Market Analysis: GBPJPY is Poised to Extend its Bearish Trend

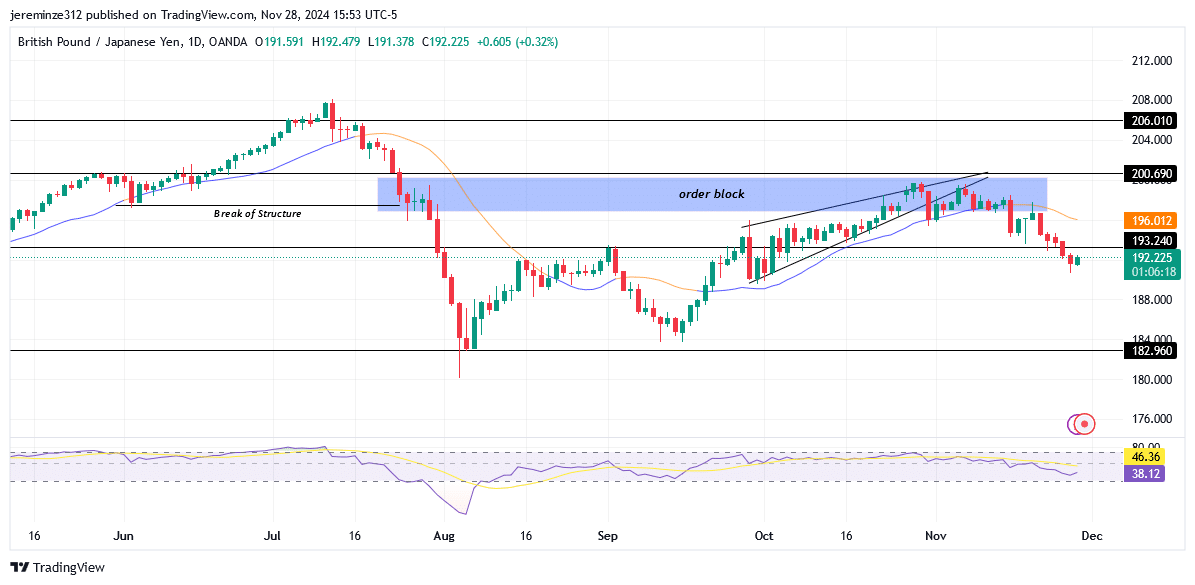

GBPJPY has experienced a significant bearish shift in market structure, confirmed by a decisive break in late July 2024. This movement featured a sharp bearish candlestick driven by strong selling pressure and minimal retracement. The decline found temporary support at the 182.960 demand zone, prompting a gradual retracement to higher levels.

GBPJPY Significant Zones

Resistance Levels: 200.690, 206.010

Support Levels: 193.240, 182.960

During this retracement, the price encountered a daily bearish order block, triggering a reversal as it reached this critical supply zone. Notably, a rising triangle pattern formed along the way, which ultimately broke downward, reinforcing bearish momentum. The combination of the bearish order block and the pattern breakdown has further accelerated the decline.

The Relative Strength Index (RSI) on the daily timeframe shows weakening bullish momentum, aligning with the bearish outlook. Additionally, the Moving Average (MA) signals continued bearish conditions as the price remains below it.

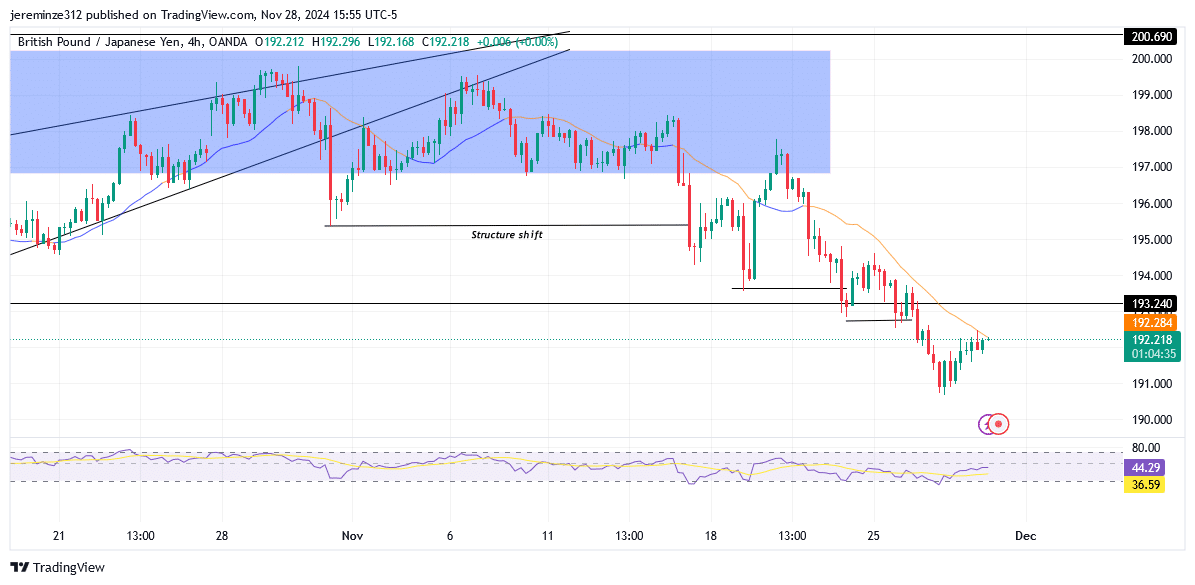

On the 4-hour chart, the bearish bias is evident, with lower highs and lower lows confirming the downward trend. While the overall sentiment remains bearish, the 4-hour RSI hints at a short-term rise in momentum, suggesting a potential retest of the 193.240 level before continuing the decline.

Market Expectation

With bearish momentum firmly intact and technical indicators supporting this outlook on both the daily and 4-hour charts, GBPJPY is expected to continue its downward movement. The primary target remains the 182.960 demand zone, where the price may attempt to breach support and move lower. In the near term, a retest of the 193.240 level is likely, offering a favorable entry point for sellers aiming to capitalize on the broader bearish trend driven by forex signals and technical patterns.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply