Gold rallied right now only because the Dollar Index has plunged after the US data dump. The Final GDP registered a 6.7% growth in the Q2 beating the 6.6% growth expected. In addition, the Final GDP Price Index rose by 6.1% as expected.

Unfortunately, the Unemployment Claims registered an unexpected growth from 351K to 362K, even if the specialists expected a potential drop to 333K in the last week. The Chicago PMI will be released later. Also, the Fed Chair Powell Testifies could shake the price of gold.

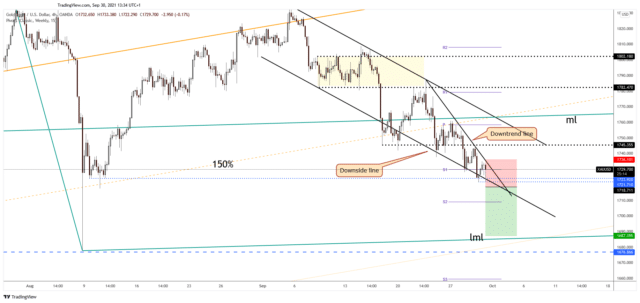

XAU/USD Technical Analysis!

Gold stands below the immediate downtrend line, so the bias is still bearish. Only a valid breakout through this line could invalidate further drop. Technically, a new lower low may activate a larger downside movement.

Also, a valid breakdown below the down channel’s downside line could validate a potential downside movement towards the 1,700 level or down towards the ascending pitchfork’s lower median line (lml). The bias remains bearish as long as it stays within the down channel and below 1745.35.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply