GBP/USD Price Prediction – March 29

In the recent past trading operations of the GBP/USD market, some upward motions featured, breaking through resistances to hit a hard higher resistance around 1.3300. Presently, the currency pair price declines after hitting the resistance around the value line. The market has lost over two hundred pips as price trades around 1.3091 at a minute positive percentage of 0.08.

GBP/USD Market

Key Levels:

Resistance levels: 1.3200, 1.3300, 1.3400

Support levels: 1.3000, 1.2900, 1.2800

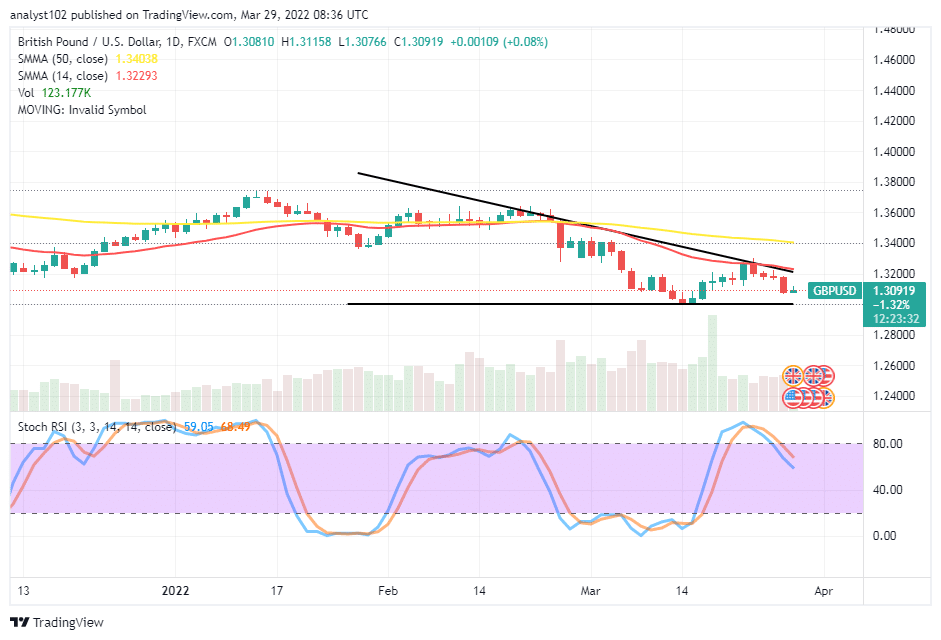

GBP/USD – Daily Chart

The GBP/USD daily chart reveals the currency pair price declines at 1.3300. The market had initially sprung upwardly until March 22 sessions. But, the following day turned uglier against getting a continuation of the trend. About a couple of days back, variant bearish candlesticks formed toward finding possible support around the 1.3000. The 50-day SMA indicator is above the 14-day SMA indicator. The Stochastic Oscillators have crossed southbound against the range of 80, indicating that a downing process is relatively ongoing. Should short-position takers ride on the downward trend to the lower support level at 1.3000 as the currency pair price declines momentum at 1.3300?

Should short-position takers ride on the downward trend to the lower support level at 1.3000 as the currency pair price declines momentum at 1.3300?

Technically, it would be better for traders to watch out for what can be the reactions of the GBP/USD market around the 1.3000 support level as the currency pair price declines momentum around the value-line. While price drops to the spot, long-position takers may brace up to get a buy entry.

On the downside of the technical analysis, the GBP/USD trade short-position takers may have to allow sell positions open 1.3200 to run more for a while. And they have to close around the 1.3000 support level. A sudden fearful breakdown at the point level latterly mentioned will lead to more sustainable downs.

Summarily, the GBP/USD market activities run under a bearish trending setting between the high of 1.3300 and the low of 1.3000. Traders are to watch out for price reactions around the lower value line before executing an order. GBP/USD 4-hour Chart

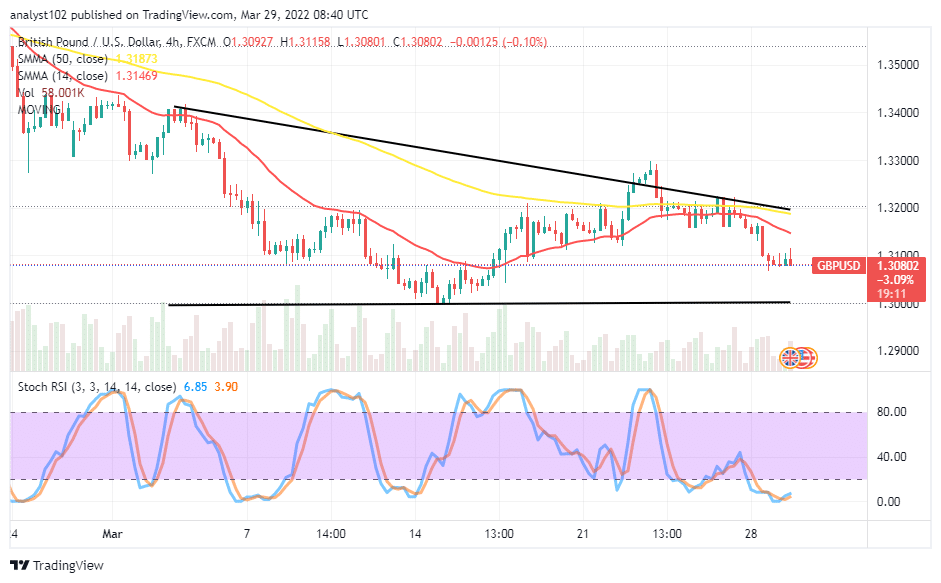

GBP/USD 4-hour Chart

The GBP/USD medium-term chart showcases the currency pair price declines at the 1.3300 level. The 14-day SMA indicator has bent downward closely beneath the 50-day SMA indicator. Some candlesticks have been converging around 1.3100 in attempts to breach southward further. The Stochastic Oscillators are in the oversold region, relatively moving in a consolidation style to signify that a downward force is in play. A bullish candlestick emerging in the current situation will end, getting smooth runs to the downside.

Note:Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Learn to Trade Forex Online

GBP/USD Price Declines at 1.3300

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply