When people first come to trading and in particular Forex the first thing they look to do is find the shiniest and fanciest trading system they can get their hands on. The thinking goes that if they can just find the latest and greatest system all their dreams will come true and the millions will come rolling in.

Whilst a solid and profitable trading method is needed to make money trading, if the trader does not use a profitable money management technique to fit that system or method then the best trading system in the world is not going to help them.

The best trader in the world could personally tutor and give a trader all their tricks and tips, but if that trader fails to use solid money management, then they are still doomed to fail! This is how important money management is and it is something that is constantly overlooked.

It takes many months in most cases for traders to search through system after system to realise that after all the systems have failed that maybe it is not the system, but something else they are doing that causing them to consistently fail.

What is Money Management in Forex?

Basically exactly as it says; Forex money management is how you manage your money when you trade. When discussing money management in Forex, traders are normally referring to how much they are risking of their account. For example; trade Joe may say: “I am risking 2% on this engulfing bar trade”. This means that if Joe was to lose his trade he would lose 2% of his overall 100% account.

It is important that all traders have a money management technique and that it is carried out with consistency. Below I will speak about this in more detail and why I am not a fan of the fixed percentage.

One of the most important aspects of money management is ensuring that the traders live to trade another day no matter what happens on any one individual trade. Anything can happen at any time in the markets and using a sensible money management technique ensures that the trader will be able to trade again no matter what happens.

A major reason that traders will fail even when using a profitable trading system is because the money management they are using simply does not give their systems edge long enough to play out over time. Traders must think like a casino when trading.

A casino knows they will lose games and also know they will have losing runs of games, but the casino knows that in the end they always come out on top. The casino factors in how much they can risk to ensure that in the end they will make money. This is exactly what traders have to do to ensure that no matter what happens and no matter what losing streaks they have, they give their profitable trading method time to play out by using a money management technique that keeps them in the game.

How to Work Out Trade Position Sizes

After the trader has decided how much they wish to risk each trade, it is important that they then before entering each trade work out how much the position size should be. Something I am regularly amazed at that traders don’t know exists is position sizing. This consistently surprises me as this one technique is so important and yet overlooked and not known to so many traders.

Position sizing is important because it allows traders to adjust their trade size depending on the factors of the trade such as the pair and stop size. I often get told by traders “I can’t trade the higher time frames because I don’t have enough money” and this is exactly what position sizing solves. Working out the position size allows traders to make bigger or smaller trades depending on the different trades circumstances.

Every trade a trader will enter will have a different size stop. If a trader is to enter the same amount on every trade no matter what the size stop is they would be risking vastly different amounts of money and different percentages of their account every single trade.

For example; if a trader put a 50,000 trade on with a 20 pip stop they are risking twice as much as if they enter the same 50,000 with a 10 pip stop.

So a trader can enter every trade risking either the same amount of money or the same percentage of their account for every trade, position sizing is used.

Using position sizing ensures that a trader will be able to place a trade and risk the same percentage of their account whether the stop is 200 pips or two pips. This also ensures that no matter how small the traders accounts are they can play trades with large stops, providing their brokers allow them to use leverage and small units.

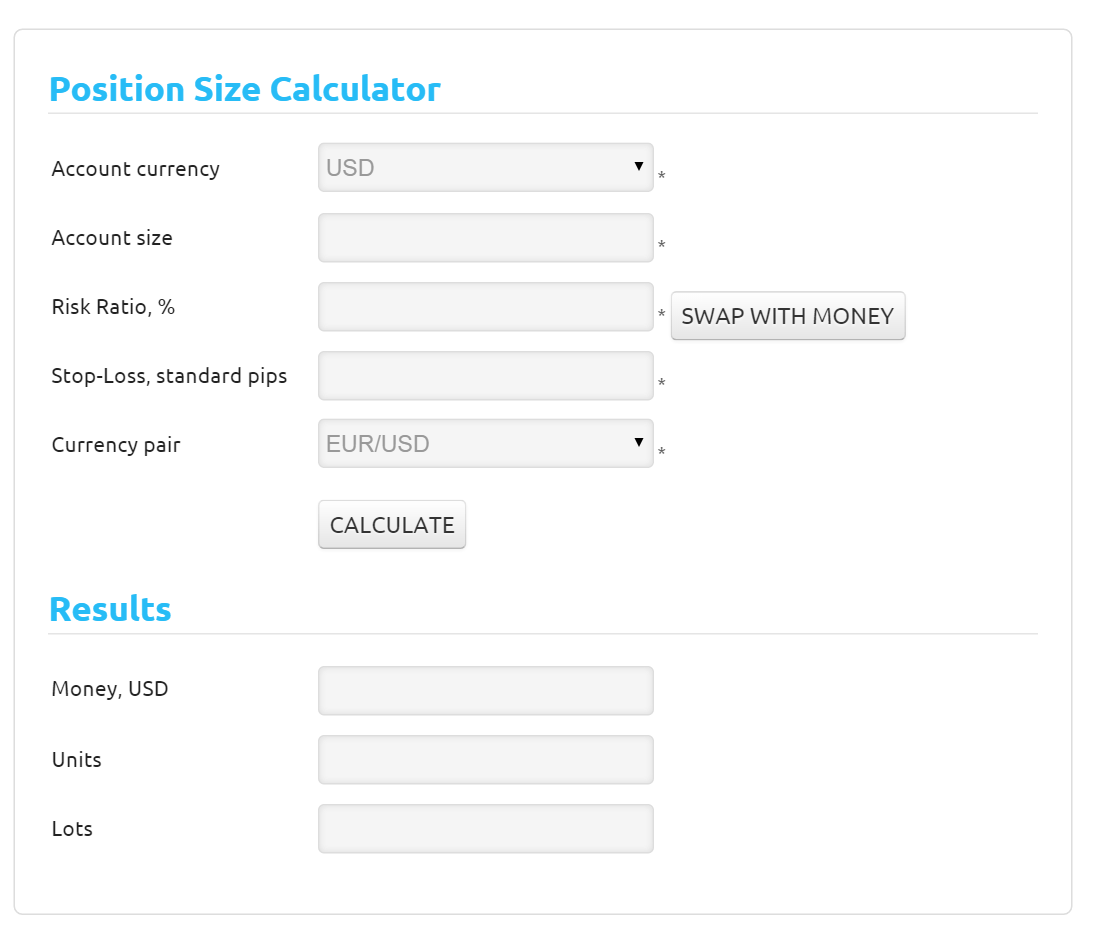

To work out the position size before each trade we use what is called a position size calculator which can be found here: Position Size Calculator

The calculator asks questions which will need to be filled in such as: account currency (the currency of your trading account), account size (your account size in $), risk ratio is either % or $ (how much in $ or % you want to risk), stop loss in pips (how big your stop is), currency pair (the pair you are trading).

After these questions are filled in, you will be given your answer of the amount you need to trade to risk the amount you input into the risk section. The results come back as: money (how much money you are risking in this trade), units and lots (how big your trade size is on units and lots). This is the amount you will then open a trade with.

For example; if the calculator comes back with Money: 200 Units: 20,000 and Lots: 0.2 it means you will be opening a trade for 0.2 lots. One full standard lot or standard contract is 100,000, so 0.2 lots of one standard lot are 20,000.

A picture of what the position size calculator looks like below:

Why Fixed Percentage is Flawed & a Few Money Management Keys!

A lot of retail traders use the commonly used money management method that is commonly called the fixed percentage method that we touched on above. This method is basically all about using the same percentage risk every trade no matter what the size stop for each and every trade. For example; trader Joe may risk 3% on every one of her trades and she will risk this same 3% no matter whether the stop on her trade is 30 pips or 300 pips.

The percentage risked will stay the same whether trading on the 1hr chart or the weekly chart. The idea behind this method is that it keeps the trader in the game. If the trader goes on a losing streak the amount of money risked continues to get smaller because the account size gets smaller, but the percentage of the account risked overall stays the same.

The problem for this method is that if the trader starts losing, it makes it harder and harder to get the account balance back to break even and make money. Because they are using a fixed percentage, if the traders starts losing the account starts getting smaller. If the account starts getting smaller the amount of money they are risking starts getting smaller and smaller and the amount they start profiting gets smaller and smaller until the wins are not covering the losses.

The problem for this method is that if the trader starts losing, it makes it harder and harder to get the account balance back to break even and make money. Because they are using a fixed percentage, if the traders starts losing the account starts getting smaller. If the account starts getting smaller the amount of money they are risking starts getting smaller and smaller and the amount they start profiting gets smaller and smaller until the wins are not covering the losses.

If a trader loses 50% of their account with the fixed percentage method they don’t just have to make back 50% to get back to break even. They have to make back 100%!

So What to do?

When you consider that most traders trade with an account balance less than $10,000 it shows that the fixed percentage model is even more flawed. Another less well know method to manage money is the fixed money method.

The fixed money method is where the trader risks the same amount of money every single trade rather than risking the same percent. The trader picks a certain amount of their account that they are comfortable risking every trade. It is important that this amount is reasonable and that the trader can also take enough losses, but also stay in the game long enough for their trading edge to play out. For example; trader Joe who risked 3% of her $10,000 account, may instead be more comfortable risking $300 of her account each trade.

With this method if trader Joe loses a few trades and the account balance goes down, instead of the amount of money she is risking going down also and making it harder to get back to break even, she will continue to still risk the same $300 every trade.

Using the fixed percentage money method it is important that traders set goals in their trading journal and plans so that when these goals are reached they can increase the amount of money they risk per trade. This way the best of both worlds can be had; the trader can bet back to break even after any losing streaks as quick as possible, whilst taking advantage of the winning streaks when they come.

Related Trading Lessons

– How You Can Transform Your Trading by Creating a Profitable Forex Edge