Whether you’re a beginner or an experienced trader, you’ll be in need of a good forex platform. We’ve prepared a review list of the best forex trading platforms in 2020 to help you narrow down your choices, and to have the right tool to enhance your investment performance.

Before deciding over a financial trading platform, it might be a good idea to know which is your investment style. It could help you determine which features and tools are the most important before picking a platform. Trading is both risky and rewarding, and knowledge is key.

We invite you to read what we have researched and the important details we have set out for you.

Our highest rank goes out to 5 best trading platforms:

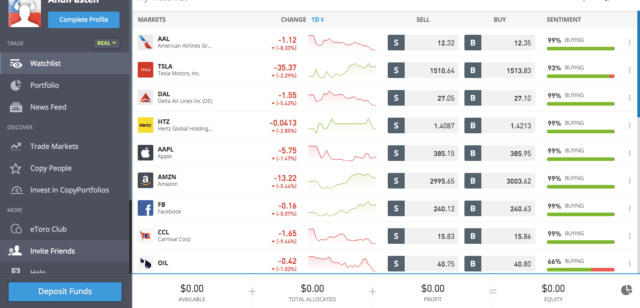

- eToro is our best trading platform. They are pioneers in social trading, licensed by top tier regulators and have a vast amount of assets.

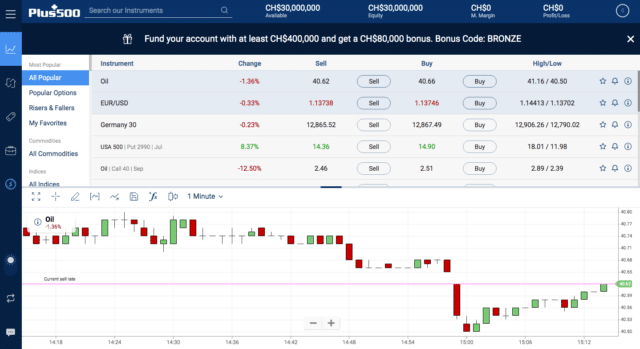

- Plus500 is known as the best CFD provider in the world and they offer clients low trading fees.

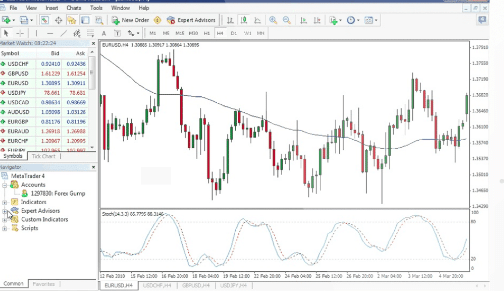

- MT4 is user friendly and can be downloaded on multiple operating systems, making it more accessible.

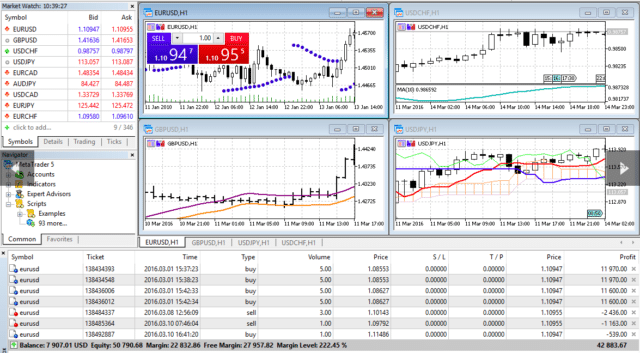

- MT5 has great algorithmic trading, a vast amount of charting frames and is friendly to over 30 different language speakers.

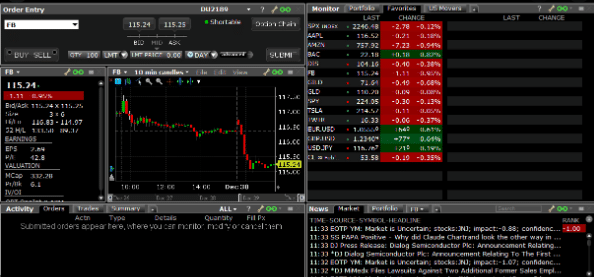

- Interactive Brokers offers a great educational section, a variety of tools and fast customer support.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

€250

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

-

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

No

FCA

No

CySEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

-

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

1.3 pips

Leverage max

100:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECCFTCNFA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.5

EUR/USD

1.3

EUR/JPY

1.6

EUR/CHF

3.1

GBP/USD

1.9

GBP/JPY

3.6

GBP/CHF

4.2

USD/JPY

1.5

USD/CHF

2.0

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

1.3 pips

Regulation

No

FCA

No

CySEC

No

ASIC

Yes

CFTC

Yes

NFA

No

BAFIN

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Min.Deposit

€0

Spread min.

0.0 pips

Leverage max

2:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

0.0

EUR/USD

0.0

EUR/JPY

0.0

EUR/CHF

0.0

GBP/USD

0.0

GBP/JPY

0.0

GBP/CHF

0.0

USD/JPY

0.0

USD/CHF

0.0

CHF/JPY

0.0

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

No

FCA

No

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

Trading leveraged products such as CFDs involves substantial risk of loss and may not be suitable for all investors. 83% of retail investor accounts lose money when trading CFDs with this provider. Trading such products is risky and you may lose all of your invested capital.

Compare Forex Brokers Fees:

Use our side-by-side comparison table to compare Forex broker accounts, spreads and fees.

Recommended

8capVisit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Forex.comVisit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

VantageFXVisit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

AvaTradeVisit Broker71% of retail investor accounts lose money when trading CFDs with this provider.... Rating Mobile App Regulation CFTCNFA

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA Bill Min.Deposit

$250 $100 $200 $100 Leverage max

100 100:1 500 400 Forex pairs

40 50 40 50 Fees & spreads

EUR/GBP

N/A 1.5 N/A 1 EUR/USD

N/A 1.3 N/A 0.9 EUR/JPY

0.3 1.6 N/A 1 EUR/CHF

0.2 3.1 N/A 1 GBP/USD

N/A 1.9 N/A 1 GBP/JPY

0.1 3.6 N/A 1 GBP/CHF

0.3 4.2 N/A 1 USD/JPY

N/A 1.5 N/A 1 USD/CHF

0.2 2.0 N/A 1 CHF/JPY

0.3 N/A N/A 1 EUR/RUB

- N/A N/A 1 USD/RUB

- N/A N/A 1 Additional Fee

Continuous Fee

Variables N/A N/A N/A Conversion Fee

Variablespips 1.3pips N/A N/A Trading platforms

Demo

Webtrader

Copytrading

Mt4

STP/DMA

Ctrader

MT5

Avasocial

Ava Options

Leverage

FCA

CYSEC

ASIC

CFTC

NFA

BAFIN

CMA

SCB

DFSA

CBFSAI

BVIFSC

FSCA

FSA

FFAJ

ADGM

FRSA

Active

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Additional characteristics

Islamic Account

Education & Webinars

Charts & Tools

Scalping

Spread Betting

Automated Trading

Free Forex Signals

Payment methods

Bank Transfer

Credit Card

Giropay

Neteller

Paypal

Sepa Transfer

Skrill

Sofort

|

What is the Best Trading Platform

According to our research, we have decided that there are 5 best trading platforms in 2020. We chose them according to their fees, customer support, risk management, tools, features, and demo accounts.

In this way, they could all be chosen by either experienced or traders that are new to this financial area. Remember that it will always be your individual goals, preferences and knowledge that will finally help you determine what is the best trading platform for you.

What makes a good forex broker?

First, let’s talk about the companies behind the platforms. What makes a good forex broker? According to investopedia “the global foreign exchange (forex) market is the largest and most actively traded financial market in the world, by far”. In this context, there are a lot of brokers offering services out there. The ability to choose the best platform, but also the best brokerage behind it is crucial.

Some things you might want to look out for in a good forex broker are the regulations. This means that your platform is supervised by financial bodies that have certain rules the broker must follow. This will protect you and your money, as well as broker’s good practices.

Fees will also be something important to look out for. Some of them include deposit, withdrawal, conversion, overnight, and inactivity fees. Don’t let your costs eat your profits.

Best forex trading platform for beginners

The best forex trading platform for beginners should have a demo account. With this, you can practice with real market data while investing virtual money with no actual value. You can then learn how to trade with risky assets like major, minor, and exotic currencies.

You will also be able to test the tools available to see which one would suit you best. It is also important to look at the research and news section that each platform does or does not offer since it will keep you up to date on important market movements.

We have taken into account each of the features that would determine which could be the best online trading platform for you. We invite you to take a look.

Top 5 Forex Trading Platforms 2020

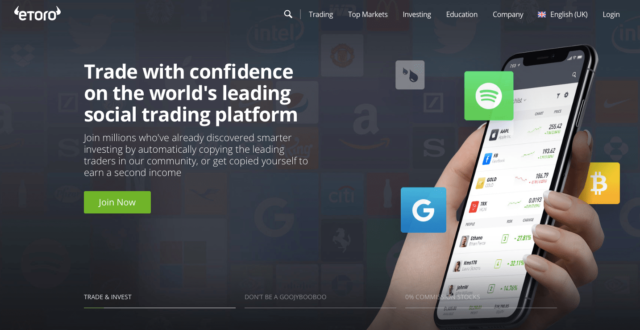

1. eToro platform

Launched in 2007, eToro has over 2,000 assets across top markets. Clients can trade stocks, indices and cryptocurrencies Bitcoin, Ripple, Dash, Litecoin, Cardano and more.

eToro also offers indices, ETFs, and commodities such as gold, silver, wheat, cocoa, sugar, and others. However, you may only deposit and withdraw using USD, which is the only base currency.

This proprietary trading platform is regulated by the Financial Conduct Authority (FCA), the Australian Securities and Investment Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

eToro stands out because of its innovations as a trading platform. They were the first to include social trading, known as Copy Trading, which engaged clients in such a way that they received recognition from FinoVate Europe in 2011 winning the Best of Show in 2011.

You can open or close a position directly on their trading station, and for those who prefer to trade on the go, a mobile app is available for both iOs and Android. There are a total of 21 languages such as Spanish, Italian, Norwegian, Danish and more for both trading and customer support.

For customer support, you can reach them using their 24 hour live chat, through their social media accounts or by sending an email. If you are new, or are trying out a new strategy, it might be a good idea to try their Practice Account that offers $100,000 for paper trading.

This means that you will be seeing the real time market, but will trade virtual money with no actual value. It is another way to learn, but it will not involve actual losses or gains.

Fees on eToro platform

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | $5 |

| Conversion Fee | From 50 pips up to 2500 pips, depending on the instrument |

| Inactivity Fee | $10 monthly after 12 months of inactivity |

| Overnight Fee | Yes. On currencies, commodities and indices. |

eToro pros and cons

Pros:

- They offer social trading

- Has a demo account

- You can trade with their mobile app

Cons:

- A withdrawal fee is charged

- USD is the base currency

2. Plus500

Based in Australia, Plus500 was launched in 2008 and is the number one CFD provider in the world today. They are regulated by the FCA and ASIC. This platform offers assets such as indices, forex, shares and commodities such as oil, silver, copper, coffee and corn.

Clients can also trade shares, optiones, ETFs and cryptos including Bitcoin, Ethereum, Litecoin, EOS, and more. If you are wondering which trading platform is best for beginners, Plus500 might be a bit harder to pioneer with because of the high risk implications by trading with CFDs.

Nevertheless, Plus500 offers a demo account for those who would like to practice before risking real funds. Another way to minimize your loss is using the four risk management tools available on the platform: stop loss, stop limit, guaranteed stop and trailing stop.

This Australian based company offers a bonus, known as Rebates, that will depend on your trading. An initial deposit bonus will also be offered and it will depend on the amount you credit into your account.

Plus500 has 24/7 customer support via Whatsapp, Live Chat or email. You can also try contacting them through their social media accounts or read the FAQ section. There are 32 languages available such as German, Chinese, Turkish, French, and more.

For better support, Plus500 offers an economic calendar so you can plan your trades better, and be on top of important events or releases that could alter the market. You can also sign up to receive real time alerts that will be sent to your email or directly to your phone as a text message.

Finally, real time alerts is a tool that will notify when a certain instrument reaches a price that might interest you, if there is a percentage fluctuation, and when there are changes in trader sentiment.

Fees on Plus500 platform

| Type of Fee | Amount Charged |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Conversion Fee | Up to 0,5% of the trader’s realised profit and loss. |

| Inactivity Fee | $10 monthly after 3 months of inactivity |

| Overnight Fee | Yes. It will depend on the instrument. |

Plus500 pros and cons

Pros:

- No withdrawal or deposit fees.

- Customer support through whatsapp messages.

- A demo account is offered.

Cons:

- Inactivity fee after three months.

- They do not have a very complete educational section.

3. MetaTrader 4 platform

MetaTrader 4, also known as MT4, is a forex trading platform available through brokers. According to their website, over 750 brokers and banks provide their services through MetaTrader 4. MT4 can be downloaded free directly from the web page to your desktop.

Each bank or broker will individually licence the platform after directly purchasing it from the official website. Although, on their website, information says that they are not giving brokers or banks licenses for MT4 since they are focused on developing MetaTrader 5, which we will talk about below.

MetaTrader 4 is considered the best forex trading platform for beginners or experts because it allows algorithmic trading by using robots or technical indicators for your trading criterias. In this way, you can program trades that will execute faster than a human can do. Copy Trading is also available.

Experienced traders will also be alured by this platform’s trading system. There are three execution modes available: instant, request and market. For instant executions there are two market orders. There are three risk management options such as take profit, stop loss and trailing stop. This platform also has four different pending orders.

MetaTrader 4 offers a desktop, web and mobile app platform for both Android and iOs. Each of these support over 30 languages, but their website only has 7. Their programming language is MQL4.

MT4 has interesting tools and features such as trading directly from your chart. You may open or close a position, and control your pending orders with a simple click.

A demo account is also available for those who have MT4 and would like to try out a new strategy or are new to the trading world.

MetaTrader 4 pros and cons

Pros:

- Over 30 languages

- You can download a demo account

- Algorithmic trading

Cons:

- Currently not available for new brokers who would like to use the platform.

- No social trading

- Only 9 charting timeframes.

- Currencies as the only trading instrument.

4. MetaTrader 5 trading station

MetaTrader 5, or MT5, is a trading platform for forex and exchange markets. It is one of the best free trading platforms that you can download for desktop, web or mobile on either Android, iOs, Linux, Mac OS, and Windows. Their programming language is MQL5.

MT5 offers trading instruments such as currencies, commodities, stocks, options, futures, and bonds. There are six pendings orders such as buy limit, sell stop limit, sell limit, sell stop, buy stop and buy stop limit.

The platform has over 30 different languages to choose from, and 24/7 virtual customer support. There is also a user manual for new traders. Also, there are physical offices at Cyprus, Australia, Turkey, Japan, China, and a few other places. If you need to know about one near you or the exact location, this is available on their website.

MetaTrader 5 added the hedging option in 2016. It is a trading strategy used by a client who would like to open different or opposite positions using the same asset.

MT5 allows access to algorithmic trading which means a computer program will follow certain trading criterias. You can access this tool via robots or expert advisors. Copy Trading is also allowed.

To stay on top of the fast moving market, MetaTrader 5 offers news on different countries such as the United Kingdom, the United States, Japan and the European Union, and release notes that are publications made by MT5 about their recent and historical platform updates.

You may also access the economic calendar which will show important real time macroeconomic events. The calendar will be organized according to the importance of the news and in a chronological way.

Clients can also analyze security quotes using the three available financial charts: broken line, sequence bars and Japanese Candlesticks. There are 21 timeframes, and each of these vary from one minute to one month, tick volumes, last price, and more. You may also make use of the color schemes.

Compared to MetaTrader 4, this platform has one more execution mode: instant, request, market, and also an exchange execution.

For those who have the need to implement technical analysis, there are 80 technical indicators and graphical objects. Trend indicators and oscillators are available to help identify trends or a certain direction an asset might take.

MetaTrader 5 pros and cons

Pros:

- Over 30 languages.

- 21 charting time frames.

- It offers an economic calendar.

- Fast and reliable.

Cons:

- No hedge funds available for exchange markets.

- Does not have the same layout as MT4.

- You can’t create offline charts.

5. Interactive Broker platform

Interactive Brokers is another easy to use forex trading platform that has been around for over 40 years. They are present in 135 markets, and 33 countries and offer assets such as stocks, futures, options and bonds. They have been awarded four times during this year.

This is our fifth best forex trading platform, and it is open 24 hours during six days of the week which is also when contact support will respond to your questions. You can reach them via email, phone or their chat support.

This platform offers an extensive educational service that includes webinars, a trader’s glossary, videos, trader’s insights, and more. Some of them are free and others can only be accessed after subscribing.

Some of their trading tools include notifications, real time monitoring, watchlists, and advanced charting. You can also customize your dashboard. A paper trading account is also available.

They have a mobile app to trade on the go, a website and desktop platform. You can even check your account on your Apple watch.

Fees on Interactive Brokers platform

| Type of Fee | Amount Charged |

| Deposit Fee | The first deposit of the month is free. It will depend on the deposit method and currency. |

| Withdrawal Fee | Yes, but the first withdrawal of the month is free. It will depend on the withdrawal method and currency. |

| Conversion Fee | No |

| Inactivity Fee | Yes, for IBKR Pro customers. |

| Overnight Fee | Yes. It will depend on the contract or the percent of trade value. |

Plus500 pros and cons

Pros:

- A great educational section.

- Customizable dashboard.

- Demo account.

- Good customer support.

Cons:

- Inactivity fee

- Deposit and withdrawal fees

Platforms Comparative in a Table

| Features | eToro | Plus500 | MetaTrader 4 | MetaTrader 5 | Interactive Brokers |

| Copy Trading | Yes | No | Yes | Yes | No |

| Demo Account | Yes | Yes | Yes | Yes | Yes |

| Social Trading | Yes | No | No | No | No |

| 24/7 customer support | Yes | Yes | No | Yes | Yes |

| Charting tools | Yes | Yes | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes | Yes | Yes |

| Desktop platform | Yes | Yes | Yes | Yes | Yes |

| Web platform | Yes | Yes | Yes | Yes | Yes |

| Cryptos | Yes | Yes | It will depend on the broker who purchases this platform. | It will depend on the broker who purchases this platform. | Yes |

| Maximum leverage | It will depend on the size of each trade. | 1:30 | It will depend on the broker who purchases this platform. | It will depend on the broker who purchases this platform. | It will depend on the country and the exchange or products you want to trade. |

| API | Yes | Yes | Yes | Yes | Yes |

Platform Comparative Fee Table

| Type of Fee | Interactive Broker | Plus 500 | eToro |

| Deposit Fee | The first deposit of the month is free. From 25 to 50 USD. |

Free | Free |

| Withdrawal Fee | Yes, but the first withdrawal of the month is free. From 1 to 10 USD. |

Free | $5 |

| Conversion Fee | No | Up to 0,5% of the trader’s realised profit and loss. | From 50 pips up to 2500 pips, depending on the instrument |

| Inactivity Fee | Yes, for IBKR Pro customers. | $10 monthly after 3 months of inactivity | $10 monthly after 12 months of inactivity |

| Overnight Fee | Yes. It will depend on the contract or the percent of trade value. | Yes. It will depend on the instrument. | Yes. On currencies, commodities and indices. |

Conclusion

Our research has led us to believe that the best online trading platforms this 2020 are eToro, Plus 500, MetaTrader 4, MetaTrader 5 and Interactive Brokers. This group of investment stations offer different features that can fit with most traders, beginners, experienced and those who love algorithmic trading.

That being said, the best trading platform will depend on what you determine as your main need when it comes to investment style.

Remember, knowledge and controlled emotions will always help you make better decisions when it comes to trading. You will always be in a risky situation when buying or selling your funds.

And remember, as Yvan Byeajee wrote in his book, Paradigm Shift: How to cultivate equanimity in the face of market uncertainty. “Trading doesn’t just reveal your character, it also builds it if you stay in the game long enough.”

How to open a Forex account?

We have prepared a step by step guide of how to open an account once you have decided which platform you will be entering your trades on. As an example, we have taken screenshots of the entire sign up process using eToro. Take a look!

1. First, you must go to www.etoro.com. The main page should look something like the screenshot below. There are two options that will take you to the signup button.

2. If you do not see a “signup button” you can click on “login instead.

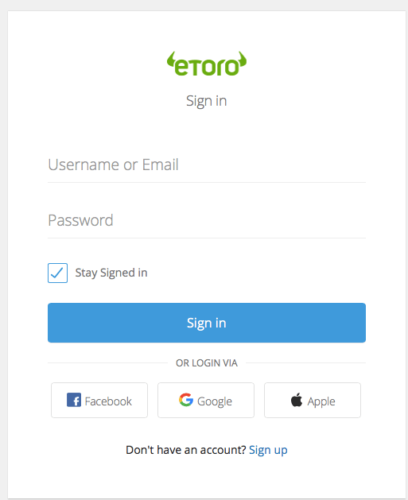

3. After clicking on the login button in the top right corner, you will be redirected to another page. Instead of signing in, click on the bottom blue letters that say “sign up”.

4. We previously mentioned a second option to signing up. We are now back at the main page. If you do not see the sign up button, scroll down a little.

The tool bar will change to white, as shown below. Now you will see a green button on the top right corner that says “sign up”. Go ahead and click on it.

![]()

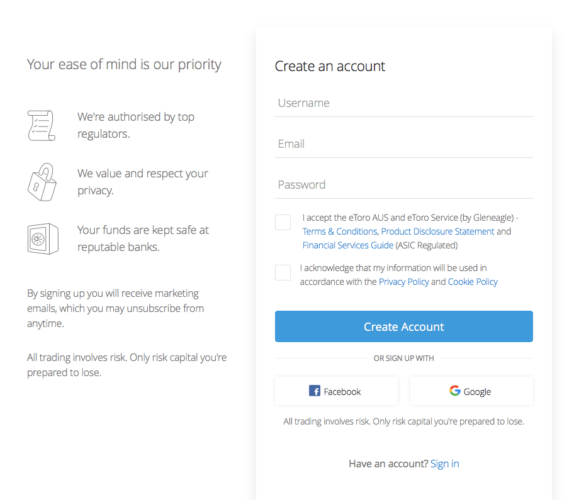

5. You will be redirected to the screenshot shown below. Enter a username, a valid email and a strong password with an uppercase and lowercase letter, and at least one number. If you are ready to accept the terms and conditions, the privacy policy, and the cookie policy, please click on the two squares to assume responsibility.

Now you are ready to click on the big blue button that says “create account”.

You could also choose to sign up with a Facebook or Google account.

6. You will be immediately accepted and redirected to your watchlist which can be edited for your personal convenience. Do not forget to complete your profile. With that, you are ready to deposit funds and begin trading.

7. The final step is to look forward to trading on your new account and use it responsibly. Enjoy!

FAQs

What is the best forex trading platform for beginners?

eToro is the best forex trading platform for beginners. Its copy trading feature allows new traders to mimic successful traders and copy their trading strategies and portfolio in a few clicks.

How much money do I need to deposit in a forex trading platform?

If you’re still a beginner trader, it’s highly recommended that you start with a $200 deposit so you can hone first your trading skills before investing a lot of your savings.

How are trading fees calculated?

The trading fees you’ll need to pay vary based on what trading platform you’ll use. You’ll generally need to pay a fixed fee or spread per trade. Some platforms also charge inactivity fees, withdrawals fees, overnight fees as well as conversion fees.