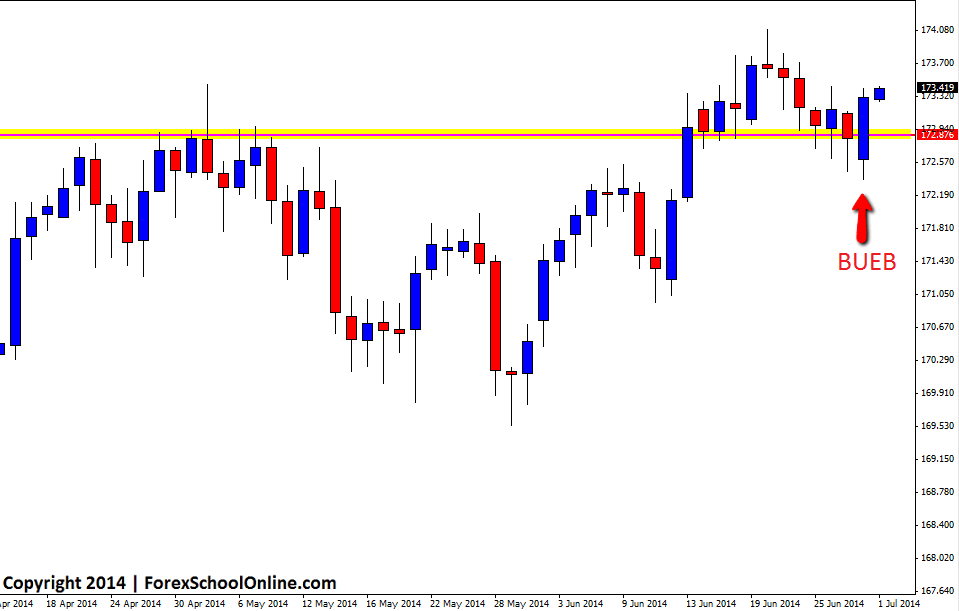

The daily price action chart of GBPJPY has printed off a Bullish Engulfing Bar (BUEB). Whilst this Bullish Engulfing Bar is not the cleanest setup, it is rejecting a daily support level that is a proven level and has acted as key resistance in the past and is now looking to act as a support level with the BUEB rejecting it.

If price can confirm the BUEB by breaking the high and moving higher, it then may be able to gain some momentum and push on higher into the recent swing highs where price recently found major resistance and produced a small rejection pin bar/rejection candle. If price retraces and moves back lower, the first major support of note for price to negotiate is as the daily chart shows below; the key daily level that is at this stage acting as a price flip support level for the BUEB.

We have discussed a lot of late in this blog just how important it is for price action trigger signals to confirm themselves before traders take their entry and also how traders should be setting their entries with pending orders. If you have missed these posts you can catch up on them here; Price Action Setup on Gold – NZDUSD Price Action Pin Bar & Trading Lesson – Why Traders Need to Take Entries With Confirmation. Whilst taking entry at the break and using confirmation can not stop all losses, it does cut out a lot of the losing trades that never go onto break or that never confirm and it does mean traders are entering with price trading in their direction and with momentum on their side. This can be especially important on intraday trades when price is moving quickly and this something traders really need to keep in mind when setting up their trades.

IS weekly S/R an issue at all? http://screencast.com/t/00ayMq7kjC

Hello Nick,

firstly nice chart. When looking at the daily chart and placing our key levels we are looking to see where price can and cannot close above or below. This is important because when price does make a break and close above or below an important level that price had not been able to previously, we can then look to that level to flp and act as a new support/resistance area and that is exactly what this BUEB is doing with price busting through and acting as a new support area. You can read more about how this works here:https://www.forexschoolonline.com//the-secrets-traders-can-read-from-candlesticks-price-action/

Safe trading,

Johnathon