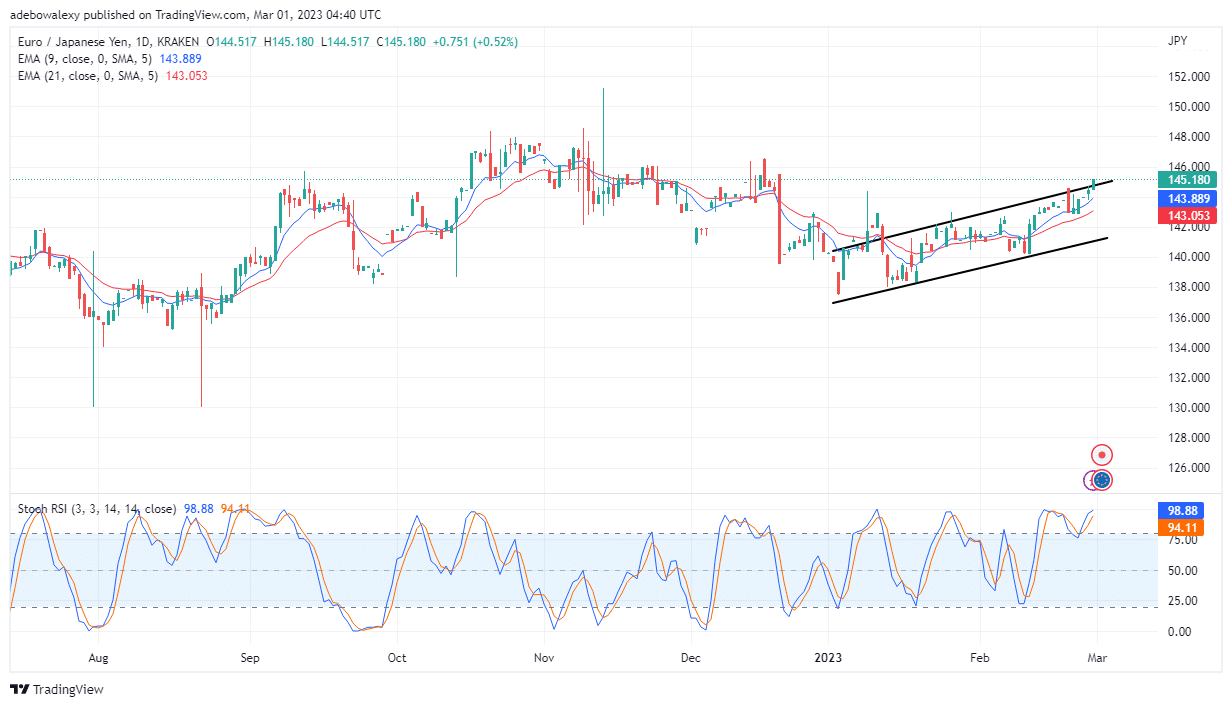

EUR/JPY has regained some upside traction, and with it, price action in this market has regained some lost ground. Additionally, trading indicators seem to be revealing that the pair may still claim more elevated price levels very soon.

Major Price Levels:

Top Levels: 145.18, 145.58, and 146.00

Floor Levels: 145.00, 144.80, and 144.50

EUR/JPY Bulls Are Breaking Resistance Levels

Although with moderate volatility, the EUR/JPY pair has been able to break the 145.00 price resistance level. Also, price action has broken through the ceiling of the upside-sloping price channel. Additionally, it could be seen at this point that price activities are now happening above the EMA lines, which indicates that price action is bound to go higher. Furthermore, the RSI indicator continues to move upward and towards the 100 level, now at the 98 and 94 marks of the indicator. Consequently, this points out that this pair may keep moving upward.

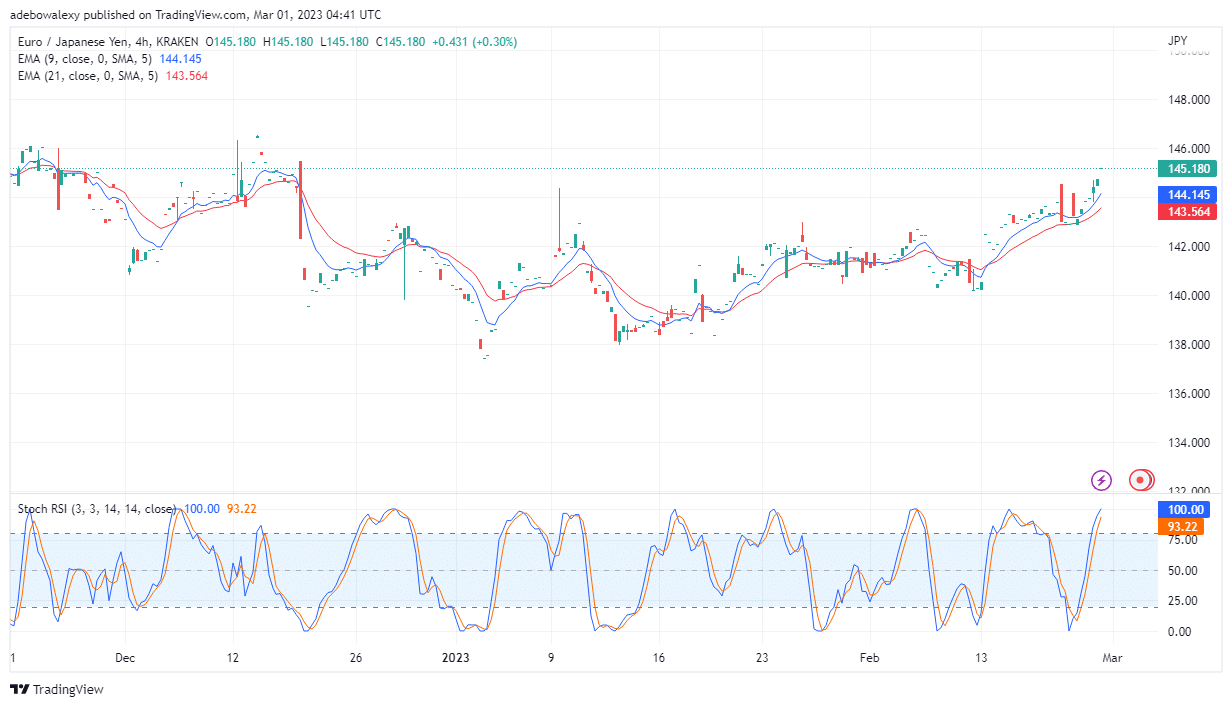

EUR/JPY Price Action Leaps Towards the 146.00 Price Level

A dashed-green price candle on the EUR/JPY 4 hour market has moved price up and towards the mentioned price mark. Also, this price candle can be seen at a considerable distance above the price candle for the previous trading session. This keeps price action further above the EMA lines, and reveals that this market possesses more upside propensity. Furthermore, the Stochastic RSI curves continue to ramp up to 100, with the leading line now ahead of the lagging one at the 100 level. Therefore, traders can expect the pair price to move towards 146.00.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply