone. The impulse move by the sellers at the $81.563 support level during yesterday’s session sustained the bearish momentum and maintained it.

On the daily chart, the AUDJPY currency pair is trading below the moving averages, which is a bearish trend zone. The impulse move by the sellers at the $81.563 support level during yesterday’s session sustained the bearish momentum and maintained it.

The bears continue the journey down south as the daily chat opens today at $81.113 in the support area.

The aggressive move by the sellers further drops the price of AUDJPY down at $80.511 support level as the journeys down south continue.

The price of the Yen is initially down at $80.367 below the two EMAs in the support area. This implies that the price of AUDJPY is in control of the bears; therefore it’s in a downward trend.

The AUDJPY pair has fallen below the 20% range of the daily stochastic in the overbought region, it indicates that the selling pressure is likely to end sooner in the days ahead in the long-term perspective.

AUDJPY Medium-term Trend: Bearish The currency pair is trading in the bearish trend zone in its medium-term outlook.

The currency pair is trading in the bearish trend zone in its medium-term outlook.

After breaking the $81.565 of the upper channel the bulls pushed the price further up to $81.736 in the resistance area shortly after yesterday’s opening before momentum loss. AUDJPY dropped to the $80.914 support level before the end of the session.

The 4-hourly chart opens today with a bearish pin bar at $81.291 in the support area.

The sellers continue the journey down south and drop the market price of the AUDJPY currency pair to the $80.514 support level.

The Price of AUDJPY is down at $80.367 below the two EMAs in the support area as the journey down south continues. This is an indication of downward momentum in the price of the Yen.

The stochastic oscillator signal pointing up at around level 5% in the oversold region suggests that the currency pair may likely encounter a trend reversal whereby buyers will emerge to push the price of AUDJPY up in the days ahead in the medium term.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply