In this blog yesterday I made a post discussing how price had crashed through the daily support level and most importantly closed below with the support level looking to act as a price flip level and go from a support level to near term resistance level. To read yesterdays original post see here: AUDJPY Breaks Daily Price Flip – How Should Traders Play it? I also suggested for traders looking to trade intraday charts such as the 1hr chart, they could target this new resistance level should price rotate higher and look to get short should bearish price action present.

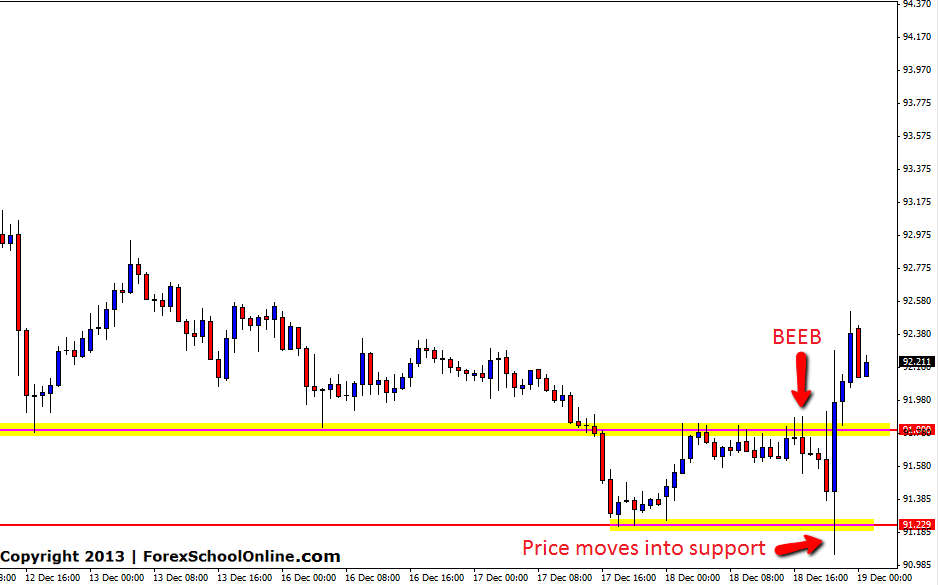

Price moved higher and into this level and at first price did not print off any bearish price action suggesting price was possibly going to move back above this level. Price then printed off a solid bearish engulfing bar (BEEB) on the 1hr price action chart. The compelling thing about this BEEB was that is was engulfing all the previous candles that were hovering around and had stalled at this key new resistance level (15 candles in all!!) showing that price had stalled and now the bears had come and ripped control ready to send price lower. Once price broke the low of this BEEB and confirmed the price action signal, price collapsed and the BEEB came off moving into the near term support level. It was at this near term support level where price found support which is quite often the case with these intraday trades and price rocketed back higher. Traders who played this BEEB had a great chance to make a solid profit or at the minimum protect their profit and capital by shortening stops when price moved into the support level.

AUDJPY 1hr Chart

Special Note: I have just released a new article that answers the two questions that I get asked a lot by traders which are ” Exactly what pairs do I trade and do I concentrate on just a few pairs or many”. In this article I discuss the best methods for traders to go about trading price action and exactly how they should run their trading. To read this article see here: Start Cherry Picking the Very Best Price Action Trades

Leave a Reply