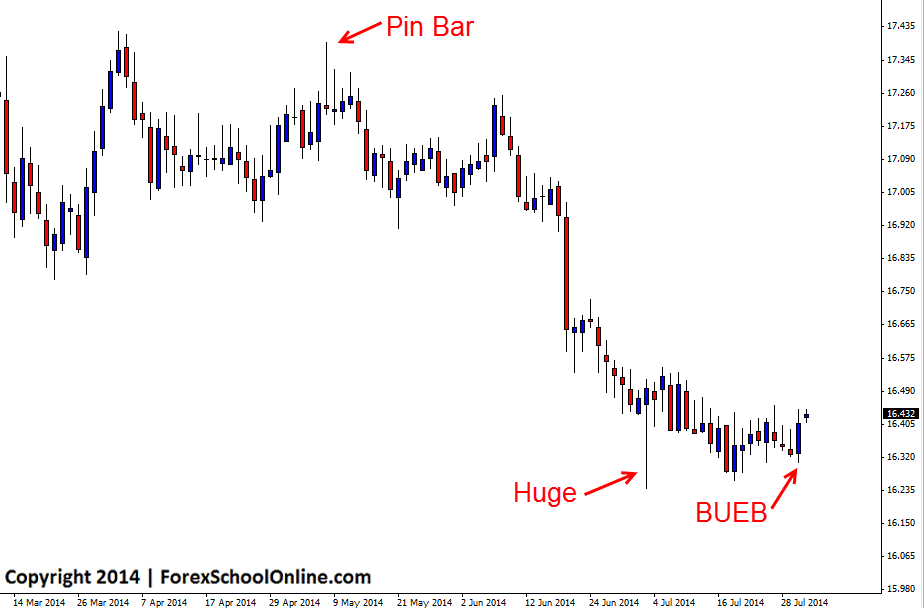

The NOKJPY has now fired off a Bullish Engulfing Bar (BUEB) down at the recent lows where price has been finding support in recent times. In the 4th July Daily Forex Market Commentary we discussed how price had formed a huge pin bar on this pair and this bullish engulfing bar has formed closed to this pin bars low, with the low of the pin bar as yet not breached.

Price has really been struggling to move higher of late with the strong recent momentum lower keeping price contained. This has meant that price moved into a tight range and sideways trading period. These sideways trading markets can be super tricky to trade at the best of times, but when they are so compacted as this market is at this point in time with price not making any free flowing moves it can make it extra tricky.

The reason ranging and sideways markets can be so hard to trade is because even if the price action trigger signals break, they then often have a lot of minor support and resistance levels in there way that can act as road blocks to price making any solid moves and this could be the case here for the bullish engulfing bar if price does confirm and look to break higher. If price can break higher, there is then minor levels directly above the BUEB and then again around the 16.5400 area. For any substantial move to be made, a break above the pin bar high as discussed in the 4th July Daily Forex Market Commentary would need to be made.

NOKJPY Daily Chart

Hi, the body of the candle should not completely contain the body of the previous candle?

Hello Luca,

no it doesn’t. An engulfing bar needs to fully engulf at least one previous candle which means it must have a higher high and lower low than at least the previous candle. You can read about it here: https://www.forexschoolonline.com//bullish-and-bearish-engulfing-bars-introduction-html/

Johnathon