Trading with leverages has become a key part of the forex market. However, despite virtually all brokers offering leverages, some have a higher leverage ratio available for their traders. To choose the best high leverage brokers, we have compiled a list and looked into the pros and cons of trading with leverages.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

€250

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

-

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

No

FCA

No

CySEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

-

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

1.3 pips

Leverage max

100:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECCFTCNFA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.5

EUR/USD

1.3

EUR/JPY

1.6

EUR/CHF

3.1

GBP/USD

1.9

GBP/JPY

3.6

GBP/CHF

4.2

USD/JPY

1.5

USD/CHF

2.0

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

1.3 pips

Regulation

No

FCA

No

CySEC

No

ASIC

Yes

CFTC

Yes

NFA

No

BAFIN

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Min.Deposit

€0

Spread min.

0.0 pips

Leverage max

2:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

0.0

EUR/USD

0.0

EUR/JPY

0.0

EUR/CHF

0.0

GBP/USD

0.0

GBP/JPY

0.0

GBP/CHF

0.0

USD/JPY

0.0

USD/CHF

0.0

CHF/JPY

0.0

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

No

FCA

No

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

Trading leveraged products such as CFDs involves substantial risk of loss and may not be suitable for all investors. 83% of retail investor accounts lose money when trading CFDs with this provider. Trading such products is risky and you may lose all of your invested capital.

Compare Forex Brokers Fees:

Use our side-by-side comparison table to compare Forex broker accounts, spreads and fees.

Recommended

8cap

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Forex.com

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

VantageFX

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

AvaTrade

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Top 5 High Leverage Forex Brokers

These leading high leverage forex brokers were determined based on insightful research from our team of analysts.

- eToro is the best high leverage broker for social traders, offering huge leverages for assets such as stocks, forex, commodities, metals, and more.

- Plus500 is a high leverage broker suitable for top traders, allowing them to enjoy over 1:300 on major currency pairs.

- Pepperstone has an international presence and its leverage of 1:500 is one of the highest currently available to traders globally.

- FXPro has made a name for itself as having high leverages for both minor and major currency pairs, allowing traders to enjoy leverage as high as 1:500 for both.

- Forex.com is the top broker that allows U.S traders to enjoy high leverages, as high as 1:50 for currency pairs.

eToro- High Leverage for Social Trading

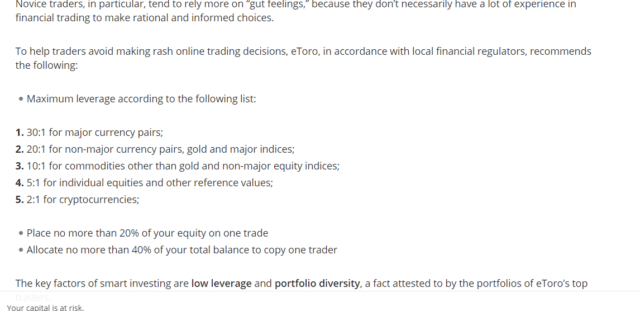

eToro is another excellent platform that offers high leverages to traders. It is one of the top social trading brokers that offer high leverages on several assets. You can trade with a leverage of 30:1 for major currency pairs, 20:1 for non-major currency pairs, Gold and major indices, 2:1 for cryptocurrencies, and more. You can take advantage of the experience of some traders to place your trades, and by using leverage, you stand to make higher profits on your trades.

On eToro, the leverages are applied in multiples of the capital a trader invests, which could be 2x, 5x, 30x or even higher. eToro lends the sum of money to the trader at the fixed ratio and the trader uses it for his trade. This platform supports the use of leverage in both long and short trading positions.

eToro fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | $5 |

| Conversion fees | from 50 pips |

| Inactivity fee | $10/month |

Plus500- High Leverage for Top Trader

Plus500 is one of the best brokers that offer high leverages to traders. The available leverage for Forex CFDs on the Plus500 trading platform is 1:300, while traders get to enjoy leverage for shares CFDs is high as 1:20.

The leverages vary based on the financial assets. For cryptocurrencies, the leverage on Plus500 is 1:20, for commodity CFDs is 1:150, for ETFs is 1:100, and for index CFDs is 1:300. Leverage is a crucial part of forex trading since currency pairings movement on average single figures. As a broker, Plus500 focuses its highest leverage amount on currency pairs and it is currently one of the highest in the world.

Plus 500 fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | free |

| Conversion fees | 0.5% of the profit |

| Inactivity fee | $10/month |

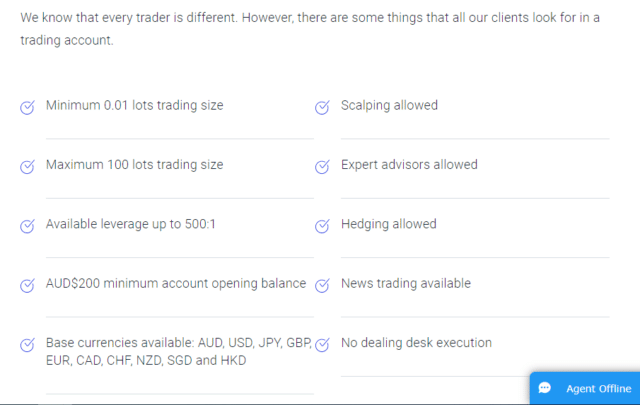

Pepperstone- High Leverage International Broker

Pepperstone is an Australian broker that offers its services to clients in all parts of the world. In addition to its numerous unique features and trading tools, Pepperstone is one of the top high leverage brokers available to traders. On Pepperstone, you can trade currencies and other assets with leverage as high as 1:500. This means that you can earn as much as $500,000 with a margin requirement of just a fraction of the amount.

This broker offer leverage of up to 1:500 for forex in ASIC, 1:50 in its DFSA jurisdiction, and 1:30 in its FCA jurisdiction. Leverages usually increase profits and losses exponentially, which makes it crucial that traders remain cautious when using leverages. The larger the position size, the more massive the pip value and the higher the impact on profit and loss.

Pepperstone fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | free |

| Conversion fees | $3.50 per $100,000 bought |

| Inactivity fee | None |

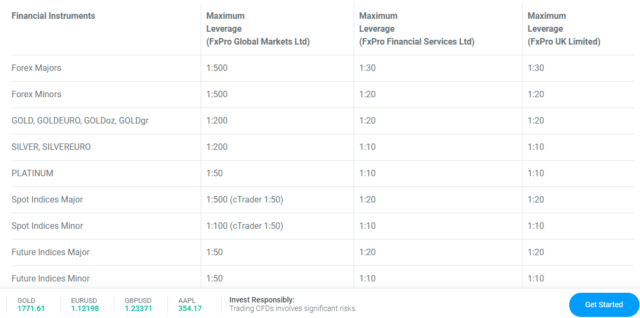

FX Pro- High Leverage for Major and Minor Pairs

FX Pro is a leading international broker that is known for providing high leverages to forex traders. What distinguishes FX Pro from the others is that it offers high leverage for both major and minor currency pairs. On the platform, traders can enjoy high leverage of up to 1:500 for both major and minor currencies. Spot indices trading also has high leverage of 1:500, while those trading commodities like Gold enjoy the leverage of 1:200. Overall, FX Pro is an excellent platform to enjoy high leverage on all currency pairs.

FXPro deploys a dynamic leverage model on its various trading platforms, which automatically adapts to the trading positions of the trader. As the volume per Instrument of a trader increases, the maximum leverage offered to them decreases accordingly and this is applicable to all the asset classes.

FXPro fees

| Type of fees | Amount charged |

| Deposit fees | free |

| Withdrawal fees | free |

| Conversion fees | Based on Tomorrow Next Deposit Rates(TNDR) |

| Inactivity fees | None |

Forex.com- High Leverage Broker for U.S Traders

Forex.com remains one of the best high leverage brokers available to traders in the United States. Traders can enjoy leverage up to 1:50, allowing them to take larger positions with little capita. This means that traders can earn as much as $50,000 on trade of just $1,000. However, similar to other platforms, trading with leverages on forex.com comes with an increased risk of losing your capital and more.

The margin requirements differ according to the Forex.com or MetaTrader platforms available, the market, the asset classes, and the position size. On this platform, users can calculate the required margin before they place an order via the margin calculator of forex.com. Traders can also monitor each position’s margin requirement separately or review their account’s total margin requirement using the Margin Indicator.

Forex.com fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | $25 for local and $40 for international |

| Conversion fees | Based on transaction |

| Inactivity fee | $15/month |

What is Leverage and Margin in Forex Trading?

Forex brokers all over the world usually offer margin trading services to their clients. What this means is that the broker will lend money to the client to purchase extra positions in a trade. They make money in interest when the client repays the loan. The margin rates vary according to the broker.

Traders borrow money from their brokers because they want to trade with leverages. Leverage is the term used in addressing the amount of borrowed money involved in a forex trade. The leverages offered by forex brokers vary. For instance, if you have a leverage of 1:50, it means that you need $1 in your account to trade $50 in the market. It is obvious that leverage increases the risk involved in trading currencies because you lose your capital and owe the broker money when the trade goes sideways.

Forex broker deploys margin requirements to determine the amount of leverage forex traders can use per trade. This is usually expressed as percentages. For instance, the USD/EUR pair requires a 2% margin means that you need to have 2% of the amount of the total trade before you are allowed to participate.

How to Choose the Best High Leverage Brokers

Choosing the best leverage forex broker is a challenge due to the large number of brokers offering the services. In the U.S, forex traders are not allowed to use the highest available leverage. Here are a few attributes to pay attention to when choosing a high leverage broker:

Margin requirements

For traders in the United States, margin requirements are set at 2% (1:50 leverage). However, on the international stage, you can trade with leverage as high as 1:500 on major currencies. It’s not necessary to use leverages on all trades, but ensure that you choose a broker with limits that are fine with you.

Support for trading software

Most forex brokers use their own proprietary trading software. However, they also offer other popular trading platforms like MT4 and cTrader. If you prefer to use the MT4, ensure that the broker you choose supports it.

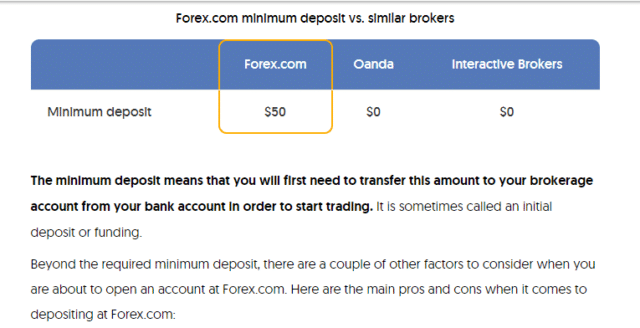

Account and trade minimums

Each broker sets the minimum amount required to open an account with them, including the amount needed to execute a trade. Some brokers don’t have a minimum account opening sum, but they all have trade minimums. It is best to choose a broker that offers account and trade minimum that suits your budget and trading style.

Commissions and fees

Forex brokers earn money via spreads and commissions. Most of them have spread-only and commissions accounts available to traders. Commission accounts have lower spreads. Make sure that you understand their charges and pricing before you open an account with them. The charges and pricing have to be okay with you.

Pros and Cons of Trading with High Leverages

Pros

- Allows you to trade with low capital: in the past, only the wealthy people with huge capital can place large trades and make massive returns on their investment. Thanks to the use of leverage in forex, any trader can trade the currencies and make huge returns. Trading with a leverage broker makes you require little capital to start trading in the FX market.

- Interest-free: although the broker is borrowing you the money to trade with leverage, it doesn’t incur any interest. By using leverage with your broker, you are getting the loan you require without the fear of repayment with interest.

- Biggest profits: using leverage to trade forex boosts the amount of profit you stand to make. A trader with $100 can earn up to $100,000 when they use leverage. Trading with massive amounts boosts the scope of your profit, and leveraging helps achieve that.

Cons

- Heavier Losses: trading with high leverages increase the probability of earning higher profits, but it also paves the way for heavy losses when the market goes sideways. Small losses with leverages turn out to be bigger. Hence, traders need to be very careful and attentive when trading with leverage in the forex market and remember to stop a trade when the market is moving in the opposite direction to your prediction.

- Liability: trading with leverage is a constant liability. It builds a sudden liability that has to be met before the end of the day. Regardless of the additional costs of a transaction, the trader has to settle the principal amount of leverage as soon as possible. Failure to do that will make it impossible for you to continue trading.

- Margin call risk: each broker has a set margin call requirement, and you might fall under it if you use leverage and fail. The margin is the transaction size you need to fulfill, depending on your trading capital. If at a point, you fall below the set threshold, the broker can initiate a margin call that automatically liquidates your portfolio. This could lead to the early closure of positions that are delivering excellent returns in the market. The margin call is a constant risk that hangs around traders that use leverage to trade currencies.

FAQs

What is the leverage?

Leverage is an opportunity to control a massive position in a financial market using a small amount of capital. It is usually depicted by a ratio. For instance, an account with a leverage of 1:100 means that you can trade a position of $100,000 with just $100,000.

However, keep in mind that higher leverages increase the risk involved in trading forex.

Do margin requirements remain the same?

No, they don’t. Each broker sets the margin requirement. This is the amount needed to place a trade successfully with the broker. Most brokers require 2% of the total trade amount to be in your account before you are allowed to trade forex with leverage.

Can I change my account leverage or margin?

In most cases, yes, you can. Most brokers provide a form for traders to fill when they wish to change their leverage or margin rates.

Can my account go negative with leverage trading?

Yes, it can. Although most brokers set their closeout levels to limit the trading losses, traders still risk incurring higher losses than their account balance. This is especially true during extreme market volatility. Hence, traders are strongly encouraged to use leverage with care and manage their accounts properly.

Which leverage should I use as a forex trader?

The answer to this question solely depends on the trader. The trader has to look at the leverages offered by the broker and decide which ones best suit his/her trading style. They also have to check to ensure if they meet the margin requirements and their risk appetite.

A comparison of the best high leverage brokers

| eToro | Plus500 | Pepperstone | FX Pro | Forex.com | |

| Feature | |||||

| 24/7 customer support | Yes | Yes | Yes | No | Yes |

| Mobile app | Yes | Yes | Yes | Yes | Yes |

| Charting tools | Yes | Yes | Yes | Yes | Yes |

| Various markets | Yes | Yes | Yes | Yes | Yes |

| Free deposit and withdrawals | No | Yes | Yes | Yes | No |

| Price alerts | Yes | Yes | Yes | Yes | Yes |

| Real-time quotes | Yes | Yes | Yes | Yes | Yes |

| Copy-trading | Yes | No | Yes | Yes | Yes |

| Social trading | Yes | No | No | No | No |