GBPJPY Analysis – Price Is Falling Again as the Bears Remain on the Prowl.

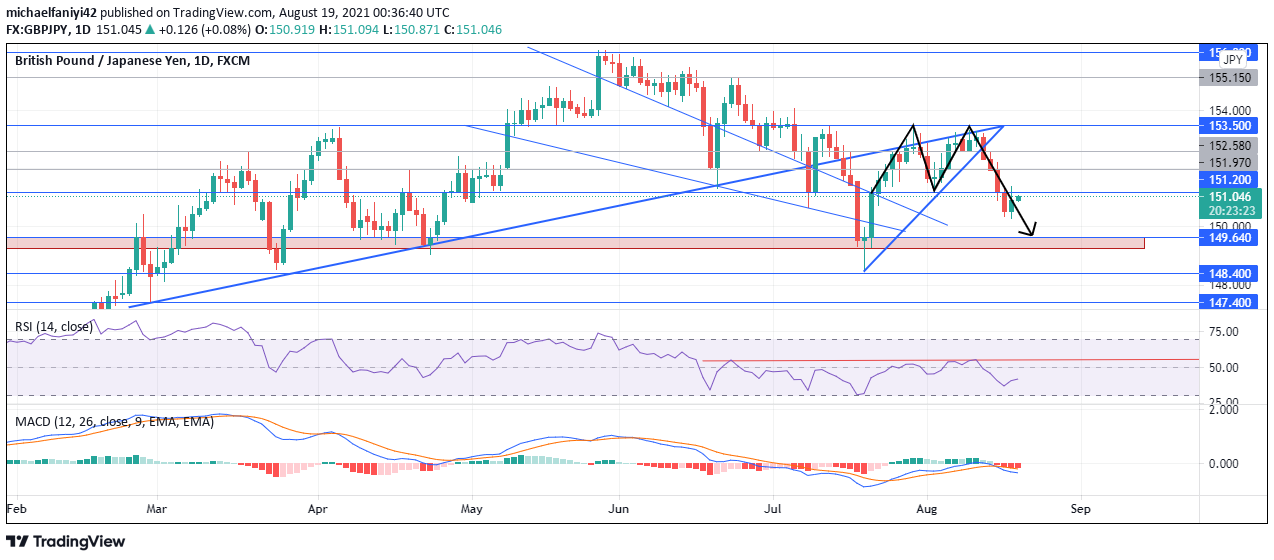

GBPJPY Bears remain active in trying to plunge the market to a lower depth. The bearish campaign which began when price hit a height of 156.000 on the 27th of May 2021 is still very much in force up till today. The market had slid into a downtrend while spiking downwards at intervals. The 149.640 support has kept the price afloat several times. In conjunction with the 148.400, they survived the latest barrage from the seller on the 20th of July 2021.

GBPJPY Key Levels

Resistance Levels: 151.200, 153.500, 156.000

Support Levels: 149.640, 148.400, 147.400 The 149.640 then worked in the bulls’ favor by firing the market up with great intensity. This pushed price upwards to the 153.500 strong key resistance in about 8 trading days. The sellers revived there and began working the market downwards again. GBPJPY, however, fell to support at 151.200, which sprang the price upward again. But again, the market found resistance at the 153.500 strong key level.

The 149.640 then worked in the bulls’ favor by firing the market up with great intensity. This pushed price upwards to the 153.500 strong key resistance in about 8 trading days. The sellers revived there and began working the market downwards again. GBPJPY, however, fell to support at 151.200, which sprang the price upward again. But again, the market found resistance at the 153.500 strong key level.

The MACD (Moving Average Convergence Divergence) gives a summary of market activities and shows that sellers have had a stronghold on the market for a long time, and even the regime of buyers has now been hijacked again by bears. The RSI (Relative Strength Index) indicator also shows that for two months now, GBPJPY has not been able to lift itself above the 55 mark. This shows the bears have retained an active influence in the market.

Market Prospects

Market Prospects

The market has been fashioned into a double-top chart pattern which has a propensity to plummet the market to lower depths. Price has dipped below the 151.200 key level and then returned to retest it. Guppy is now falling again after rejection at 153.300 for the second time in about two weeks. This is now a good time to go short on the GBPJPY as bears have set everything for a strong market fall.

Bears remain very resilient in the plummeting market and we can see the GBPJPY plunge to test the 149.640 strong support again.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply