Weekly Price Action Trade Ideas – 8th to 13th Dec 2019

Markets Discussed in This Week’s Trade Ideas: EURUSD, NZDUSD, GBPUSD and AUDSGD.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

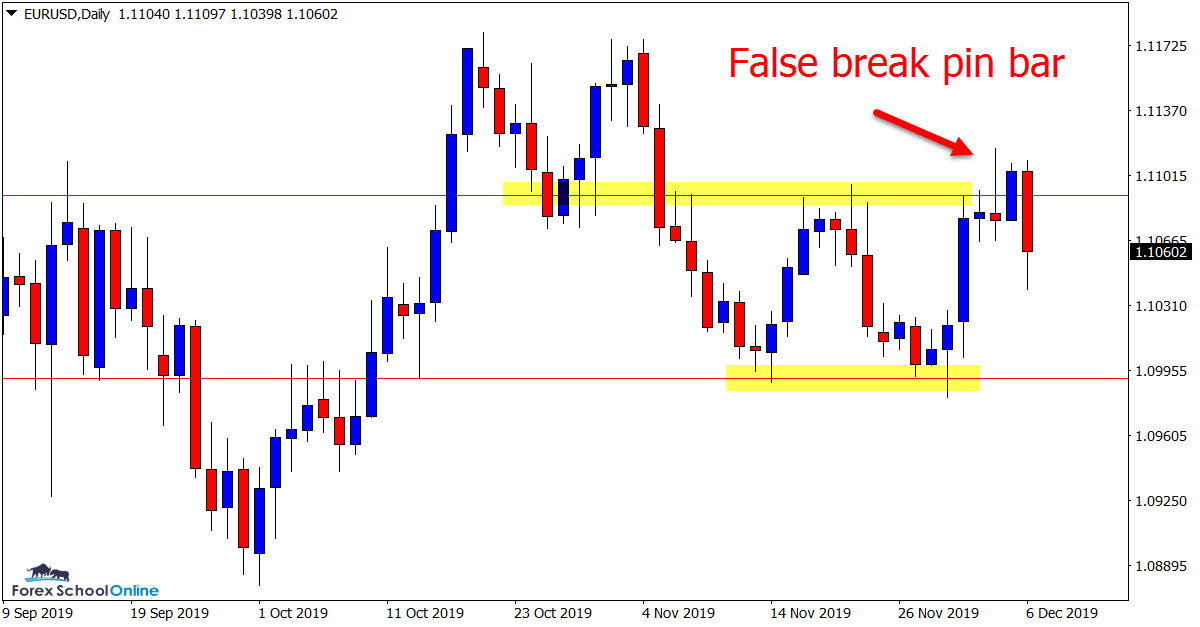

EURUSD Daily and 4 Hour Charts

False Break Pin Bar

In last week’s trade ideas we looked at the bullish engulfing bar – BUEB that price had formed on the daily chart, watching to see if price could pop higher and into the resistance level.

After breaking the high of the engulfing bar, price made a solid move higher to make an important test of the daily resistance.

As the daily chart shows below; price formed a false break pin bar that has since seen price roll back lower.

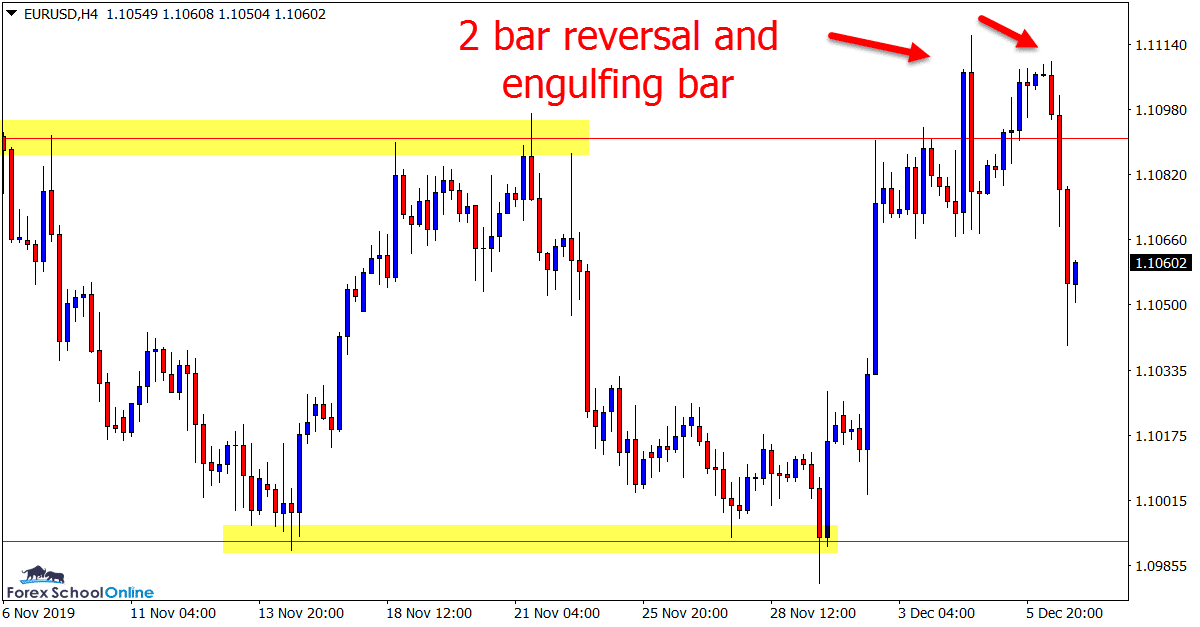

The 4 hour chart also formed bearish price action setups.

Because price is stuck in a range as we have previously discussed, there are a lot of minor support and resistance levels that need to be factored in for any trades or potential trades.

Daily Chart

4 Hour Chart

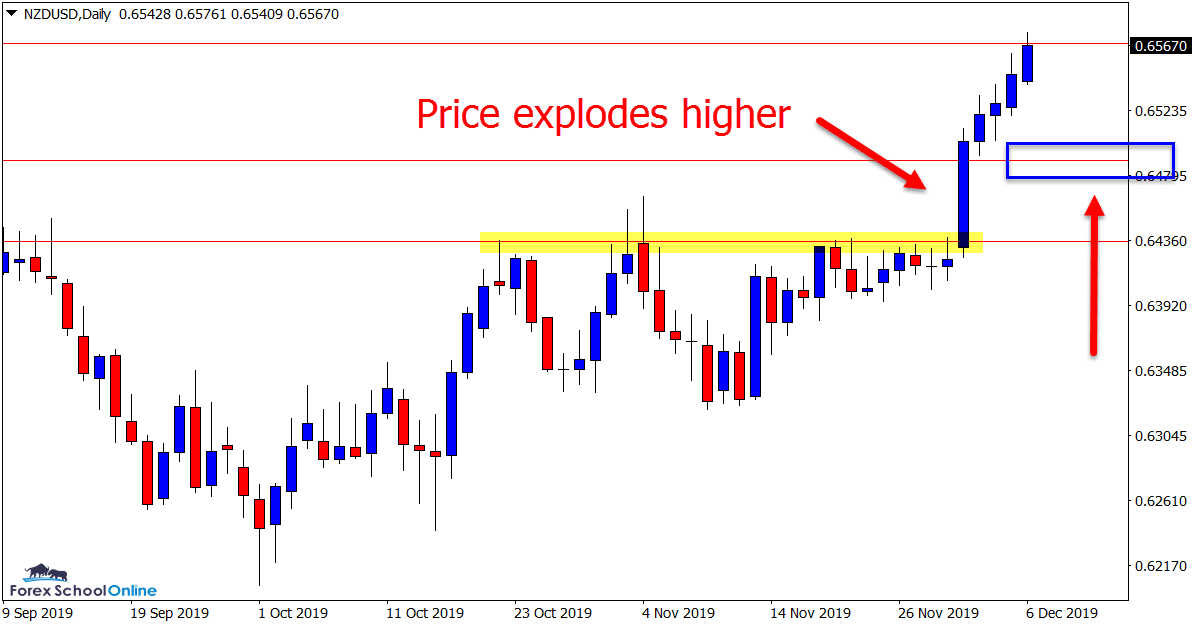

NZDUSD Daily Chart

Huge Breakout Plays Out

We have been looking at this market closely in recent times and last week we were watching to see if price could finally make a substantial breakout higher.

Price on the daily chart was forming all the indications and clues that it was building momentum and looking for a potential fast breakout higher.

Price has now moved into the daily chart resistance. If price can rotate back lower and into the near term support it could be a solid level to hunt for long trades with this momentum higher.

Daily Chart

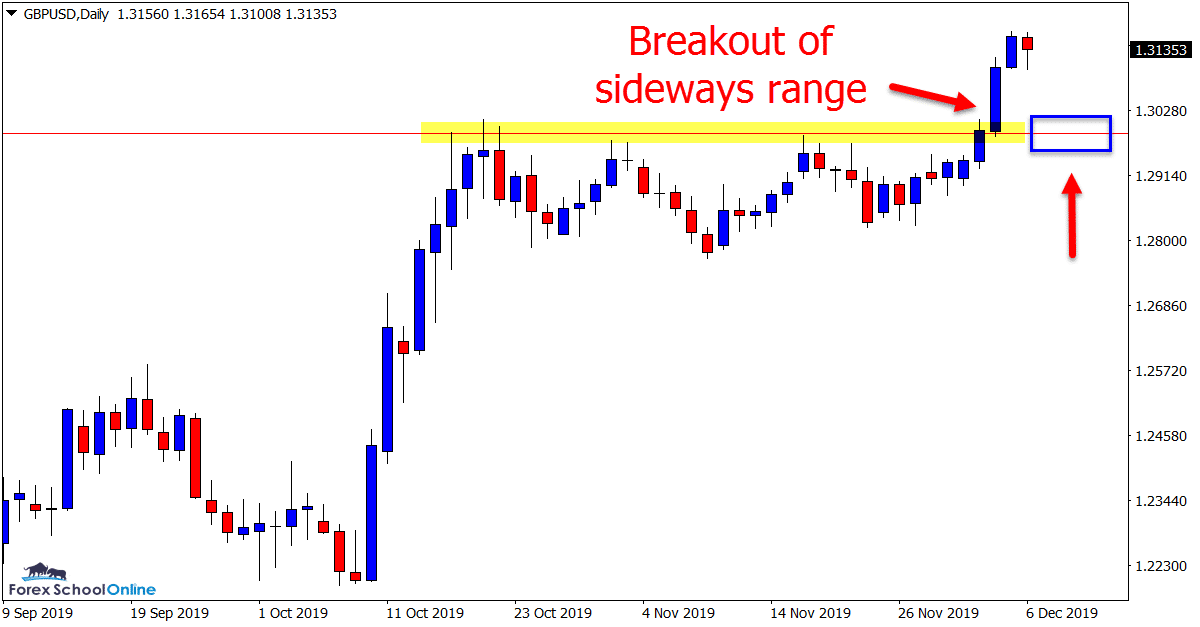

GBPUSD Daily Chart

Consolidation Box is Broken

After a period of consolidation, price has now broken higher into the continuation phase.

This is a common pattern that occurs on all time frames. Price forms a strong move such as the large and fast move higher on the daily chart we had here. It then pauses and consolidates before breaking in the same direction with the continuation.

This creates a lot of trading opportunities. We can look to play the range whilst price stays consolidating. We can then look to make breakout trades when the continuation plays out. We can also look to make breakout and retest trades after the breakout has formed.

Daily Chart

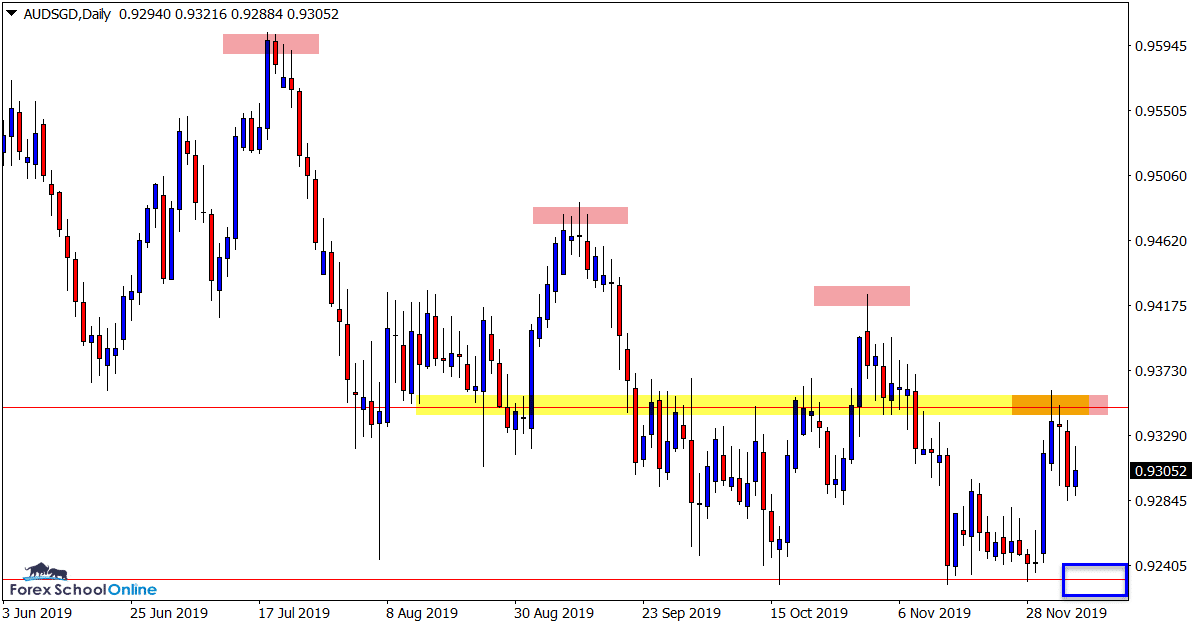

AUDSGD Daily Chart

Lower High is Formed

Last week we discussed this market and the major support price was sitting on, looking to see if we would get another break and move lower.

At this stage the support level has held. However; price has formed yet another lower high on the daily chart keeping the downtrend intact.

If price can roll lower in the next new sessions, then the same support level discussed last week could be a solid level to watch for possible breakout trades.

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

Please leave questions or comments in the comments section below;

Dear Jonathan,

I am reading your article just from last month. Your page is full of information. I have seen many course offered by different mentors. But I’m confused which course is truly perfect to take a good idea. Can you help me regarding this?. my email address is: [email protected].

with regards

sir, i am very curious to know how many pairs ? do you analyse per week , it’s for my confusion i was concentrating on 14 pairs and failing , here i can see you analysed only 4 pairs and another master is using only 5 pairs for the week , is that quite enough to concentrate on maximum 4 to 5 pairs , please help me i am confused sir thank you

Hi Hari,

I watch and trade a large variety of pairs. You can read about the markets and pairs and why here; https://www.forexschoolonline.com//start-cherry-picking-best-price-action-trades-forex-pairs-johnathon-fox-trades/

Anything else let me know,

Johnathon