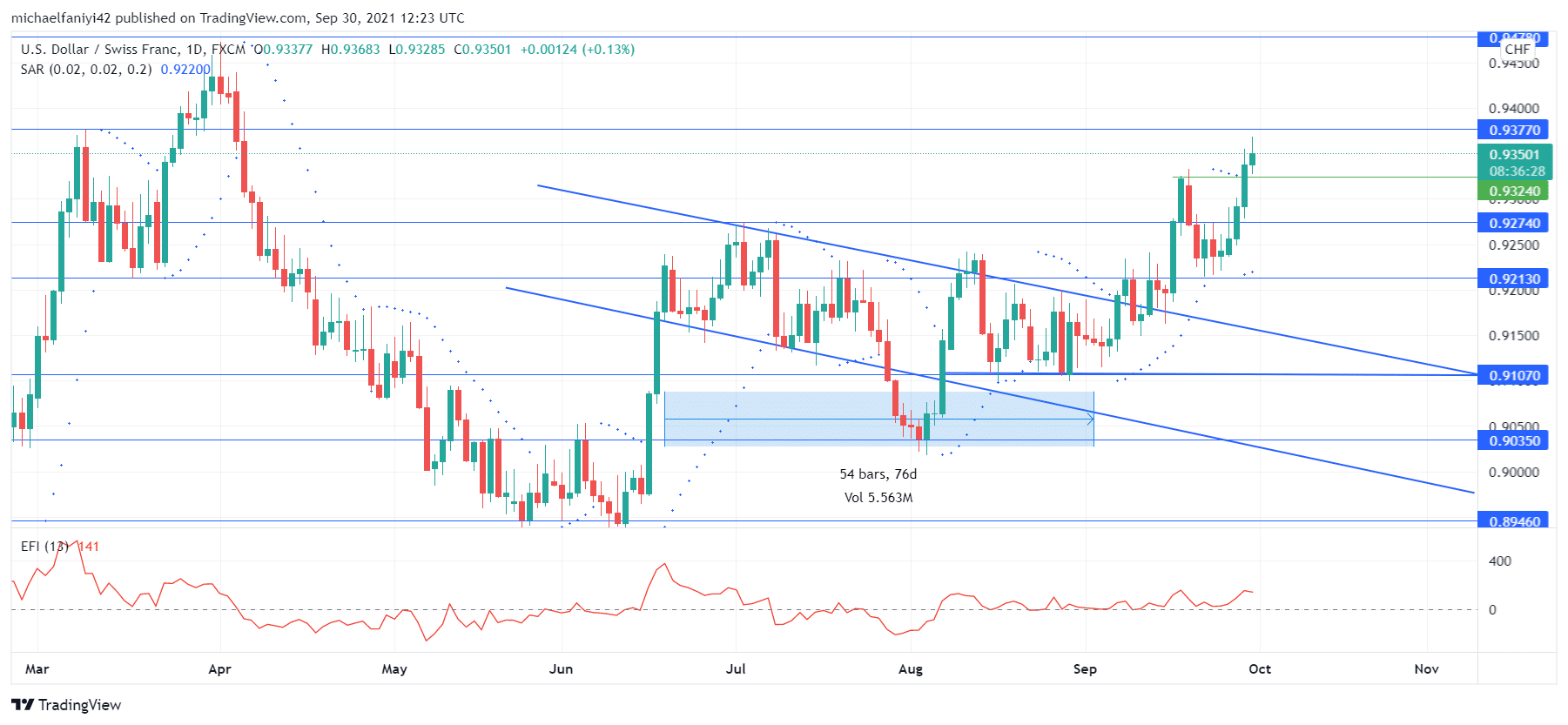

USDCHF Analysis – Price Breaks Through 0.92740 After a Retest at 0.92130

USDCHF breaks through the 0.92740 resistance level to press on with its bullish campaign. The market had previously broken above this level on the 17th of September, but the bulls ran out of steam, and price collapsed below the level. However, a retest at the 0.92130 support level gave buyers the needed push to break above the 0.92740 barrier, and this time, the bulls have maintained their upward impulse.

USDCHF Significant Zones

Resistance Levels: 0.92740, 0.93240, 0.93770

Support Levels: 0.92130, 0.91070, 0.89460 The market commenced its bullish agenda after dropping to the 0.89460 support level on the 25th of May 2021. Price was confined above that level with 0.90350 as resistance. This led to an accumulation in which price breaks out on the 16th of June. USDCHF then surged in two days to the 0.92130 price level. At this level, the market started sliding down under bearish pressure, but the 0.91070 support remained impenetrable, which led to a tapering movement.

The market commenced its bullish agenda after dropping to the 0.89460 support level on the 25th of May 2021. Price was confined above that level with 0.90350 as resistance. This led to an accumulation in which price breaks out on the 16th of June. USDCHF then surged in two days to the 0.92130 price level. At this level, the market started sliding down under bearish pressure, but the 0.91070 support remained impenetrable, which led to a tapering movement.

The tapering movement of the market resulted in a break out to the upside of the descending channel. Price surged directly above 0.92740, and despite falling below it, the market has risen back above it via a retest of the 0.92130 support level. USDCHF is now set to continue its bullish agenda. All indications are towards a strongly bullish market. The Parabolic SAR (Stop and Reverse) has its dots under the daily candles to confirm a definite upturn after the market’s retracement.

Market Predictions

Market Predictions

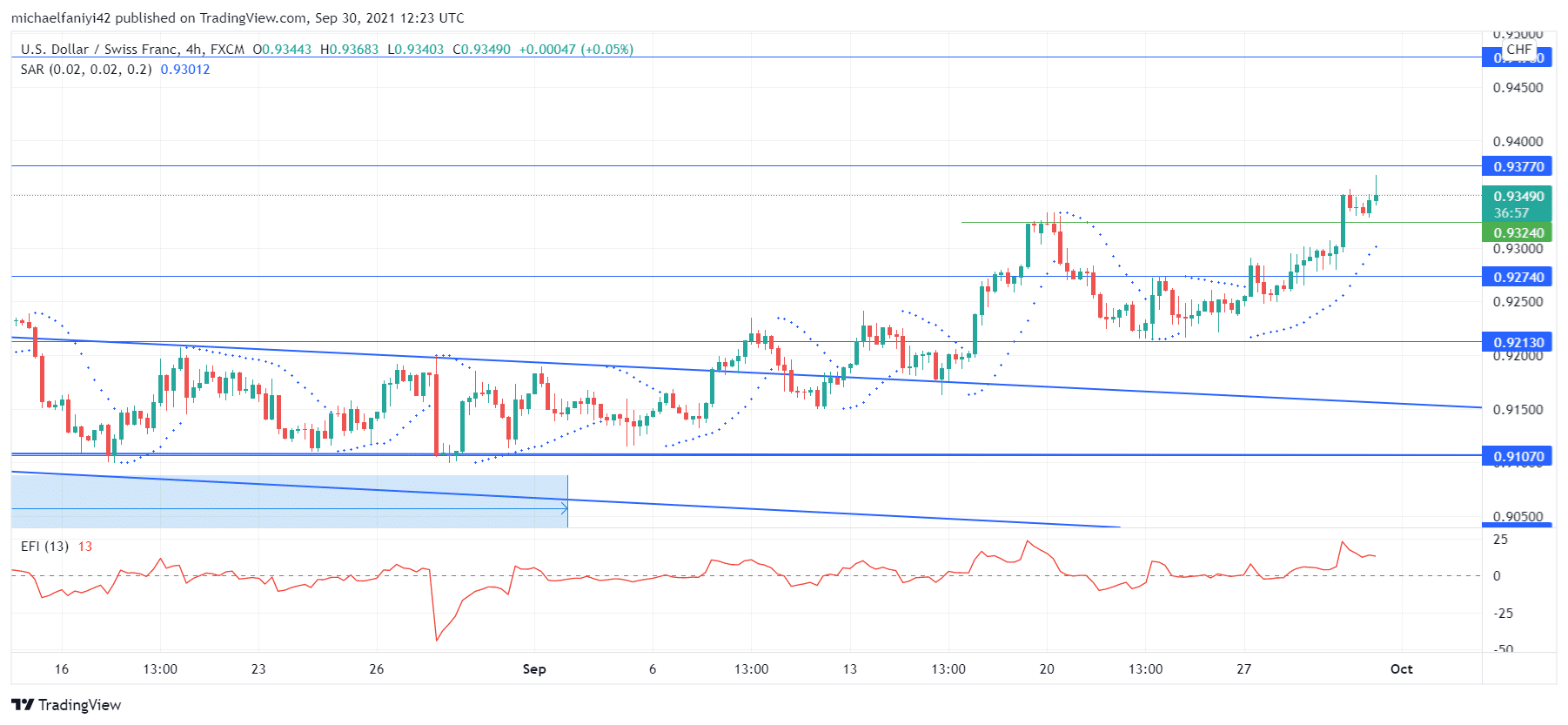

In the short term, the market retains its bullish fervor. USDCHF breaks through the previous rejection level of 0.93240 and a pullback to this level is helping the market continue its upward climb. The Parabolic SAR has multiple dots below the 4-hour candles to show a strong upward climb. The EFI (Elders Force Index) is strongly positive. This shows much volume of buyers working in the background of the market.

USDCHF is predicted to also break above 0.93770 and continue to 0.94780.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply