USD/CAD Long-Term Analysis: Ranging

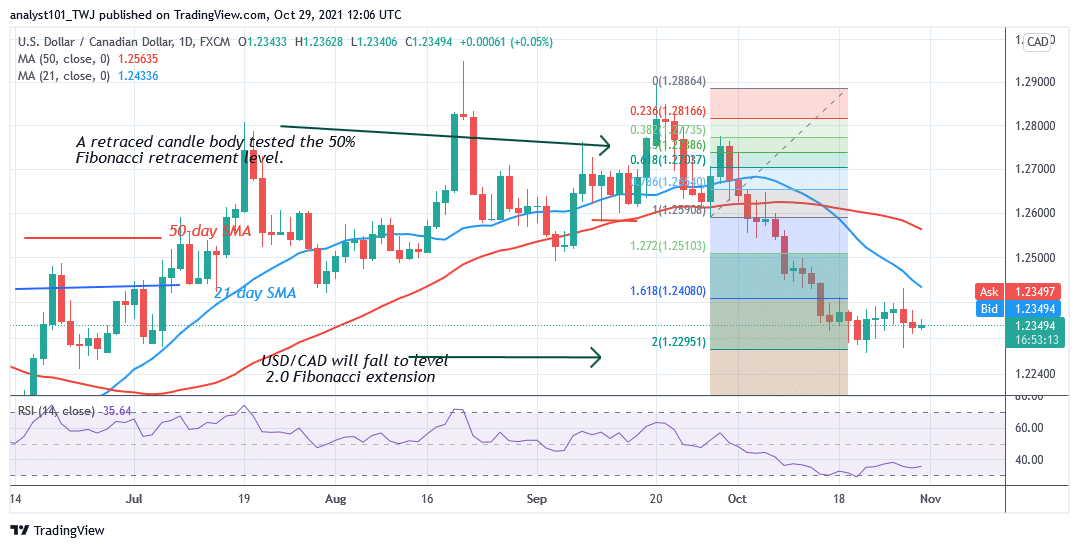

Since October 20, USD/CAD fell to the low of level 1.2295 and remained in a range-bound move. According to the Fibonacci tool, the downtrend has reached bearish exhaustion. The market has declined to level 2.0 Fibonacci extension or level 1.2295. Buyers and sellers have not decided about the next move. This has caused the currency pair to resume a sideways trend. Nevertheless, the currency pair will trend when buyers or sellers break the range-bound movement. According to the price action, sellers have an advantage over buyers as the pair continues to trade in the bearish trend zone.

USD/CAD Indicator Analysis

The Relative Strength Index period 14 has remained at level 35 as the pair continues the range-bound move. The market is in the downtrend zone and below the centerline 50. USD/CAD has a bearish crossover. That is the 21-day SMA crosses below the 50-day SMA indicating a sell signal. The pair is above the 25% range of the daily stochastic. The stochastic bands are sloping horizontally indicating the range-bound move.

Technical indicators:

Major Resistance Levels – 1.3300, 1.3400, 1.3500

Major Support Levels – 1.2300, 1.2200, 1.2100

What Is the Next Direction for USD/CAD?

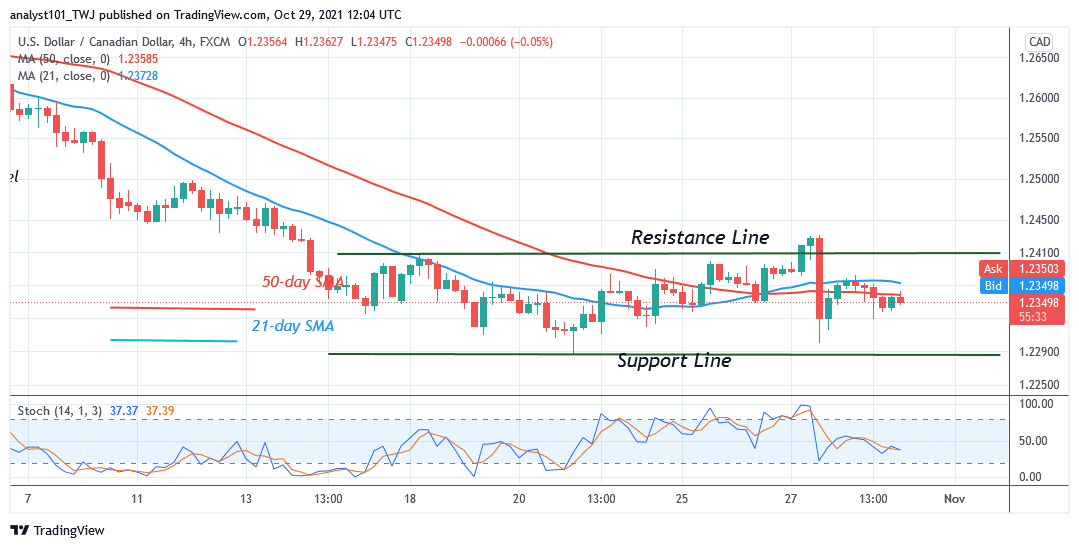

On the 4 Hour Chart, the pair have remained in a range-bound move as buyers and sellers contemplate the next move. On October 27, the bulls broke the resistance at level 1.2410 but the selling pressure was overwhelming as price fell back to the range-bound zone. Today, USD/CAD is fluctuating between levels 1.2290 and 1.2410.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply