Weekly Price Action Trade Ideas – 25th to 29nd March 2019

Markets Discussed in This Week’s Trade Ideas: AUDCHF, NZDJPY, CADJPY and US500.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

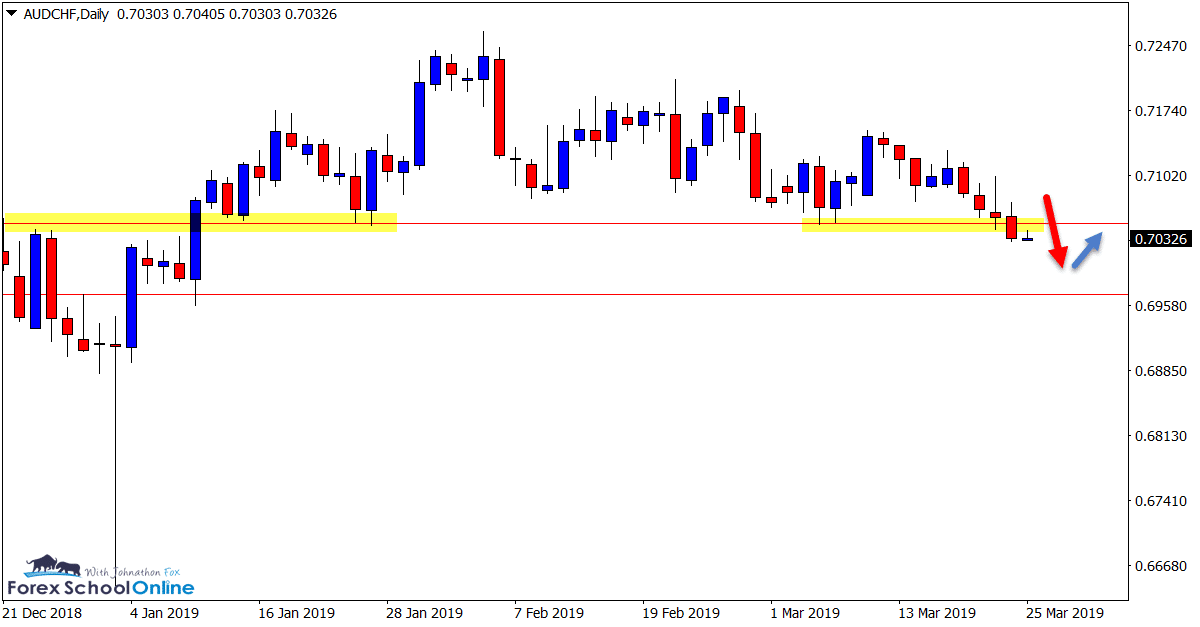

AUDCHF Daily Chart

Watching for Break, Re-test and Reversal

In last week’s price action trade ideas we were looking to see if price would make a move lower and take out the major daily support.

Price in the last session begun to make a move through this level and whilst this has not been aggressive, we can now watch the intraday charts to see if price action will hold as a new price flip and old support / new resistance.

Potential short trades could be hunted on smaller time frames at this level looking for A+ high probability triggers that confirm price is looking to reverse at this level.

Daily Chart

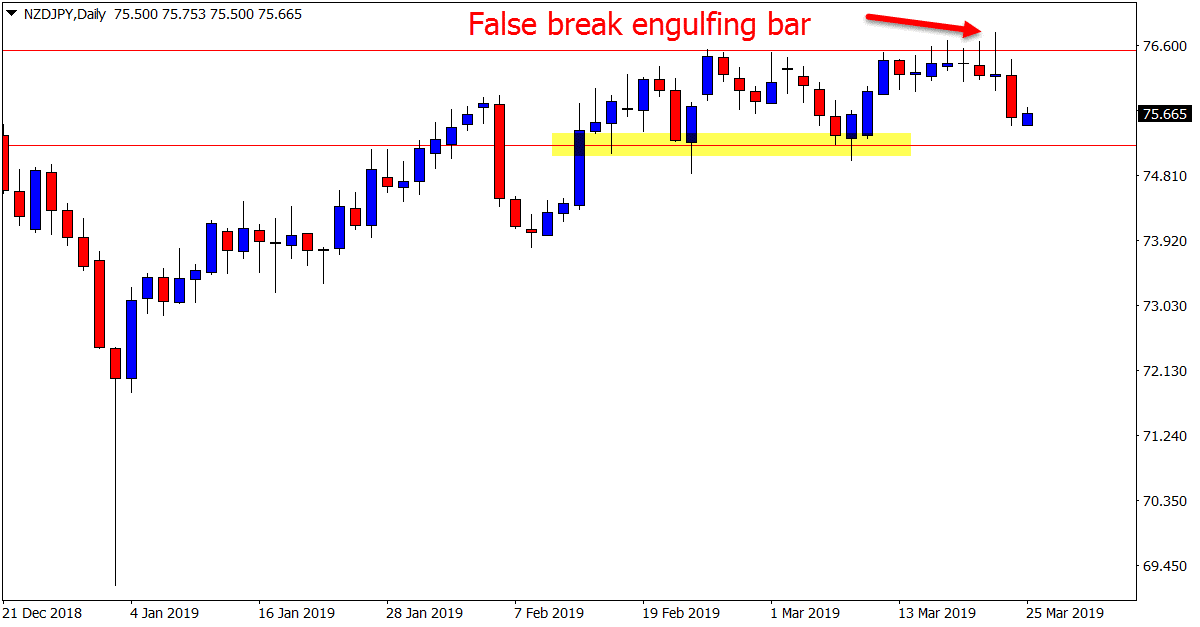

NZDJPY Daily Chart

False Break Engulfing Bar

Price on the NZDJPY daily chart made a large attempt at breaking out higher and through the daily resistance level in last week’s trading.

Instead of breaking out higher, price ended up forming a false break bearish engulfing bar and snapping back lower.

A break higher could have seen price move out and away from the tight sideways box that it now finds itself stuck in. Near term support is not far away and looking to make trades whilst price stays within this tight range looks tricky.

Daily Chart

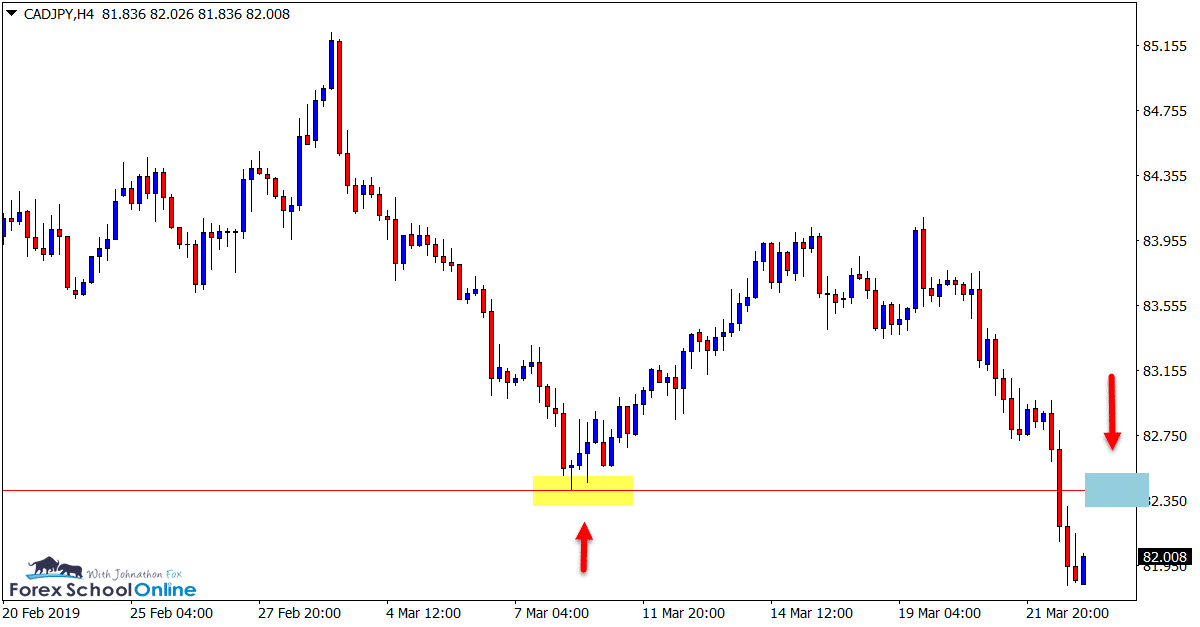

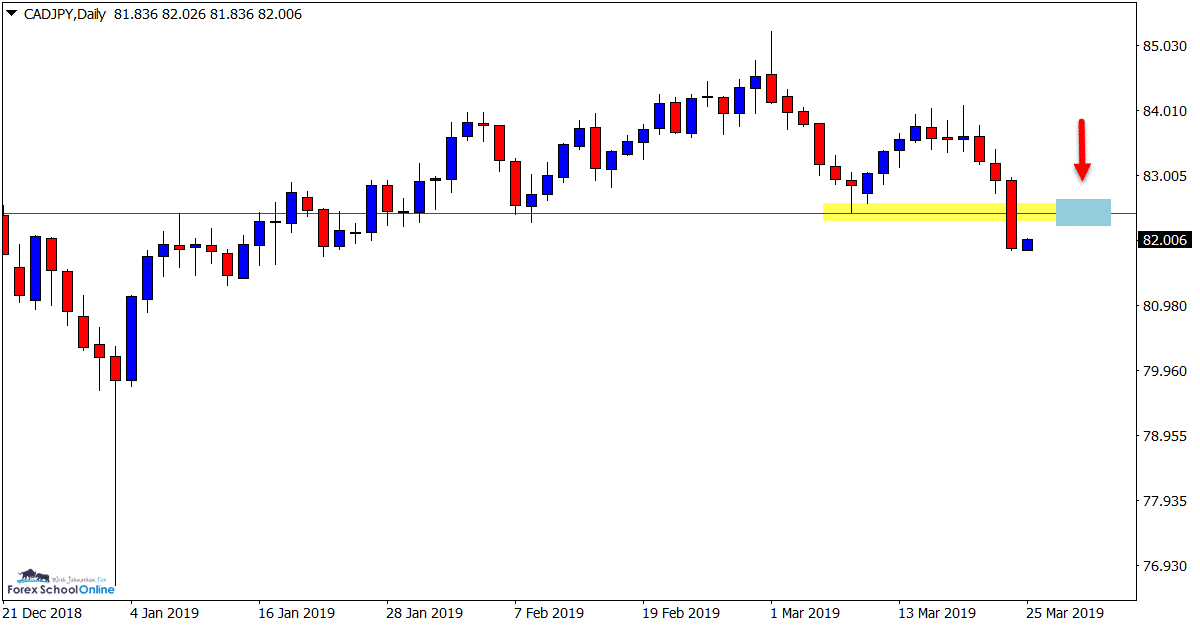

CADJPY Daily and 4 Hour Chart

Can Price Slide Into New Resistance?

At the end of last week price broke out and through the major daily support level aggressively to open up potential short trades.

In recent week’s we have seen price in this market make consecutive lower highs and now break a major support level looking to form a potential new short-term trend lower.

If price can slide higher and back into the overhead resistance, traders could watch to see if it will hold as a new resistance and a potential area to target short trades.

Daily Chart

4 Hour Chart

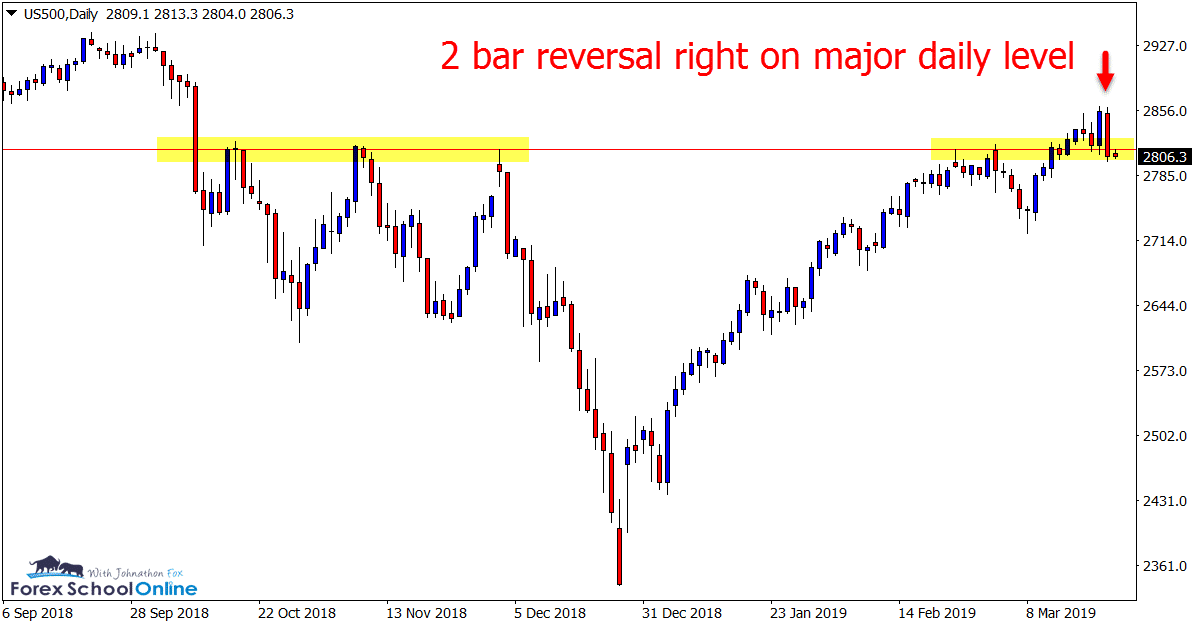

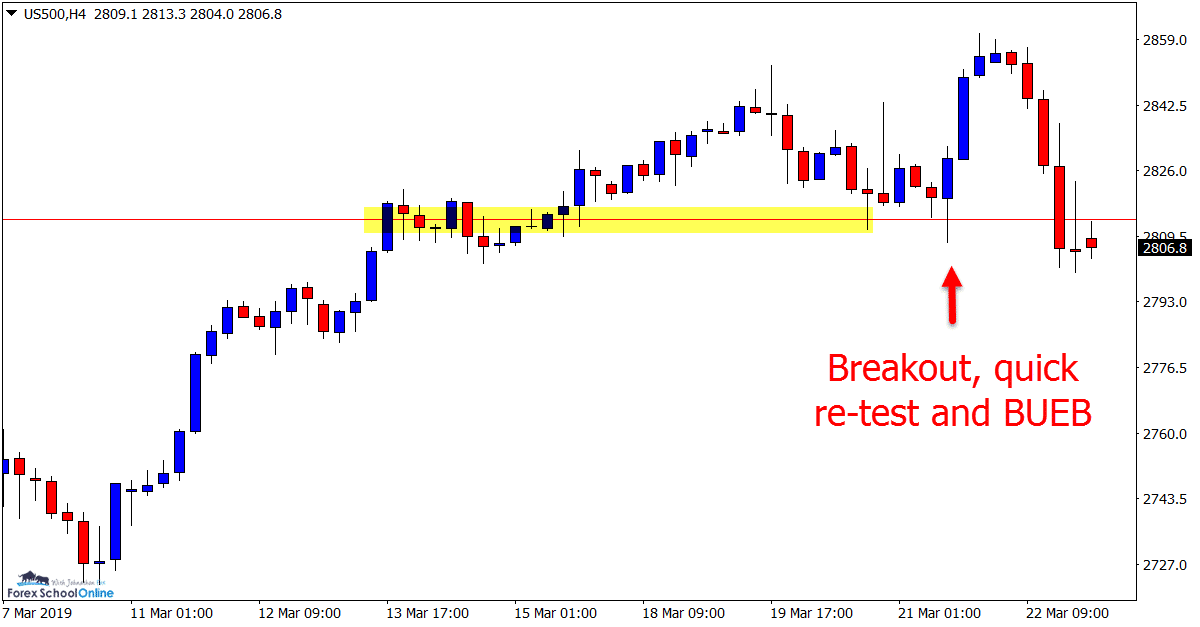

US500 Daily and 4 hour Charts

Still Uncertain at Major Daily Level

This is a market we have been discussing a lot about in recent times as quite a lot has been happening on the charts.

In last week’s commentary we were looking to see if price would breakout higher and open the door for any bullish trades to get long.

Whilst price did make a break higher, fire a quick re-test and form a 4 hour bullish engulfing bar sending price back higher, this move has been relatively short-lived.

As shown on the daily chart below; price is now once again right back at the major daily level and making another test which looks to be crucial for where price goes in the coming sessions.

Daily Chart

4 Hour Chart

Charts in Focus Note: All views, discussions and posts in the ‘charts in focus’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Please leave questions or comments in the comments section below;

Hi Johnathon,

Thanks for the overview.

I agree on CAD/JPY because I have open Sell Limit order and waiting for retrace up to 82.20-82.30 on H4 chart.

On the weekly chart we have bearish engulfing bar which indicates sell option until resistance on 80.76.

Hi,

weekly EB is not swing high and sort of stuck in the middle on weekly chart. Daily chart shows a fairly solid retrace area that is also recent candle low on weekly chart.

I am bearish, but would prefer a smaller time frame pullback and reverse.

Good luck with your trade,

Johnathon

Nice analysis

Thanks Bivon, nice to have you.

Johnathon

Hi Johnathan,

Just wondering if you have entered any trade last week as I could not catch one.

Thanks

Hi Shayan,

if not finding many trades you can look at practicing with other markets and/or time frames.

Also keep in mind; trades come in swing and roundabouts. You will find yourself sitting on your hands for periods and then the markets light up with a lot – try to save your cash during the periods where you don’t see anything you like.

Safe trading,

Johnathon