The outside bar is a reversal pattern that can be both bullish and bearish depending on how and where it is formed.

When used correctly the outside bar can lead to explosive and highly profitable trades.

In this post we go through exactly what an outside bar is and how you can use them in your own trading.

What is an Outside Bar?

The outside bar is a one candlestick reversal pattern.

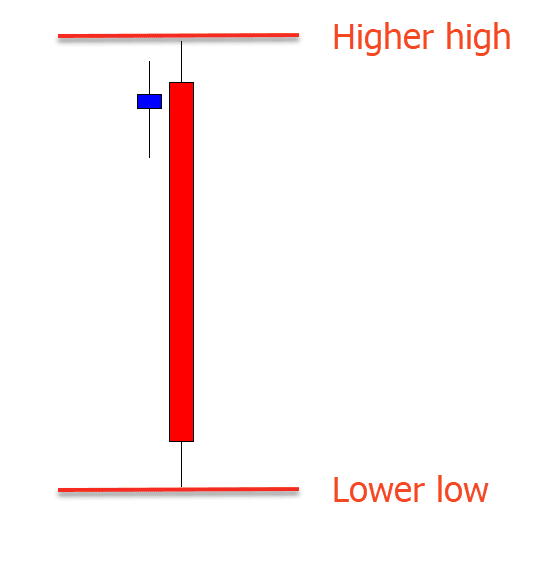

To be a valid outside bar pattern the candlestick needs to have a higher high and a lower low than the previous candlestick. When price has a higher high and a low low it is completely ‘outside’ the previous candle.

See the example below; price has a clear higher high and also a clear lower low than the previous candlestick.

The outside bar can be both bullish and bearish depending on where it is formed.

For a bearish outside bar we need to see it formed up at a swing high and for price to close in the bottom 1/3 of the candle.

For a bullish outside bar we need to see it form at a swing low and for price to finish higher and in the top 1/3 of the candle.

How to Identify the Outside Bar?

Whilst the outside bar is not as common as some of the other candlestick patterns like the pin bar and inside bar, it is very easy to identify.

The outside bar will often be a large candle and it will be sticking out.

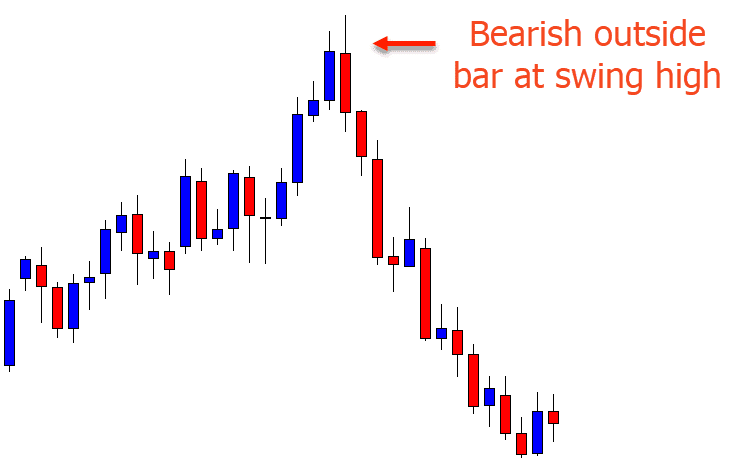

Checkout the example outside bar below. Price makes a swing higher and then forms the very obvious outside bar. Price has a higher high and also a lower low than the previous candlestick.

Keep in mind; this is a reversal signal so it is very important where you play this candlestick trade from. Just as the example shows below, with a bearish outside bar you need to be finding them up at swing highs.

How is the Outside Bar Traded?

There are a couple of main strategies when it comes to entering the outside bar.

The first thing to keep in mind is using other factors in your favor when looking for a potential outside bar trade.

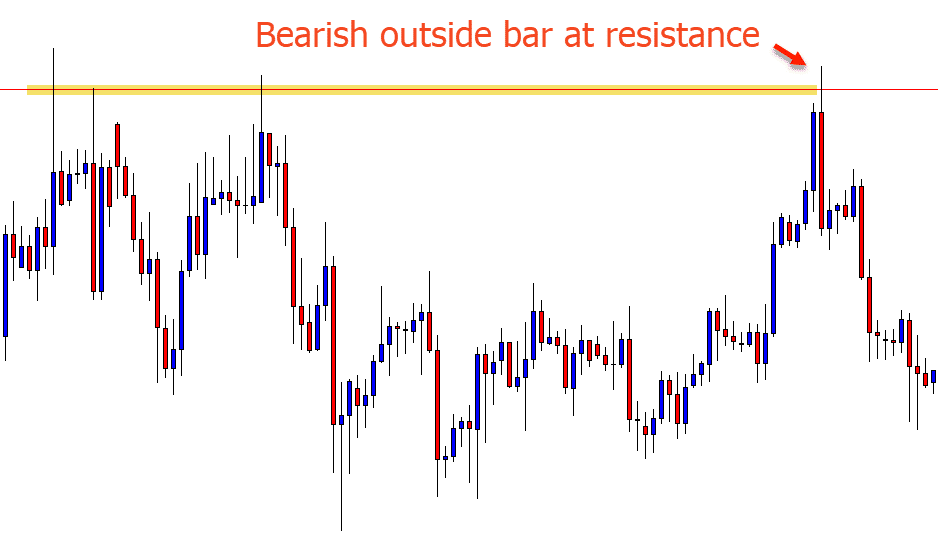

You don’t want to be just using the outside bar pattern by itself. To increase your trades odds you want to be using other confluences such as the major areas of support and resistance.

In the example below, price moves higher into a swing high that is also a key resistance level before forming a quality outside bar.

Where to Set Stop Loss and Profit Target

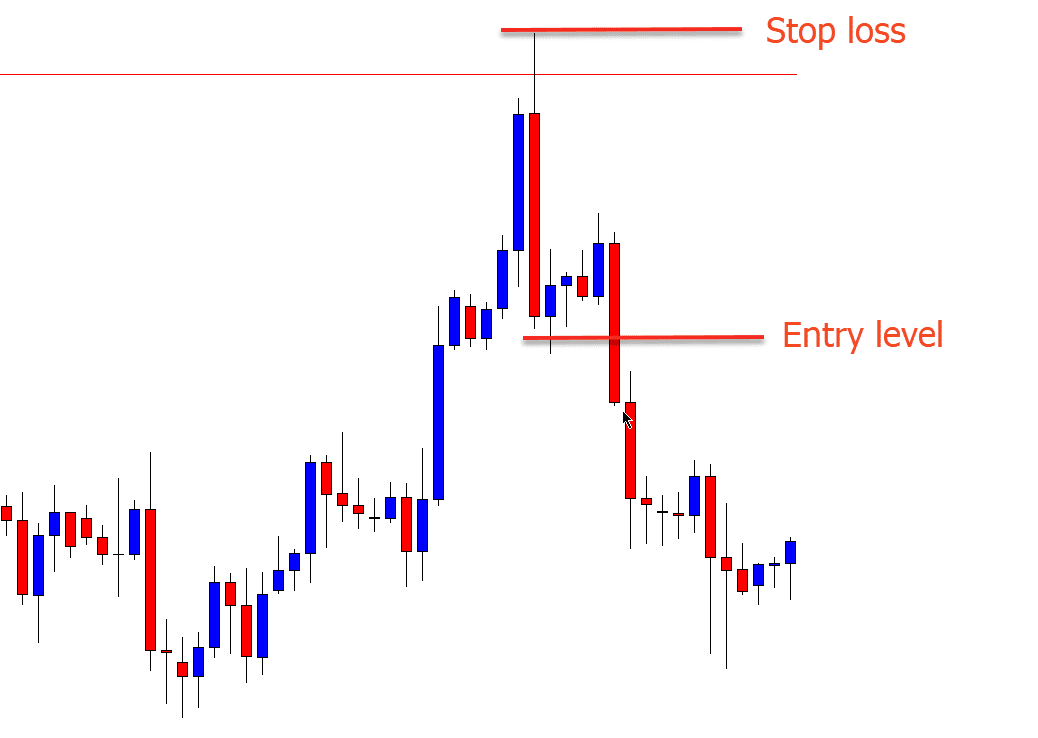

For entry you can either use a confirmation entry or a retrace entry. Retrace entries are taken when price moves back into a point of interest. Using a retrace entry will give you a better potential risk reward, but it is also much riskier.

When using a confirmation entry you are waiting for price to break the high or the low and then entering. For example, if you are looking to enter a bearish outside bar you would be waiting for price to move below the low of the outside bar before then entering. You could use a pending sell stop order so you don’t have to actually watch and wait for price to make this move.

You have a couple of different strategies you can use for your stop loss placement depending on how aggressive you are and the type of risk reward you are looking for.

If you are a very aggressive trader you could look to use the surrounding support or resistance levels to set your stop loss. For example; if entering a bearish outside bar you may look to place you stop loss above the closest resistance level. This could give you a tighter stop loss and a bigger potential reward.

If you are more conservative you could look to use the standard stop loss method. This method involves placing the stop loss above the high or low of the candlestick. For example if you are looking to go long from a bullish outside bar you could place your stop loss below the low of the candlestick. This will often give you a much safer stop loss point, but it will also often be a bigger stop loss level.

Leave a Reply