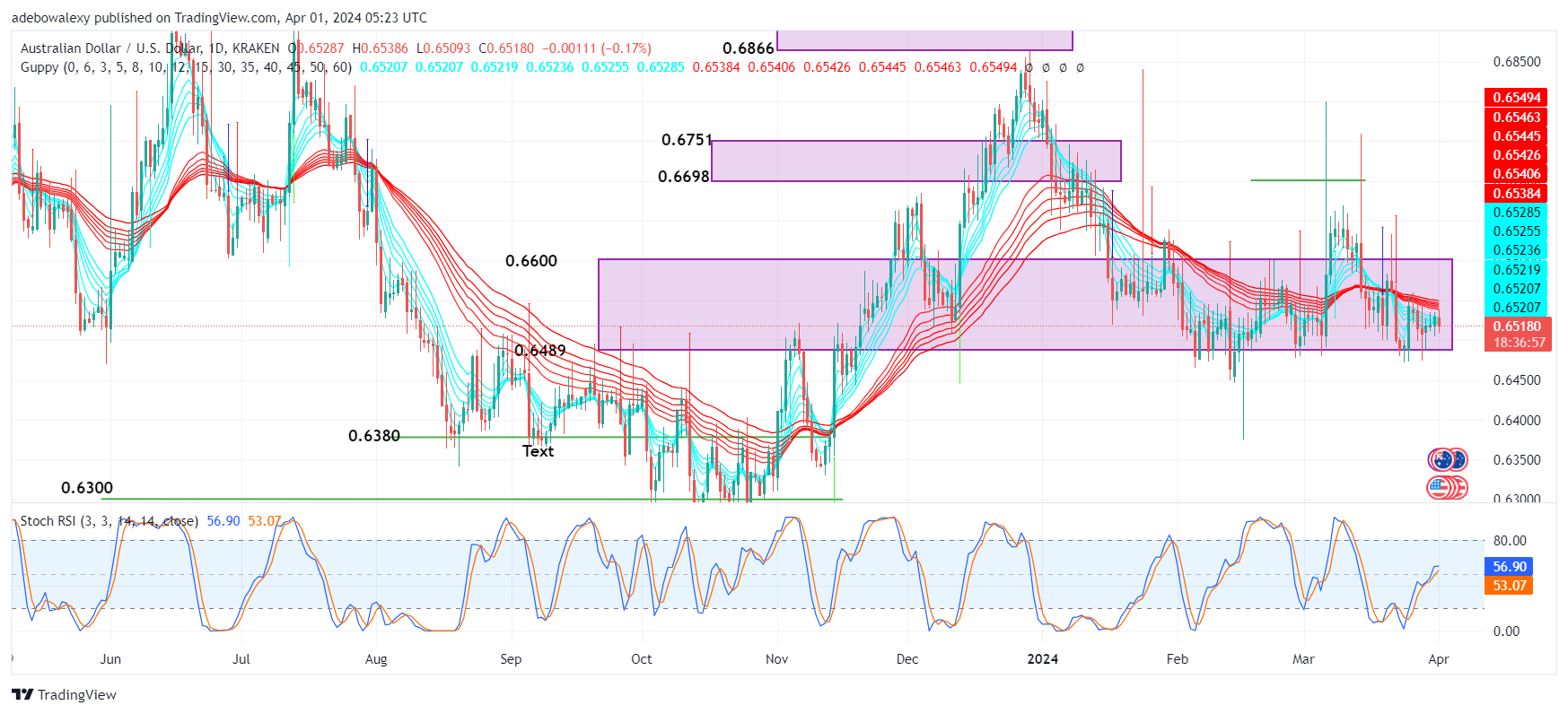

As the market anticipates the US PMI data, it appears that the US dollar has enough strength to resist the AUD/USD pair from rising higher. This can be observed as the pair started the week on a bearish note. With more influential market data still pending, we can expect some intrigue in this market.

Key Price Levels:

Resistance Levels: 0.6600, 0.6700, and 0.6800

Support Levels: 0.6518, 0.6500, and 0.6400

AUD/USD Reverses Course Bearishly

Price action in the AUD/USD market has reversed its earlier upward trajectory, causing the pair to now trade below the Guppy Multiple Moving Average (GMMA) lines. Additionally, the gains accumulated in the previous session seem to have been erased by today’s trading activity.

However, it is worth noting that the Stochastic Relative Strength Index (SRSI) line still maintains a general upward trend. The leading lines of this indicator show a slight deviation to reflect the price correction on the daily market. Consequently, this suggests that stronger downward pressure may be required to trigger a more significant correction.

AUD/USD Market Remains Above Most GMMA Lines

In the AUD/USD 4-hour market, price action remains above most of the GMMA lines. The size of the last price candle on this chart indicates that headwinds have exerted significant influence. However, it appears that many traders are staying on the sidelines due to the anticipated US data release.

This has resulted in minimal downward progress during the ongoing session, keeping prices above the converging GMMA lines. Moreover, similar to the observation in the daily market, the SRSI lines here also maintain a general upward trend, signaling a consistent cautious sentiment in the market. Considering these factors, traders can anticipate the market continuing towards the $0.6600 mark by utilizing Forex signals with targets near that this mark.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply