Gold was into a downside movement after its last swing higher. Now, the rate has signaled that the downside movement could be over and that the bulls could take the lead again. In the short term, it could move sideways before really offering a great trading opportunity. It’s trading in the red at 1792.74.

During the week, the US is to release high-impact indicators which could bring sharp movements in Gold. The ADP Non-Farm Employment Change, ISM Manufacturing PMI, Average Hourly Earnings, Unemployment Rate, ISM Services PMI, and the Non-Farm Payrolls could be decisive indicators.

XAU/USD Technical Analysis!

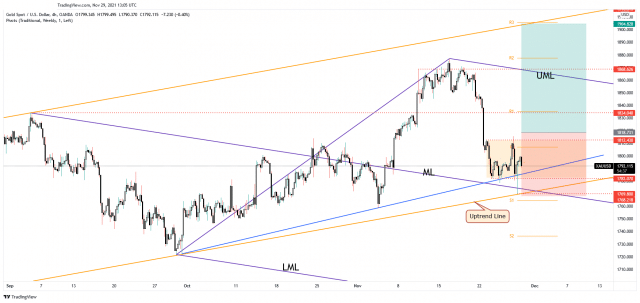

XAU/USD has registered a false breakdown with great separation below the 1782.07, under the uptrend lines, and through the descending pitchfork’s median line (ML) signaling that the yellow metal has found a strong demand zone and that the buyers could take the lead.

It’s traded within a range between 1,812.43 and 1,782.07 levels. Escaping from this pattern could bring great trading opportunities. An upside breakout through 1812.43 could activate an upside continuation. Only a valid breakdown below 1,769.80 could invalidate the bullish scenario.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply