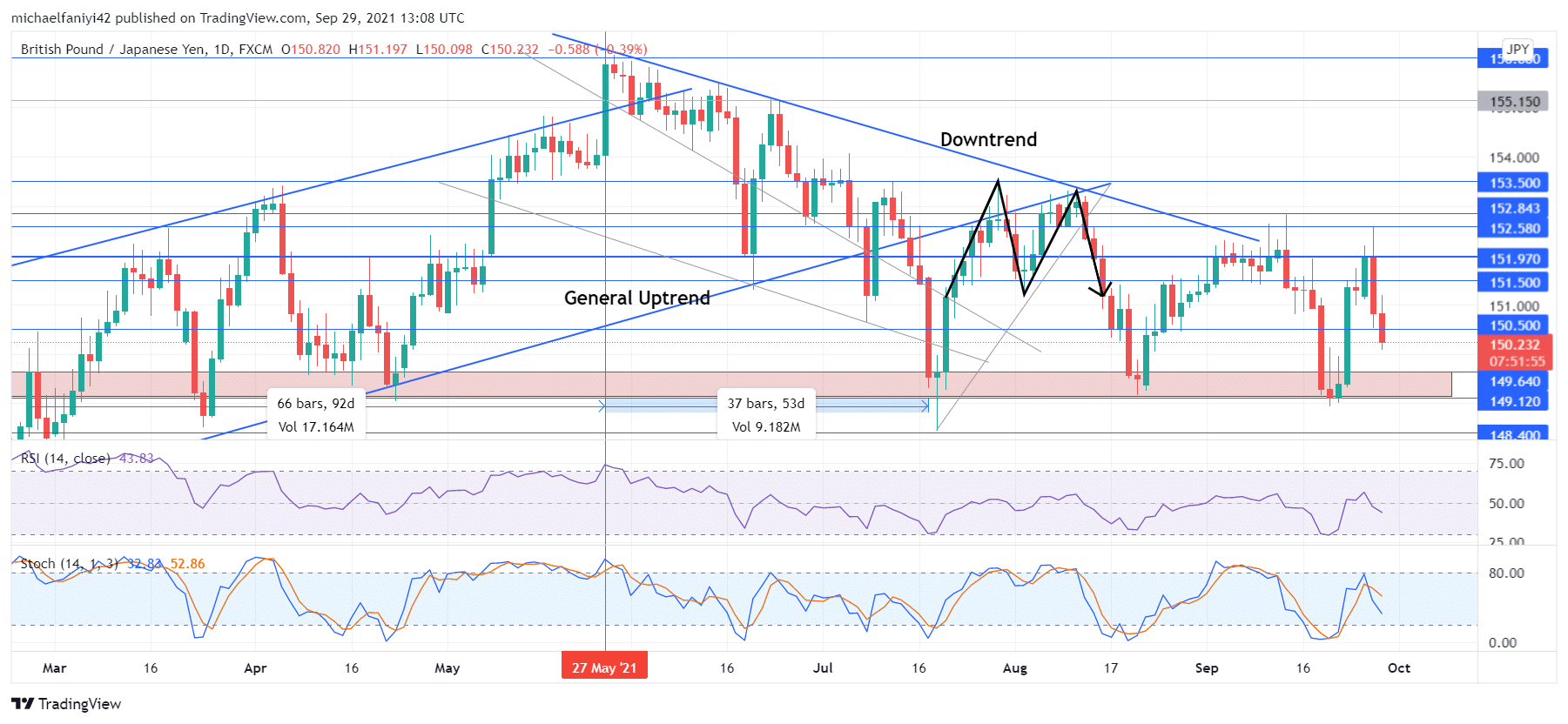

GBBJPY – Price Keeps Cranking Between 151.970 and the 149.640 Weekly Support

GBPJPY keeps cranking between two critical levels and the bears resist the push of the buyers. The market has not aligned to a ranging pattern as price has been repeatedly pushed up and down at intervals. The 149.640 key support remains very solid in preventing the market from plummeting below it. However, GBPJPY is repeatedly rejected at 151.970.

GBPJPY Key Levels

Resistance Levels: 151.500, 151.970, 152.580

Support Levels: 150.500, 149.640, 149.120 In the first half of the year, from January to late May, the market was generally bullish. Then, from early June to the present, the bears have been exercising dominance over the market. However, the 149.640 key zone (which extends to 149.120) remains a reference point for the market. The level has generally prevented price from dropping below it. The latest event of this action happened on the 21st of September 2021.

In the first half of the year, from January to late May, the market was generally bullish. Then, from early June to the present, the bears have been exercising dominance over the market. However, the 149.640 key zone (which extends to 149.120) remains a reference point for the market. The level has generally prevented price from dropping below it. The latest event of this action happened on the 21st of September 2021.

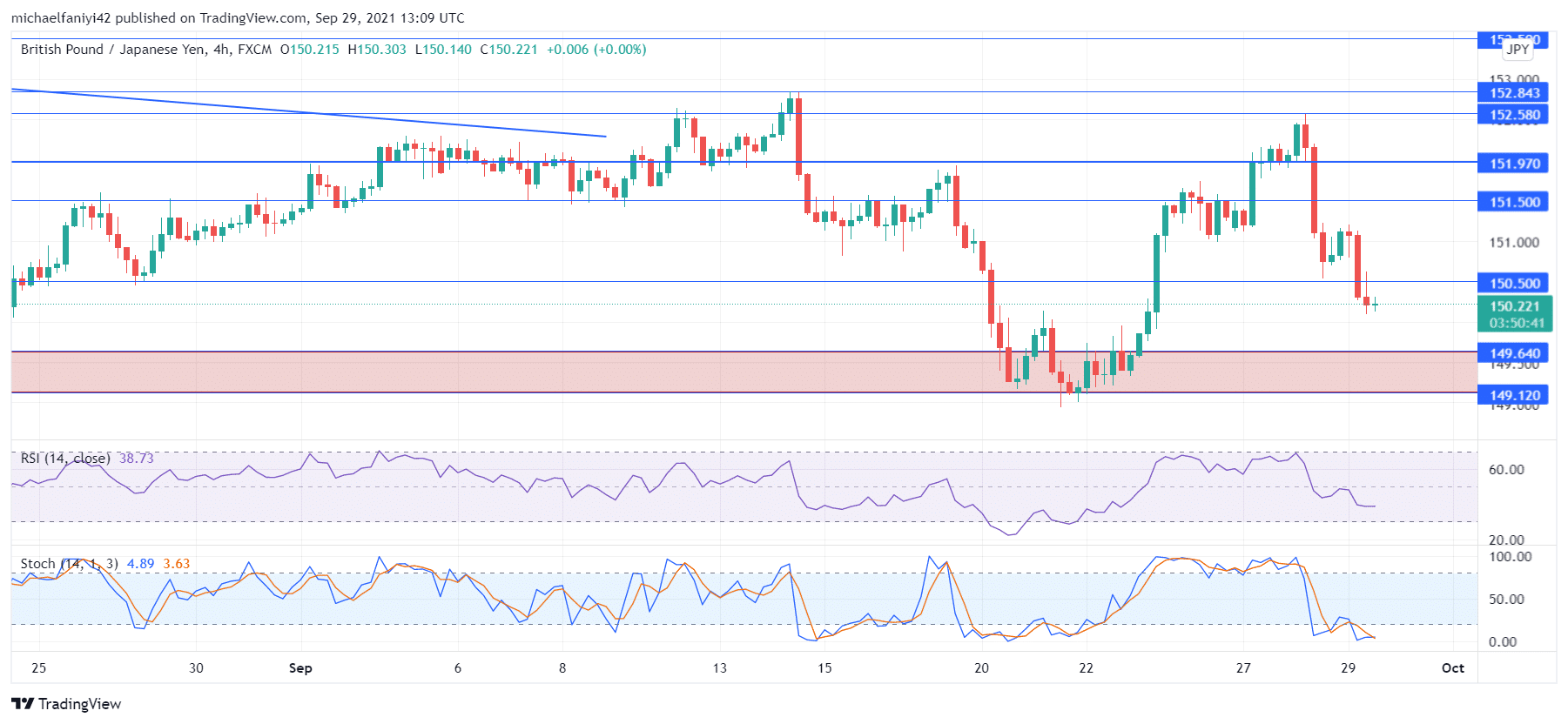

The continuous action of rebuffing action by the 149.640 support on the price has now led to a cranking movement, in which the market is ranging between the support and a strong resistance level at 151.970. Despite the ranging movement, the Relative Strength Index suggests that the market has more bearish tendencies as its signal line has largely remained below the 50 mark. The price currently keeps falling and we can see a downward cross already from the Stochastic Oscillator.

Market Anticipation

Market Anticipation

The market is keeps dropping after it is rejected again at the 151.970 resistance. On the 4-hour chart, the RSI line has dropped to 38 from the overbought border. The Stochastic Oscillator has plunged to the oversold region also, and this also signals an imminent rise in the market which is most likely to happen at the 149.640 region for the market to continue its cranking movement.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply