Yesterday in this blog we spoke about a daily bearish engulfing bar on the daily chart in this market that may push price lower and give trend traders the chance to get into trades with the obvious trend in this market. To see yesterdays post see HERE. Whilst price did not move all the way into the support area, it did break the low if the bearish engulfing bar and move lower and into a swing low to give traders enough room to make valid long trades that would have enough space to move back higher that they would then not be trading straight back into price traffic.

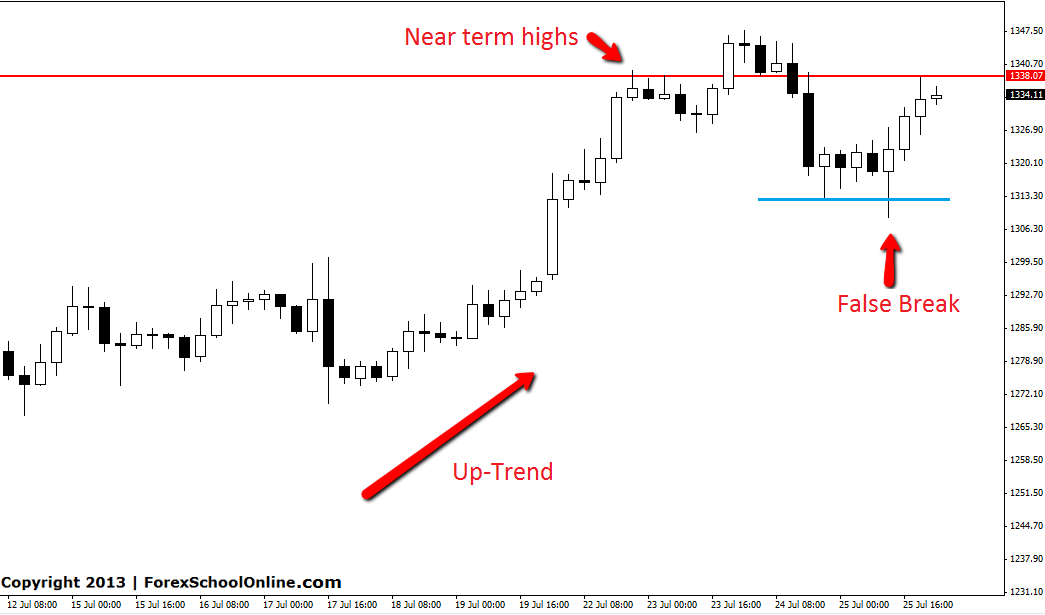

After price broke the daily engulfing bar low and moved lower price formed a large false break bullish rejection candle on the 4hr chart clearly rejecting lower prices and showing that the trend was about to resume and continue back higher. This false break and rejection of lower prices was a key indication that the bulls were taking re-control of the market and were looking to once again push price back higher.

Price has now pushed back higher into the near term highs and is consolidating. For this market to move higher it is going to have to break out of this key resistance area and of that happens a breakout play could be on the cards. Keep an eye out….

GOLD 4HR CHART | 26 JULY 2013

Leave a Reply