Whilst many traders focus on using the best strategy for finding trade entry signals, how you manage and take your profits will often have a bigger impact on the amount of profit you make.

Using trailing stop loss strategies is one way you can capture bigger running winning trades whilst ensuring your downside is minimized.

In this post we look at what exactly a trailing stop loss is, the best times to use it and four strategies that can be used in all markets.

What is a Trailing Stop Loss

As the name suggests; a trailing stop loss is a stop loss you are trailing along behind the price as it moves higher or lower.

Whilst you might start your stop loss above or below your trigger signal, as price moves in your favor you can begin moving and trailing your stop. Doing this has both some advantages and disadvantages.

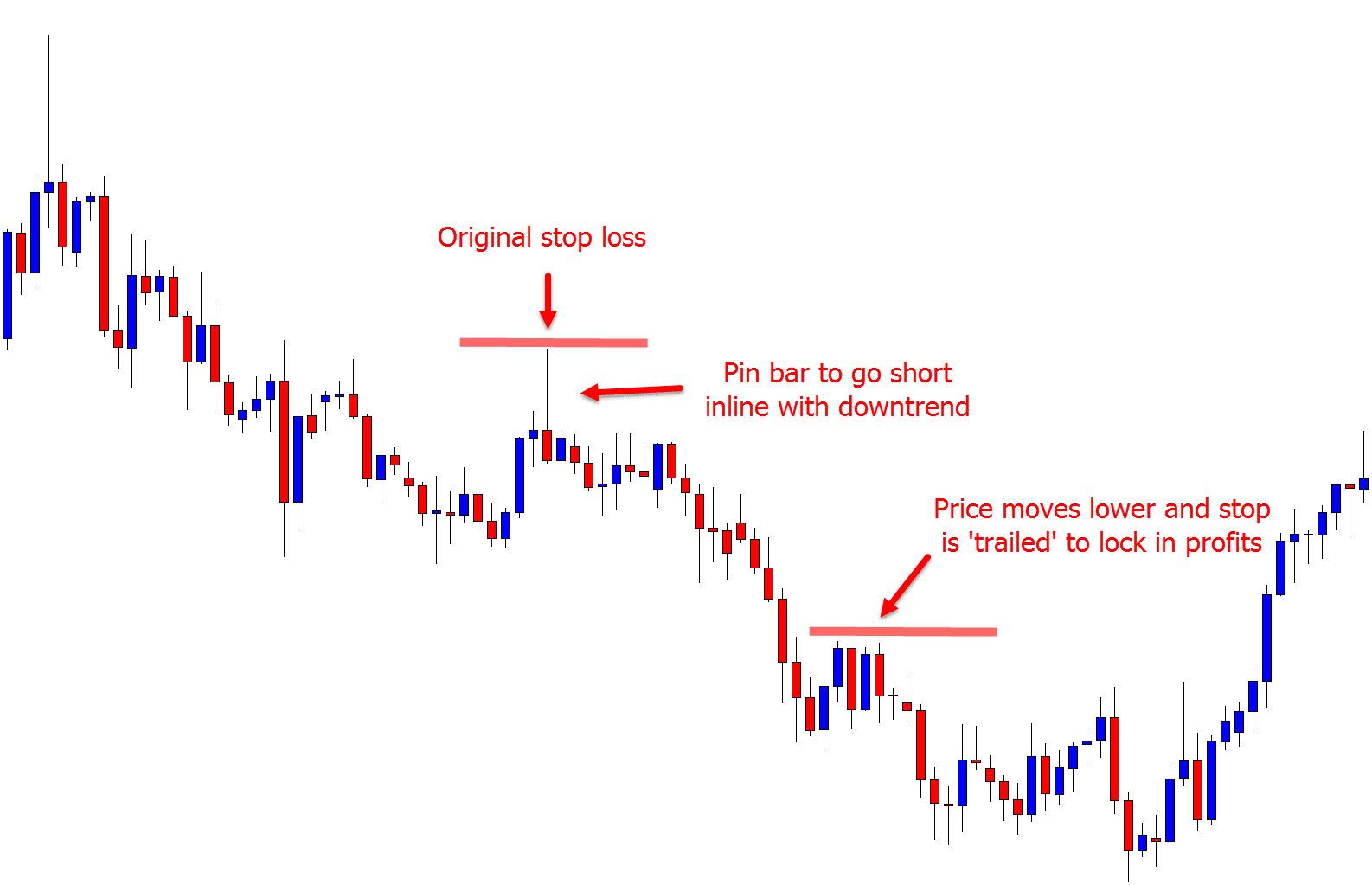

Below is a chart example of how a potential trailing stop loss could be used.

Note: in this post I have used the same pin bar entry signals for examples to make it as easy to explain and understand as possible. However; trailing your stop loss can be used with many different entry signals and strategies.

You will see in the example below after the pin bar entry the first stop could potentially be placed above the high of the pin bar. As price moves lower and the trade moves into profit the stop loss could be trailed to lock in profit.

This would also open a ‘free trade’ situation in that you would be in the trade with profit locked in, but still have the potential to make a bigger profit if the price continues to move in your favor.

The Disadvantages of a Trailing Stop Loss

Like most trading strategies and methods there are disadvantages to using a trailing stop loss.

Whilst a trailing stop loss can help you capture bigger running trades and bigger potential profits, it can also stop you out before you achieve those profits.

Because you are trailing your stop loss behind the price action you are continually putting your stop closer to the current price. This means you are a higher chance of getting stopped out.

This can result in you being stopped out before price goes to where you thought it would and missing out on potential profits.

It is key to know the best times to use a trailing stop loss and where you should put it for the best chance of success.

The Best Times to Use a Trailing Stop Loss

The two best times to trail a stop loss are when price is in a clear trend or there are clearly set out price action levels.

If there is a clear trend, then you will immediately identify it and you will not be struggling to work out if there is or is not a trend. These are the trends where price is obviously moving higher or lower with a series of swing points.

The reasons these can be great markets to use trailing stops is because you will be more likely to stay in the trade for a longer period. You will also be a higher chance of riding the obvious trend for as long as it lasts.

When the market has clear price action levels and zones such as major support and resistance levels or recent swing points, then they can be used to help you trail your stop.

In saying that; some of the worst markets to trail a stop are when price is very sideways or choppy. This is when price is a lot more likely to whip around and move side to side before it goes to your profit target. If using a trailing stop in these types of markets you are a lot more likely to be stopped out before price reaches your profit targets.

Using Breakeven Stop Loss

Using a breakeven stop loss is the simplest way to trail your stop loss. When using a breakeven stop loss you are waiting for price to move in your favor and then setting your stop loss to a ‘breakeven’ position. This means that if price was to reverse you would be stopped out, but crucially it would be at breakeven and you would not lose any money.

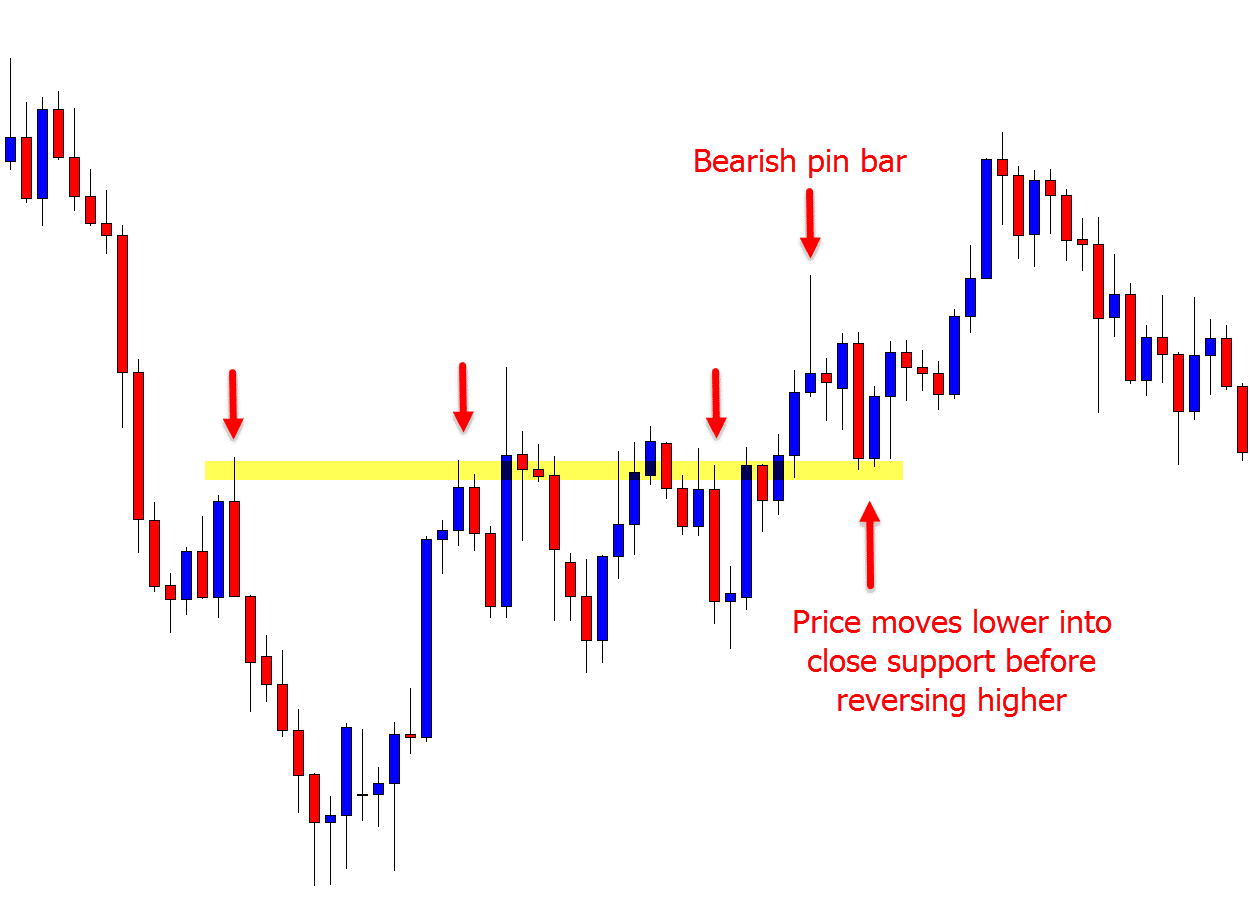

There are pros and cons to using a breakeven stop loss and I have added two examples below to show you both.

In the first chart a bearish pin bar is entered. There is a very close support level and to protect capital in case price hits this support and reverses back higher the stop loss could be set to breakeven.

As the chart shows; price hits the support and zooms back higher. The trade would be stopped at breakeven, but crucially there would be no loss.

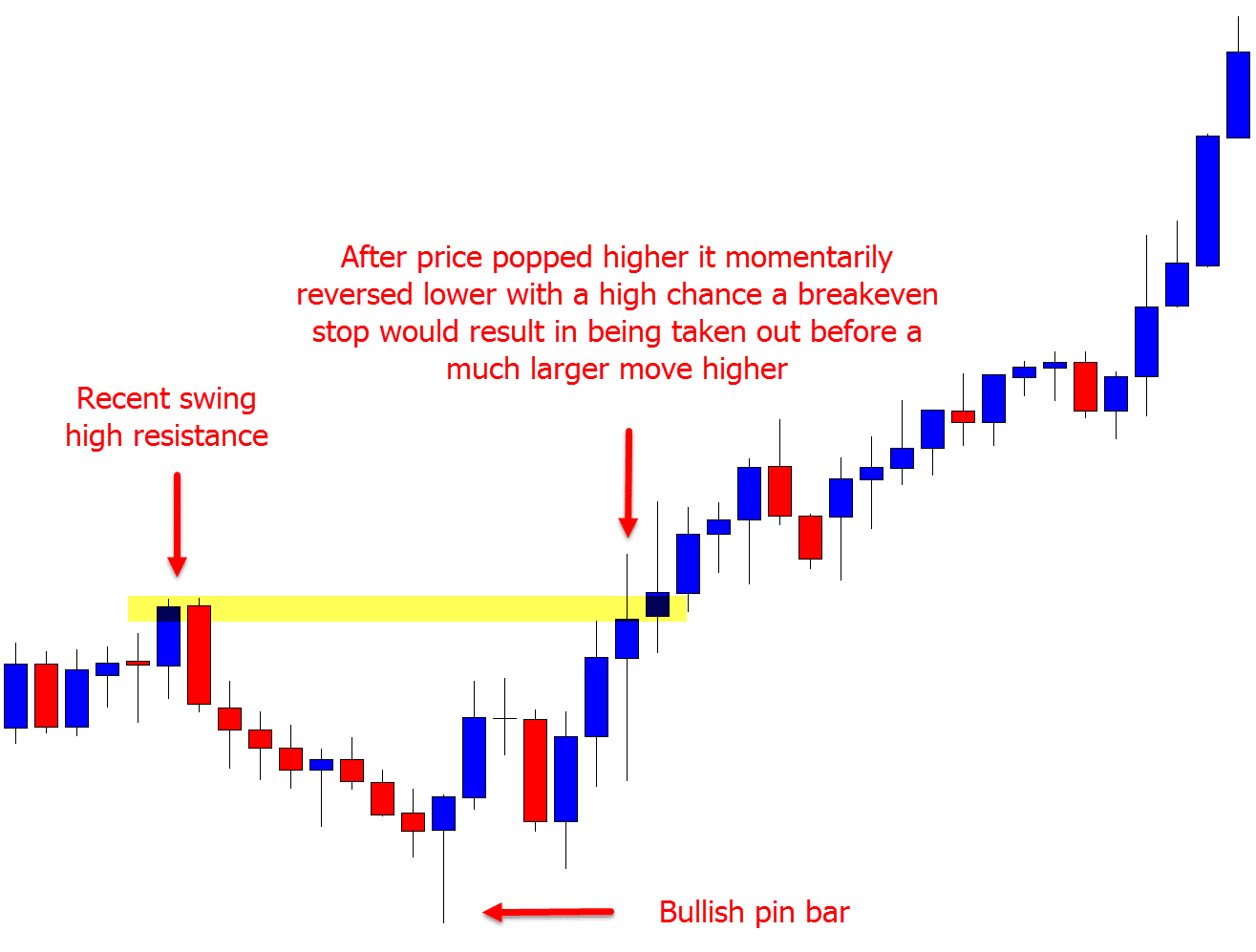

In the second example below a bullish pin bar signal is formed. After moving higher price rotates into the above resistance level.

To protect capital the stop loss could be moved into breakeven. As this example shows; depending on where the entry was made there would be a high likelihood that the trade would be stopped out at breakeven before price goes on to make a much larger move higher.

As both of the examples show above; whilst the breakeven stop loss can protect your downside, at times it can stop you from achieving far bigger profits.

Using the Recent Swing Points to Trail Your Stop

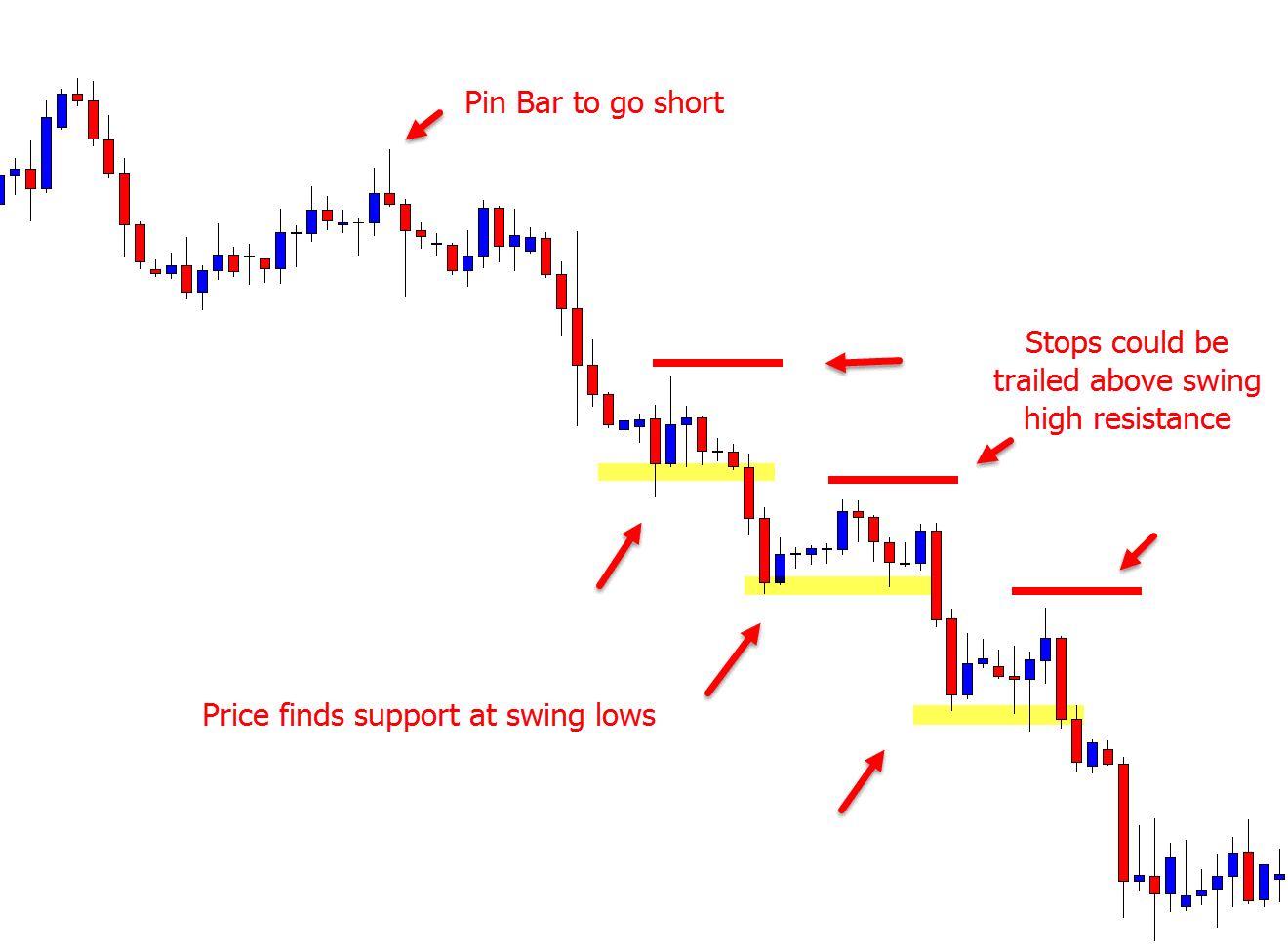

This is a strategy best deployed during strongly trending markets where there is a clear set of swing points.

For a downtrend you will see lower highs and lower lows and for an uptrend a series of higher highs and higher lows.

When using the trend swing points to set your trailing stop loss you are looking to capture a large portion of the trending move until the trend snaps and price moves back the other way.

The chart example below shows a bearish pin bar to go short followed by price selling off lower. After this move price pauses at the swing low. If price breaks the swing point the stop loss could be trailed to lock in the profits and potentially capture a bigger move should price continue.

One thing to keep in mind when using these types of levels to trail your stop loss is that the big money will often move price just above or below them before reversing. I am sure you have seen price trickle above or below major levels and then quickly reverse. Keep this in mind when setting your stop loss areas.

Using the Price Action to Trail Your Stop Loss

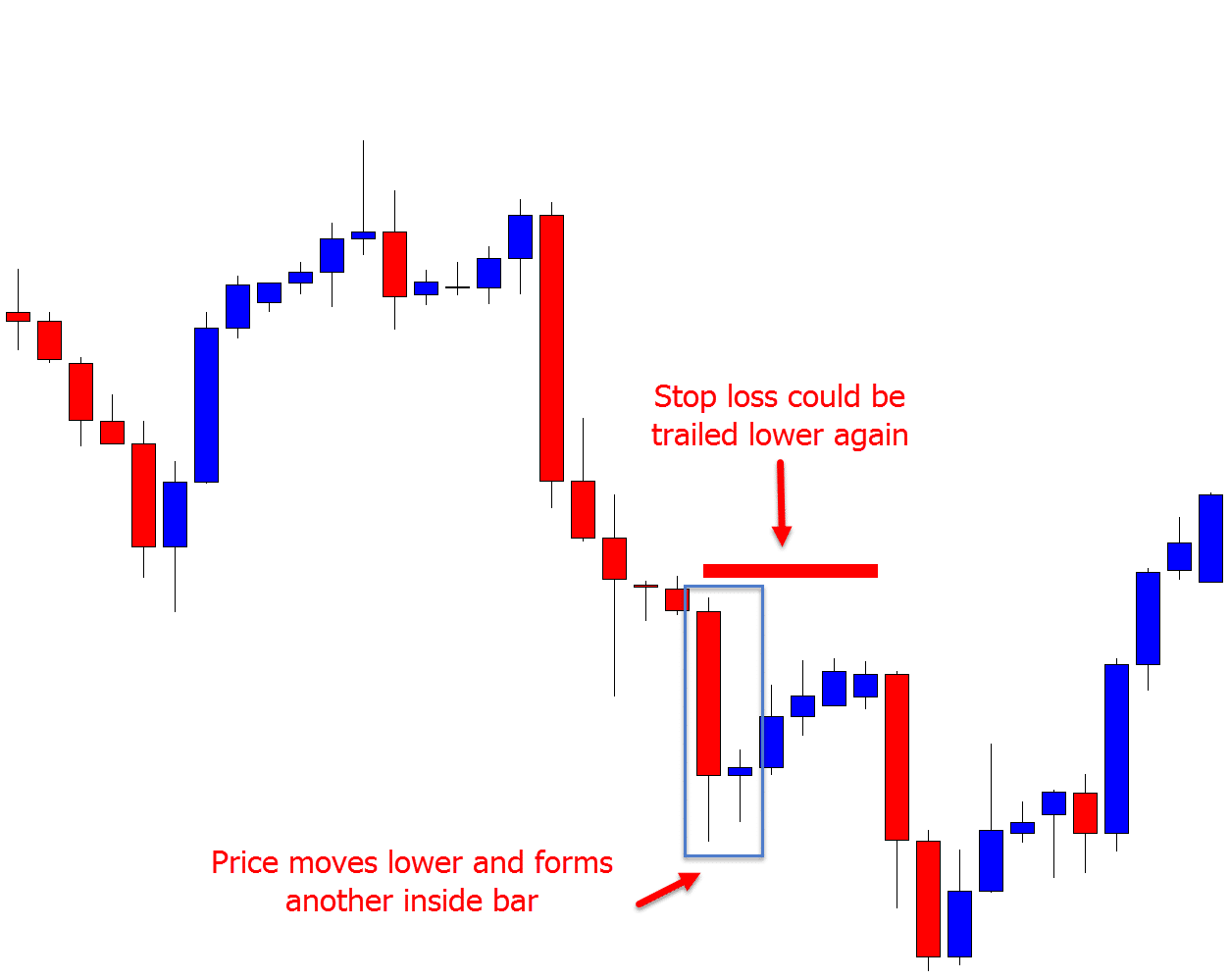

There are many ways you can use the price action clues to trail your stop. The one we cover in this post is how you could use the inside bar, but you could use other candlestick patterns or the recent price action information.

Using the inside bar to manage and trail your stop loss is a very simple strategy.

I have included two charts of the same price action below to highlight an example of how the inside bar could be used as a potential stop loss trailing strategy.

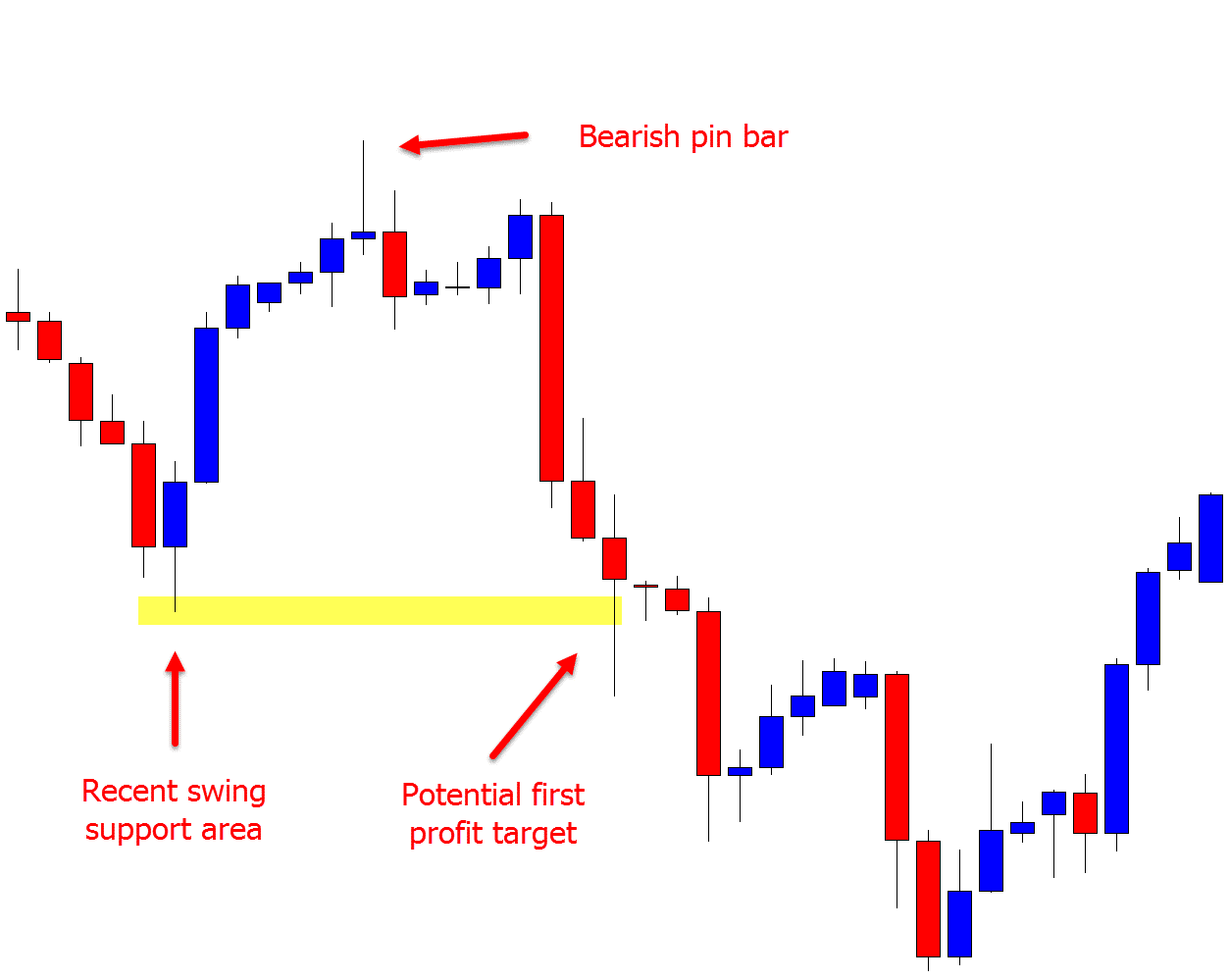

As the first chart example shows below; price fired off a bearish pin bar to go short. After moving into the support level and potential first profit target, the stop loss could be managed to lock in profits.

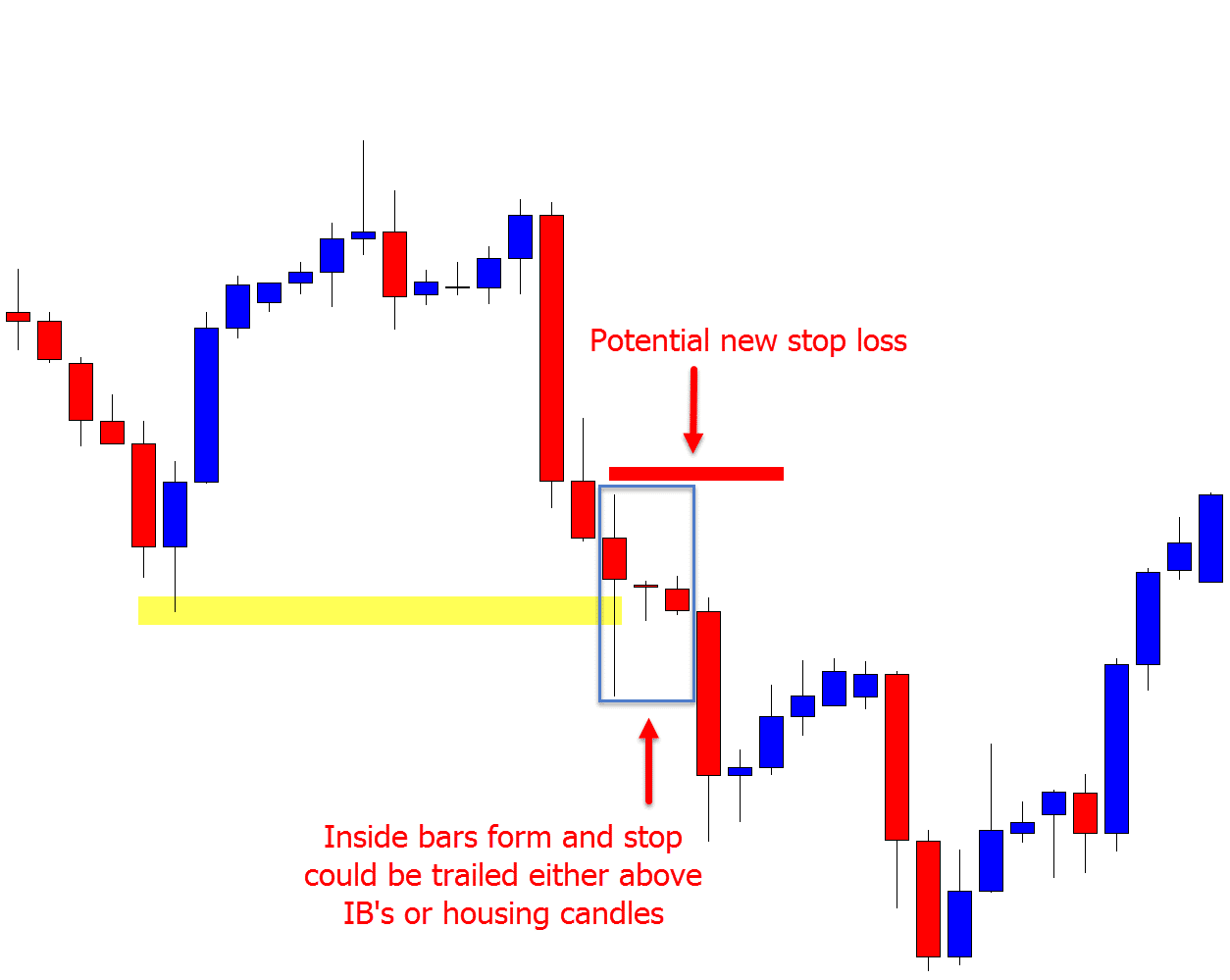

As the second chart below shows; price then forms two inside bars. The stop loss could be moved above the inside bars for a very aggressive stop, or above the inside bars housing candle for a more conservative stop loss.

Using Support and Resistance to Trail Your Stop Loss

This trailing stop loss strategy is similar to using swing points however, with this strategy to trail your stop loss you don’t have to be trend trading.

When using major support or resistance levels to trail your stop loss you can also be using the key levels price is looking to breakout of.

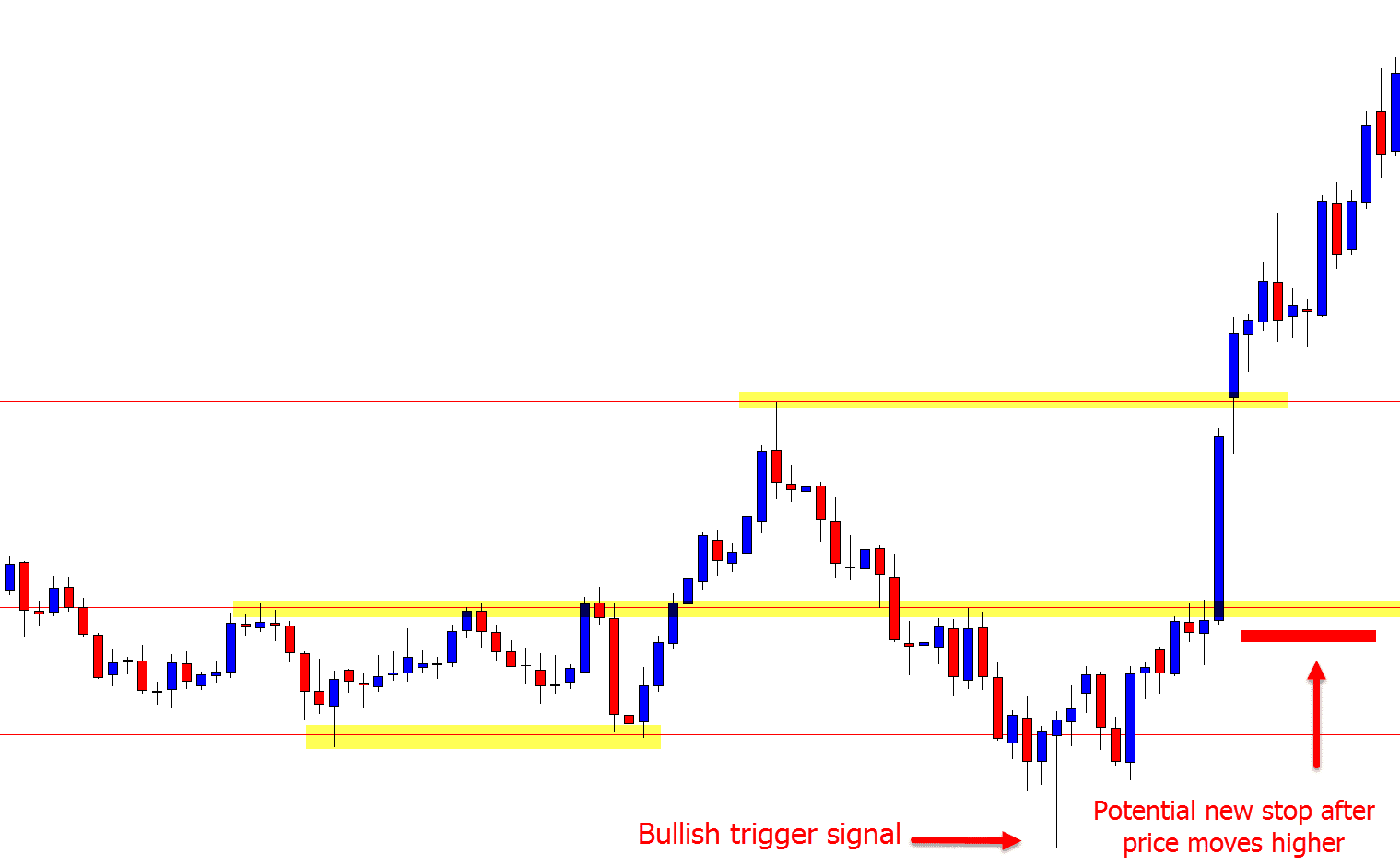

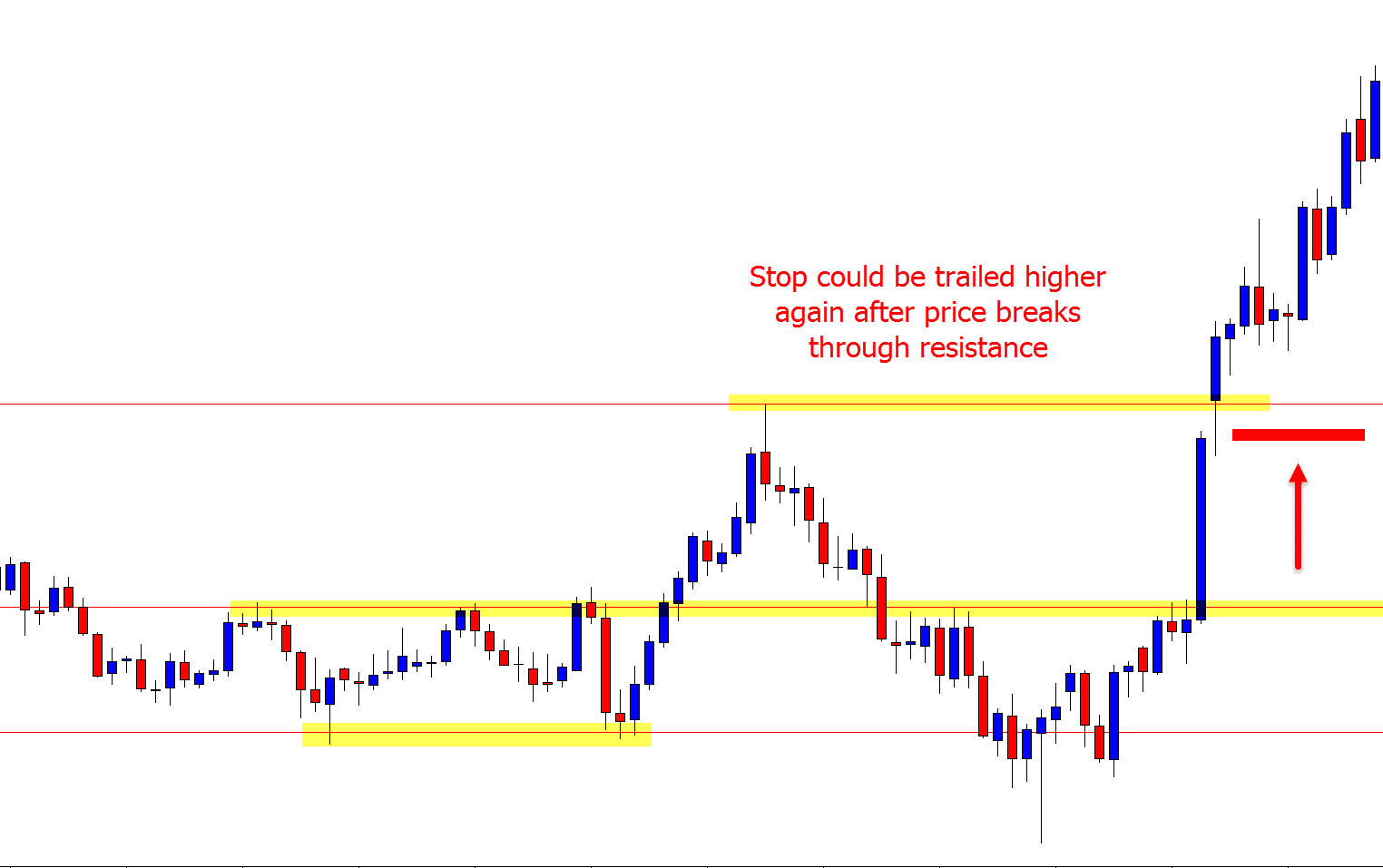

Below is an example of a market that has clear support and resistance levels. Price fired off a bullish trigger to go long and price moved higher into the overhead resistance.

Whilst the breakeven stop loss could be used here as discussed above, we could also look to see if price breaks out of the resistance. If price does break through, then the new stop loss could be set on the other side.

This would mean that if price breaks back below the old resistance, new support level, we would be stopped out for a profit, but we now have our stop loss set below the key level.

As shown below; if price continues the move higher and breaks out once again we could repeat the process and trail the stop loss in the same manner.

Lastly

How you manage your trades, take profit and minimize losses is just as, if not more important than the trades you enter.

It is no surprise that two traders using the same strategy can have vastly different results. Where one trader makes the most of their winning trades and has a system for capturing large profits when they come, the other trader take profits early.

There are many ways you can manage your trades. You could use part of each strategy. For example; take 50% profit at your profit target and then trail your stop loss for the rest. Often the best way is to find a method that suits you and your style, and perfect it, before then looking to test and use other strategies.

Safe trading,

Johnathon

Leave questions or comments in the comments section below;

Leave a Reply