USD/JPY moved sideways in the last weeks but the range could be over soon. The pair is extremely bullish even if the Dollar Index dropped today. The Japanese Yen was weakened by the Nikkei’s growth. The Yen depreciated versus all its rivals and not only versus the USD.

The pair stays higher even if the US Unemployment Claims, Flash Manufacturing PMI, and the Flash Services PMI have come in worse than expected today. Only the CB Leading Index has beaten expectations registering a 0.9% growth versus 0.7% expected.

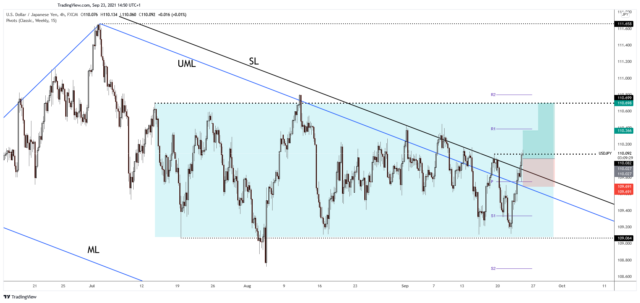

USD/JPY Technical Analysis!

USD/JPY rallied after failing to retest 109.06 static support. It has stayed near the descending pitchfork’s upper median line (UML) signaling an imminent upside breakout. Now is pressuring the 110.08 former high.

A valid breakout through this obstacle could signal strong growth ahead. Technically, in the short term, we cannot exclude a minor decline. The USD/JPY could come back down to test and retest the broken levels before approaching and reaching new highs.

The 110.69 range’s resistance is seen as an important upside target if the pair resumes its growth.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply