Moneta Markets is a new forex and CFD trading platform that has started to gain traction. However, since it is still new, some traders don’t know the services that Moneta Markets offers. This post will help address it and discuss all the features and services of the Moneta Markets platform.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

€250

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

-

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

No

FCA

No

CySEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

-

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

1.3 pips

Leverage max

100:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECCFTCNFA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.5

EUR/USD

1.3

EUR/JPY

1.6

EUR/CHF

3.1

GBP/USD

1.9

GBP/JPY

3.6

GBP/CHF

4.2

USD/JPY

1.5

USD/CHF

2.0

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

1.3 pips

Regulation

No

FCA

No

CySEC

No

ASIC

Yes

CFTC

Yes

NFA

No

BAFIN

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Min.Deposit

€0

Spread min.

0.0 pips

Leverage max

2:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

0.0

EUR/USD

0.0

EUR/JPY

0.0

EUR/CHF

0.0

GBP/USD

0.0

GBP/JPY

0.0

GBP/CHF

0.0

USD/JPY

0.0

USD/CHF

0.0

CHF/JPY

0.0

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

No

FCA

No

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

Trading leveraged products such as CFDs involves substantial risk of loss and may not be suitable for all investors. 83% of retail investor accounts lose money when trading CFDs with this provider. Trading such products is risky and you may lose all of your invested capital.

Compare Forex Brokers Fees:

Use our side-by-side comparison table to compare Forex broker accounts, spreads and fees.

Recommended

8capVisit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Forex.comVisit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

VantageFXVisit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

AvaTradeVisit Broker71% of retail investor accounts lose money when trading CFDs with this provider.... Rating Mobile App Regulation CFTCNFA

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA Bill Min.Deposit

$250 $100 $200 $100 Leverage max

100 100:1 500 400 Forex pairs

40 50 40 50 Fees & spreads

EUR/GBP

N/A 1.5 N/A 1 EUR/USD

N/A 1.3 N/A 0.9 EUR/JPY

0.3 1.6 N/A 1 EUR/CHF

0.2 3.1 N/A 1 GBP/USD

N/A 1.9 N/A 1 GBP/JPY

0.1 3.6 N/A 1 GBP/CHF

0.3 4.2 N/A 1 USD/JPY

N/A 1.5 N/A 1 USD/CHF

0.2 2.0 N/A 1 CHF/JPY

0.3 N/A N/A 1 EUR/RUB

- N/A N/A 1 USD/RUB

- N/A N/A 1 Additional Fee

Continuous Fee

Variables N/A N/A N/A Conversion Fee

Variablespips 1.3pips N/A N/A Trading platforms

Demo

Webtrader

Copytrading

Mt4

STP/DMA

Ctrader

MT5

Avasocial

Ava Options

Leverage

FCA

CYSEC

ASIC

CFTC

NFA

BAFIN

CMA

SCB

DFSA

CBFSAI

BVIFSC

FSCA

FSA

FFAJ

ADGM

FRSA

Active

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Additional characteristics

Islamic Account

Education & Webinars

Charts & Tools

Scalping

Spread Betting

Automated Trading

Free Forex Signals

Payment methods

Bank Transfer

Credit Card

Giropay

Neteller

Paypal

Sepa Transfer

Skrill

Sofort

|

About Moneta Markets

Moneta Markets is a forex and CFD trading platform launched as a subsidiary of Vantage International Group Limited (VIG). The parent company has over a decade of experience in the financial markets, and it is licensed in three jurisdictions. At the moment, it handles over $100 billion in trading volume every month.

Moneta Markets grants traders access to a wide range of financial markets, with the forex assets the most widely used. The broker offers services to traders all over the world, granting them access to over 300 financial instruments via its simple web-based platform. Moneta Markets trading platforms are known for providing fast and easy access to the financial markets. Other features include precision trading and lightning-fast execution. The customer support team at Moneta Markets is available 24/5, providing services to the traders whenever possible.

Moneta Markets pros and cons

Pros

- Supports over 300 financial instruments

- Segregated client funds saved with National Australia Bank.

- Excellent Moneta Markets Web Trader platform.

- Excellent trading tools

Cons

- No online information regarding spreads and commissions

- Customer support isn’t 24/7

Regulation and security

Moneta Markets is a fully regulated forex and CFD broker. The broker complies with the strict regulations put in place by the Cayman Islands Monetary Authority. The company always strives to offer transparent and fair access to global financial markets. It is a trading name of Vantage International Group Limited, a company that is regulated and licensed by Cayman Islands Monetary Authority (CIMA), with a Securities Investment Business LAW (SIBL) number 1383491

To ensure the safety of the traders, client funds are saved in a segregated account with Australia’s AA rated National Australia Bank (NAB). NAB is currently one of the four largest financial institutions in Australia and is ranked amongst the top 20 safest and most secure banks in the world. Hence, user funds are safe and secure with the bank. The broker also has Professional Indemnity Insurance, which covers the work handles by the company employees, and representatives. The SSL certificate and 128-bit encryption on the Moneta Markets platform ensure that traders can deposit and withdraw their funds safely on the site.

Tradable products

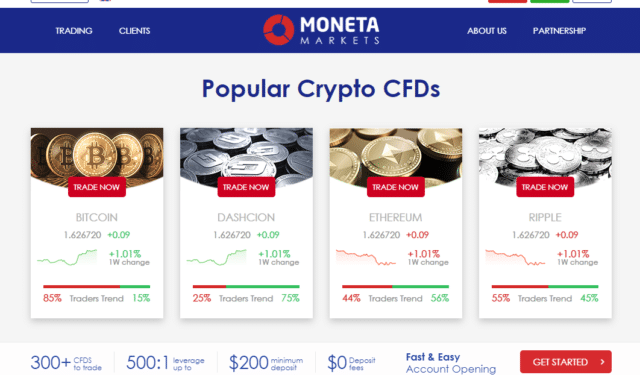

Moneta Markets allows users to trade over 300 assets across multiple financial markets. Users can trade forex, commodities, indices, cryptocurrencies, and equities. Various assets carry varying leverage specifications, with Moneta Markets offering leverage as high as 1:500. This high leverage is something that other brokers can’t offer, giving Moneta Markets a huge advantage in the market.

The broker supports major FX pairs such as the EUR/USD, GBP/USD, USD/JPY, and AUD/USD. In addition to that, Moneta Market supports over 45 forex currency pairs, both major and minor. In the crypto space, Moneta Markets supports Bitcoin, Dash, Bitcoin Cash, Ripple, Ethereum, and Litecoin.

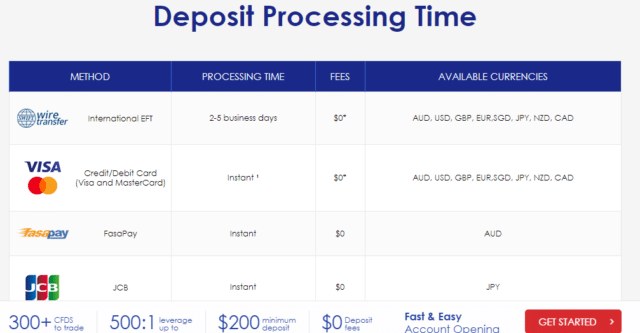

Deposit and withdrawal options

Moneta Markets supports a wide range of deposit and withdrawal options. Users can fund their Moneta Markets wallet using any of the following options: bank transfer, Visa, MasterCard, Fasapay, JCB, Bitcoin, and Sticpay. However, withdrawals on Moneta Markets can only be made via bank transfer.

The broker supports multiple currencies for depositing funds. The supported fiat currencies include; USD, AUD, GBP, EUR, NZD, SGD, JPY, and CAD. The supported cryptocurrency on Moneta Markets is Bitcoin.

Moneta Markets has a minimum deposit sum of $200. However, the deposits are made free as the broker doesn’t charge a dime. For withdrawals, the funds must go into the same account name as the deposit account.

Ysers can log in to the Moneta Markets Web Trader platform to access the deposit and withdrawal options. International bank wire transfers attract a minimum fee of 20 units of the trading account base currency, i.e., 20 USD or 20 EUR, and so.

Trading platform and features

Moneta makes use of its proprietary trading platform, the Moneta Platform. The Moneta WebTrader platform is designed to allow users to have simple and easy access to the financial markets. It has pip-perfect precision and unmatched stability.

Traders using the Moneta WebTrader get to enjoy various technical indicators and chart types, making it easy for them to carry out an analysis. The in-built Client Portal eases the account opening process and easy deposits and withdrawals.

Moneta WebTrader has a convenient Order Module situated close to the trading charts. This allows traders to place their trades with pip-perfect precision. This feature also comes with a real-time calculator that displays the trading volume of the user in both pips and dollar value. It also has an ultra-fast market order placing ability.

With the Moneta WebTrader, users get to enjoy over 45 technical indicators and around six different chart types, making it easy to cater for any trading style of the trader. For traders that have specific trading styles, the Moneta WebTrader has a trend line and suite of drawing tools that help you achieve that.

The risk management features of the Moneta Markets helps traders limit their losses. The platform makes setting Stop Loss and Take Profit orders easy to the users.

Commissions and spreads

At the moment, there is litte details regarding commissions and spreads on the Moneta Markets website. However, the broker offers commission-free with spreads and swaps payable for the assets Forex, Indices, Commodities, and Cryptocurrency CFDs. The trading fees on Moneta vary depending on the market the user is trading.

Account types

On Moneta Markets, there is only one single account type. Most trading platforms are democratizing account types, and Moneta Markets is one of them. The trading conditions remain the same, and there are no up-selling services on the platform. The minimum deposit on Moneta Markets is $200 or the equivalent in other currencies,

Customer Support

It is easy to contact the customer support team at Moneta Markets as they provide multi-lingual support 24/5. The users can access the Moneta Markets support team via email, live chat, or phone call. Moneta Markets also has an FAQ section available for users to find answers to common questions.

Bonuses and Promotions

Traders can opt-in to get a 50% bonus when they deposit funds into the Moneta Markets platform. However, the minimum deposit to qualify for the bonus is $1,000. Furthermore, terms and conditions apply for earning the bonus.

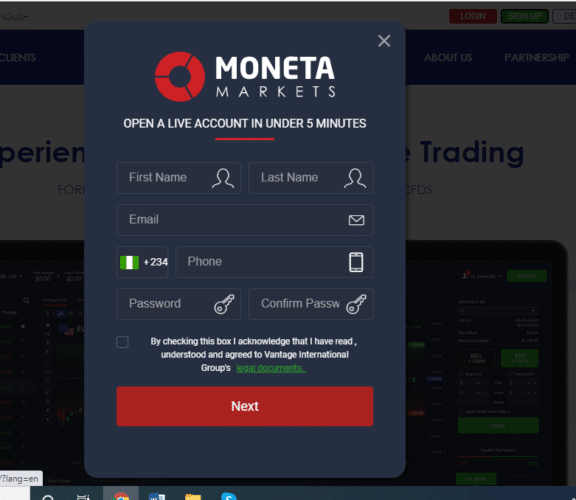

How to start trading with Moneta Markets

To open a Moneta Markets account, following these steps.

- Visit the Moneta Markets website and click on the SIGN UP button at the top

- Provide the needed information like name, email, phone number, and password.

- Afterward, provide the personal details on the next page.

- The next page will require you to provide your financial details. This includes your payment details and more. Once you register on the Moneta Markets platform, you can start trading the assets.