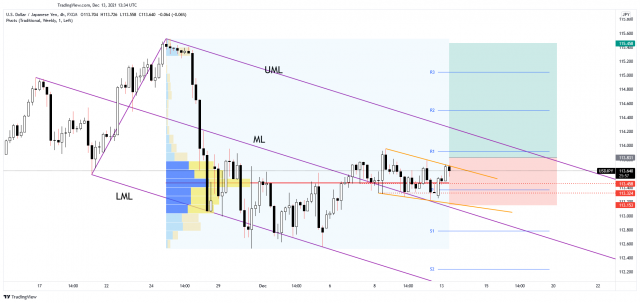

The USD/JPY pair moves somehow sideways in the short term, that’s why we need strong confirmation before taking action. Technically, it’s trapped within a Falling Wedge pattern, a valid breakout could activate an important movement.

The USD appreciated in the short term as the Dollar Index has managed to erase Friday’s losses. As you already know, the US Consumer Price Index reported a 0.8% growth in November versus 0.7% expected, while the Core CPI registered a 0.5% growth matching expectations.

Today, the Japanese Core Machinery Orders reported a 3.8% growth beating the 1.9% growth expected. Tomorrow, the Revised Industrial Production could rise by 1.1%. On the other hand, the US is to release the PPI and the Core PPI

Still, the next major and high-impact event is represented by the FOMC on Wednesday. Also, the US retail sales could bring strong action on USD/JPY.

USD/JPY Technical Analysis!

The USD/JPY pair found temporary resistance at the immediate downtrend line, at the Falling Wedge’s resistance, so a minor decline is natural. 113.32 stands as a strong support, USD/JPY could develop a broader upwards movement as long as it stays above this downside obstacle.

A valid breakout above the minor downtrend line could announce a potential breakout above the descending pitchfork’s upper median line (UML) as well. In the short term, it could continue to move sideways.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply