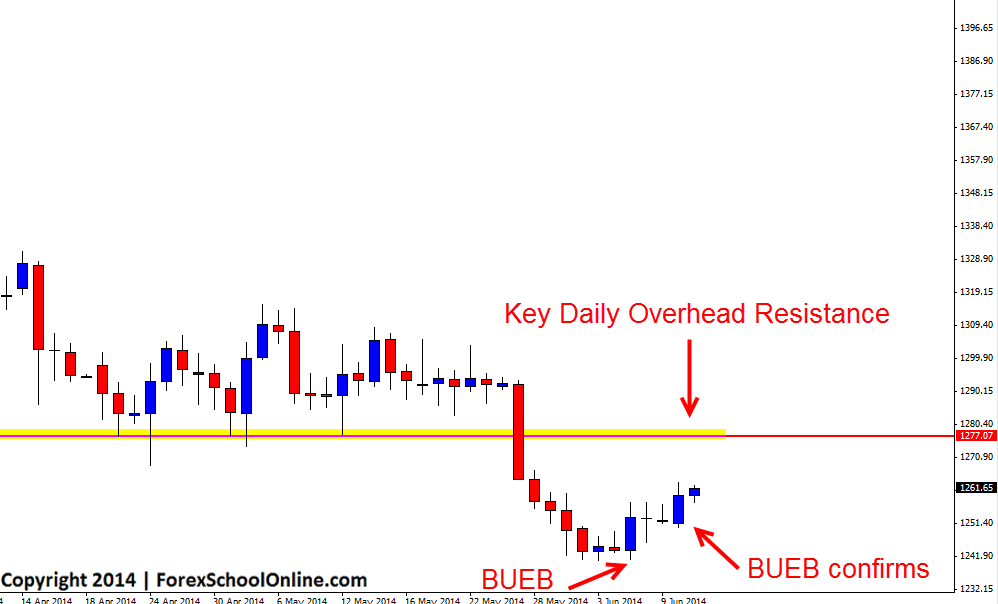

In this blog recently I made a post; Large Gold Engulfing Bar Forms Rejecting Key Support Level when price had formed a large counter trend bullish engulfing bar (BUEB) on the daily chart of Gold. This setup has now been confirmed with price breaking the engulfing bar high.

It is important that traders use confirmation to enter their setups with their entries as I teach in this lesson; Taking High Probability Price Action Entries at the Break because when entries are taken at the break, traders cut out a lot of the losses that don’t need to be taken in the first place and it also means that when the entry is being entered, price is moving in the same direction as the traders trade. In other words the trader is trading with the momentum.

When taking a retrace entry, price is moving away from where you want it to go. When you take this type of entry, you have to hope that something turns price around to make it come back to make you a winner. When you enter at the break, price is moving and trading with momentum in the direction of your profit targets and where you want price to go. You don’t need price to turn. In fact; you just want it to keep doing the same thing.

This setup is still a counter trend setup and over-head is the major resistance level. If price can make it to the key daily level, it may look to act as a price flip level and a solid level to hunt for high probability bearish trigger signals such as the ones taught in the Forex School Online Lifetime Membership Courses.

Daily Gold Chart

Leave a Reply