EURCHF Maintains a Still Motion

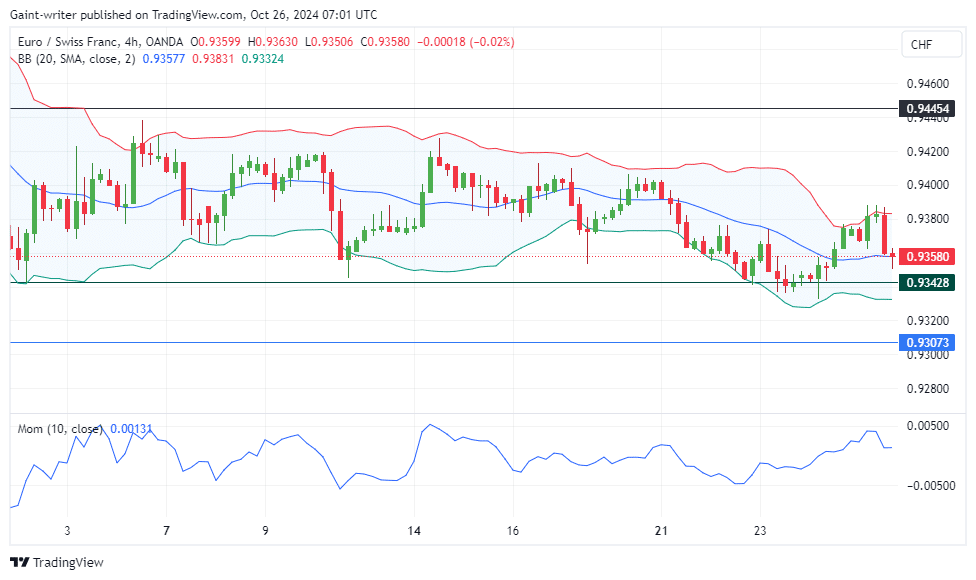

The EURCHF pair holds steady amid consolidation. EURCHF remains locked in a consolidation phase as market pressure fails to produce a decisive move. The 0.93420 level has emerged as a significant barrier, with sellers struggling to push below it.

EURCHF Key Levels

Resistance: 0.94000, 0.95400

Support: 0.93420, 0.92500

Bearish momentum has been building but attempts to break lower have been thwarted for months, keeping the market in a tight range. Buyers, meanwhile, have also struggled to gain ground, resulting in a prolonged standoff. Since September, EURCHF price has shown minimal movement, indicating both buyers and sellers are cautious.

The currency pair is currently consolidating just below the middle band of the Bollinger Band indicator, reflecting limited buyer momentum and continued suppression at this level. This setup suggests neither side has established a clear advantage, as both wait for a potential breakout or shift in sentiment.

The Momentum Indicator lacks a strong push in either direction, showing a stagnant phase with no definitive signs of acceleration. However, on the short-term timeframe, the ongoing tug-of-war may soon prompt a breakout, especially if one side gains confidence and manages to tip the scales.

Market Expectation

Currently, the EURCHF pair remains in a consolidation zone, with low momentum but increasing potential for a breakout. Traders should monitor the Bollinger Band indicator for signs of volatility and the Momentum indicator for any renewed push.

An upward move past the middle Bollinger Band could signify bullish intent, while a breakdown below 0.93420 would favor sellers. The best forex signals will take into account the current state of the market.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply