Weekly Price Action Trade Ideas – 23rd Dec 2020

Markets Discussed in This Week’s Trade Ideas: GBPUSD, GOLD, USDX and GBPJPY.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

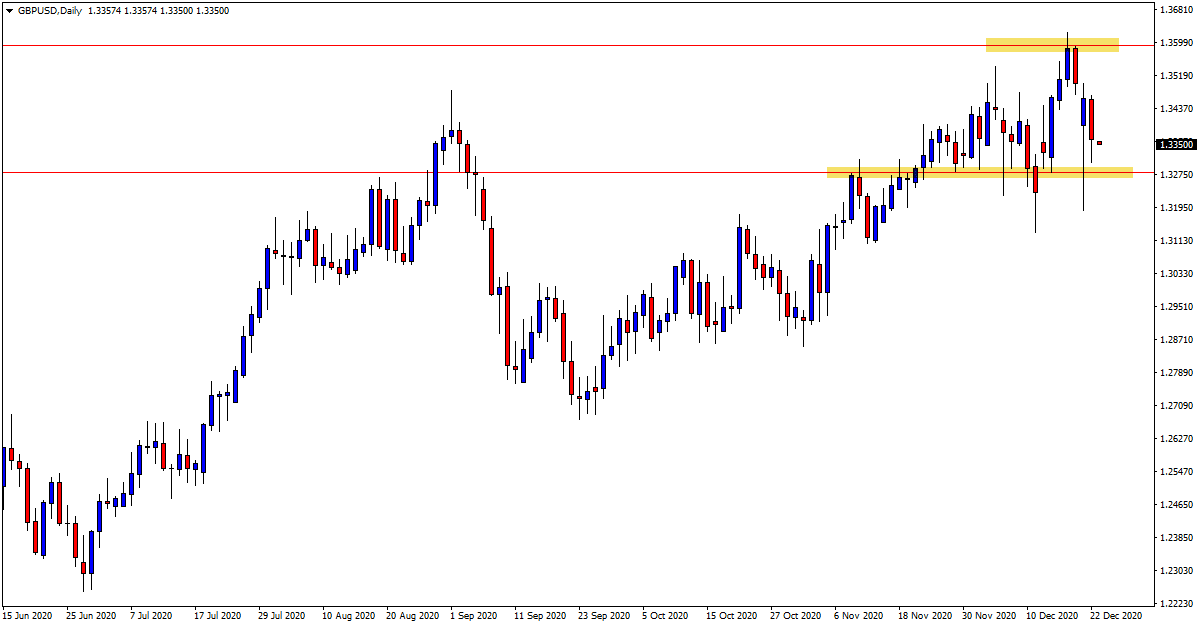

GBPUSD Daily Chart

-

Looking for Range to Continue

Price has been in a solid trend higher over the last four months with this pair on the daily chart.

However, in the last couple of weeks price has been very sideways and has created a range and sideways pattern.

As the daily chart shows, price is now rotating between fairly clear support and resistance levels.

Whilst these levels continue to hold I will look for this range to continue and for trades from both of these levels.

Daily Chart

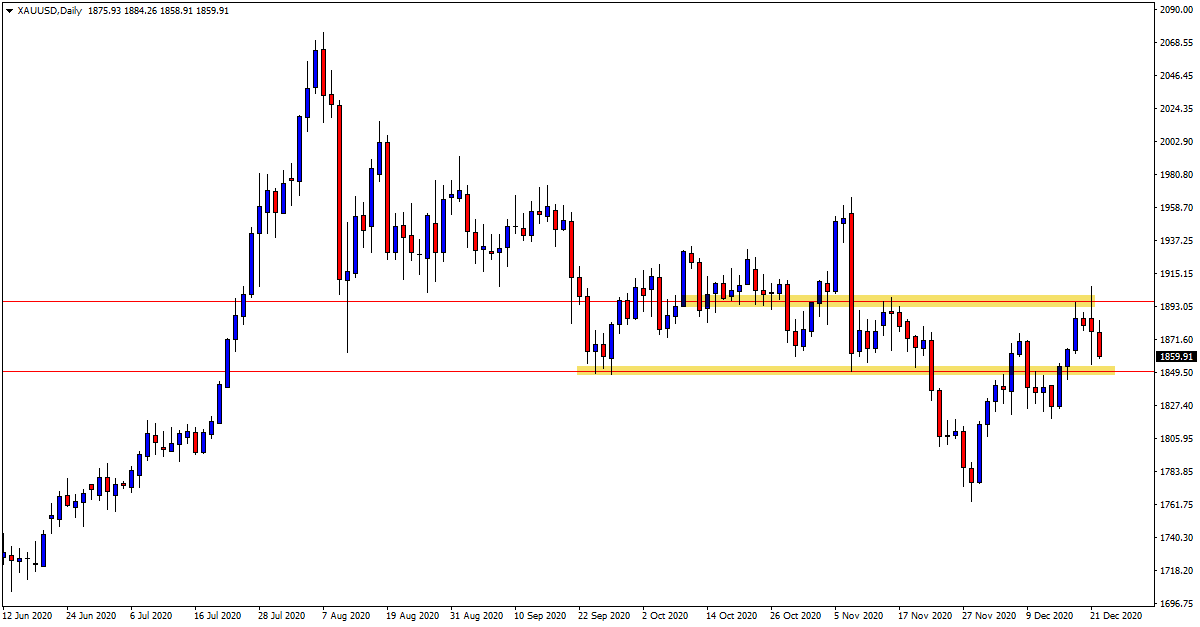

GOLD Daily Chart

-

Sideways Chop Continues

This market is extremely choppy and has now been this way for the last six months.

Looking to find a high probability and also solid reward trades whilst price action is like this looks to be extremely challenging.

Because price is chopping up and down and not making any sort of sustained move either higher or lower it is hard to make high probability trades. Whilst we might pick the direction correctly, we could be stopped before price gets to our target.

Until the price action becomes a little clearer I am sitting on my hands and watching this market.

Daily Chart

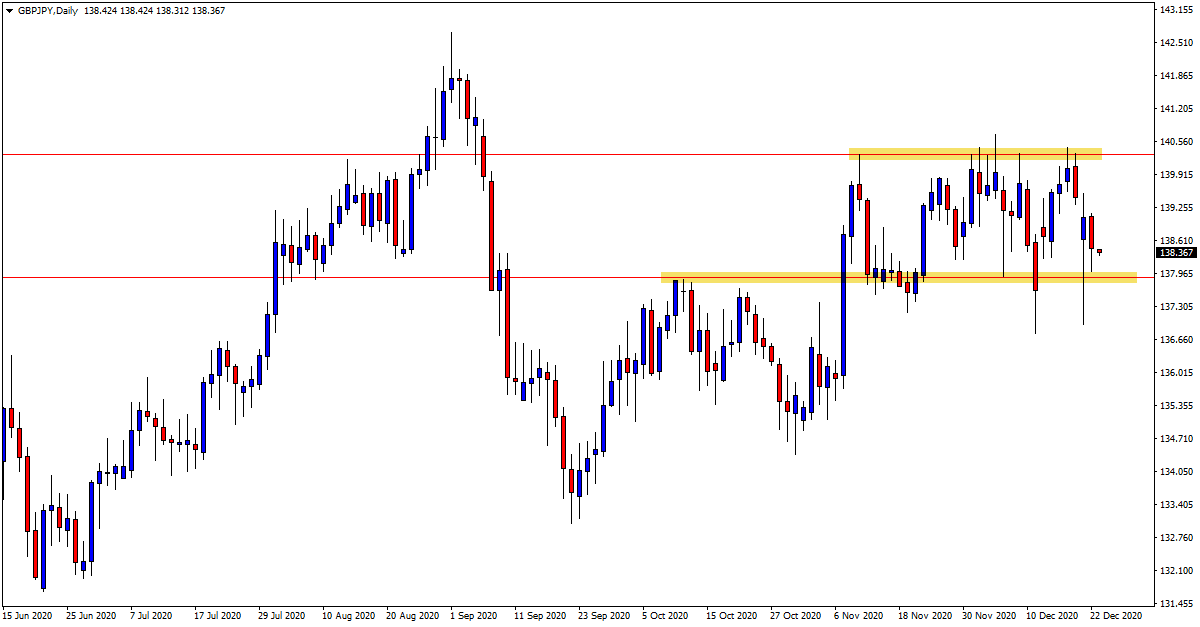

GBPJPY Daily Chart

-

Looking to Trade Both Sides

Whilst this market is also in a clear cut sideways range pattern, there is a decent amount of space between the range high and low. The range support and resistance levels are also pretty clear cut.

Because there is a nice amount of space between the range high and low it allows for range trades to be played that will offer decent risk reward outcomes.

Whilst this range continues to hold we can look to make trades from both sides of the market.

Daily Chart

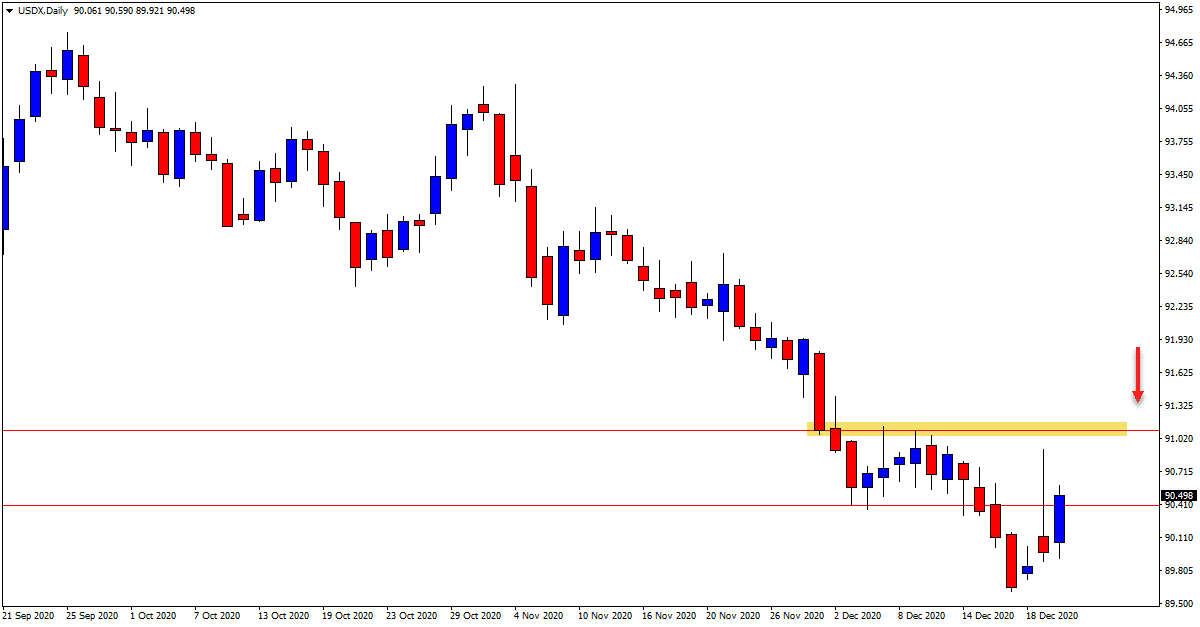

USDX Daily Chart

-

Can the Downtrend Continue?

We have been discussing this market regularly in recent times and looking to make short trades as the trend lower continues.

Price in the last few sessions has now rebounded and is looking to make a pullback higher.

Just overhead looks an important resistance level.

If price can move into this level and show some bearish rejection, then it could be a solid level to start looking for new short trades inline with the trend lower.

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

Please leave questions or comments in the comments section below;

Leave a Reply