Forex Trade Management: 3 Quick Tips To Managing Your Trades

Something that is ABSOLUTELY VITAL for success, but often not discussed or understood correctly by a lot of traders is just how important taking full profits are for staying in business and ensuring that the overall account risk reward stays in a good position.

I will often have a trader or member show me a list of their winning trades that are solid A+ trades, followed by just one or two trades that have wiped out a chunk of their winnings.

This will then be followed up by them telling me how they are going to change something and they want my thoughts or ideas.

Often they are looking to change something huge like a major part of their whole trading method or they are looking through their whole trading edge for where they are going wrong.

#1: Do You Regularly Take 100% Profit on Winning Trades?

The problem is often not in the trades being entered.

The problem is simply that the profits when winning do not cover the losses when losing and a major reason for this can be because a trader is not taking enough 100% winning trades.

Let me explain;

When we have a losing trade it is always a 100% losing trade. What I mean by this is that if we risk 3% of our account each trade, then we are going to lose 3% if we lose.

Often we can take multiple profits off the table. We can also use break-even.

If used wisely this can increase profits and also protect from bigger losses.

However, what happens if we take 50% profit at the first main profit target, we move our stop higher to a break even position and we are then stopped out at break even having only taken 50% profit on the winning trade?

NOTE: Need a quick introduction into breakeven? Read Here

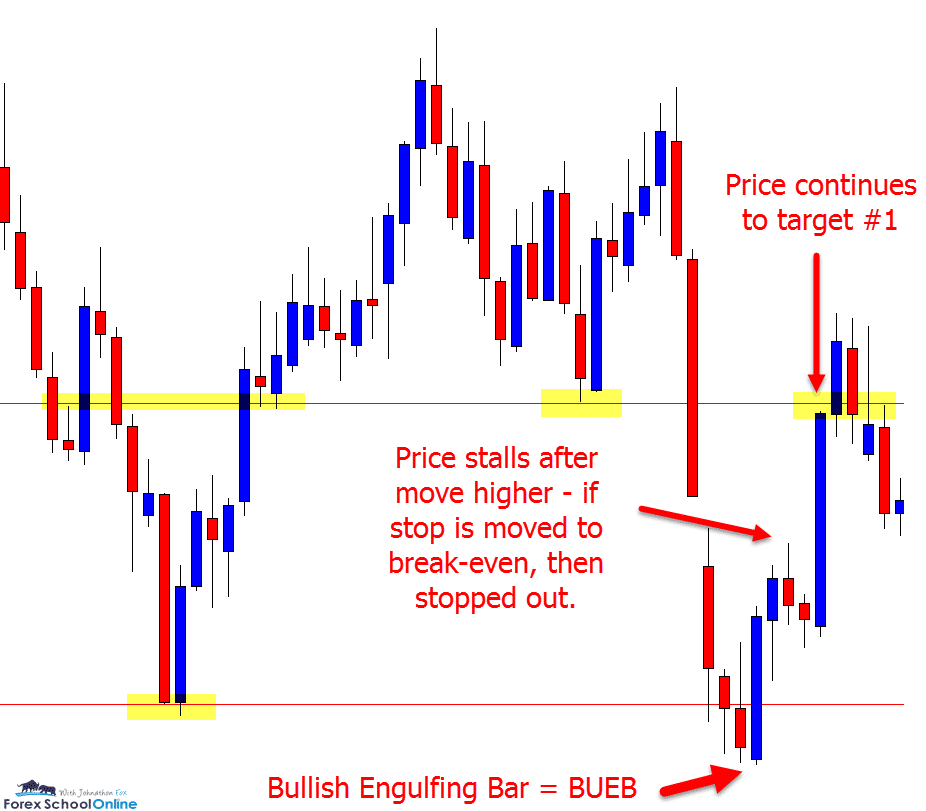

See below for the chart example of this:

As the chart above shows; the trader takes 50% profit and moves their stop to break-even after price moves higher from the Bullish Engulfing Bar and then they are stopped out.

Now; many, many times this management will stop the trader from taking on a full loss.

What we need to be careful and super mindful of is that we cannot pick individual situations out of a chart or trade an edge from one trade.

In the chart example above the trader ends up taking 50% profit at target 1 and then having the rest of their position (50%) stopped at break-even.

If the profit target 1 was 1/1 RR (Risk Reward), the total profit overall was 0.5 RR.

So whatever was risked, if for example 3% was risked at the start, then 0.5 is the reward. That would look like; 3% x 0.5 = 1.5%.

Over one trade this is not so bad and a trader can get away with it, after all adding 1.5% to your account looks okay.

However, if you turn right around the very next trade and make a loss, you will lose 3% and now be losing money.

This is where it hurts and that is why full profit trades are important for your overall account risk reward situation and they become more important the longer you trade.

Quick Example of Small Changes

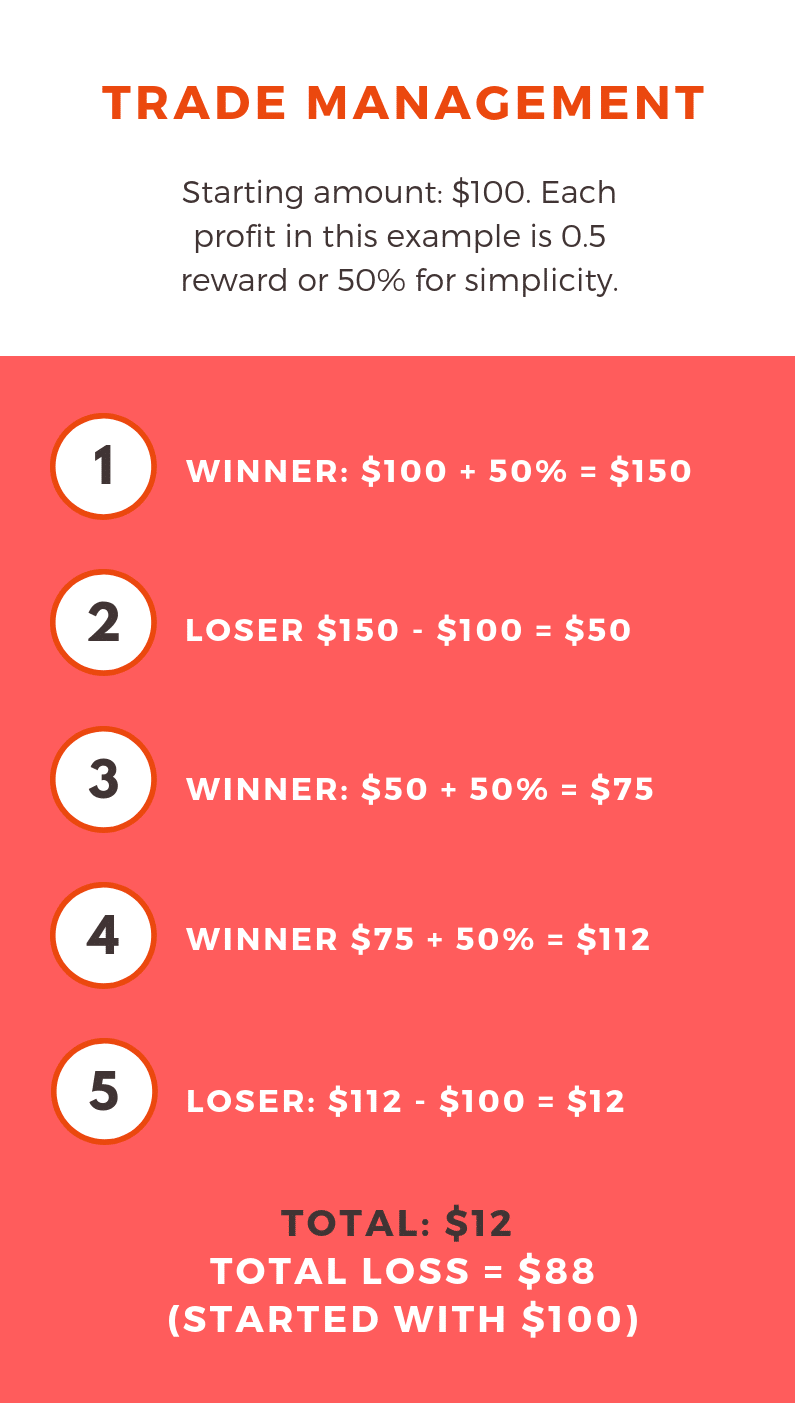

Look at a small sample size of trades below, keeping in mind there is a winning edge over the market. This is a small five trade sample with three of these trades being winners and two losers.

NOTE: These numbers are for illustration purposes only to highlight risk rewards.

The longer the trader plays out this management, the longer they would lose money.

Starting amount: $100. Each profit in this example is 0.5 reward or 50% for simplicity.

Start: $100

- Winner: $100 + 50% = $150

- Loser $150 – $100 = $50

- Winner: $50 + 50% = $75

- Winner $75 + 50% = $112

- Loser: $112 – $100 = $12

TOTAL = $12

Total Loss = $88 (started with $100)

Another five trades with a different order that also has a winning edge over the market with three winners and two losses, but ends in a losing outcome is below;

Start: $100

- Winner: $100 + 50% = $150

- Winner: $150 + 50% = $225

- Loser: $225 – $100 = $125

- Loser: $125 – $100 = $25

- Winner: $25 + 50% = $37.5

TOTAL = $38

Total Loss = $62 (started with $100)

#2: Do You Get Jumpy and Quickly Switch Around Methods and Strategies?

This applies to the strategies you use for entries and how you manage / exit your trades.

Do you often switch quickly after a few losses or if you think the grass over the other side of the pond could potentially be greener?

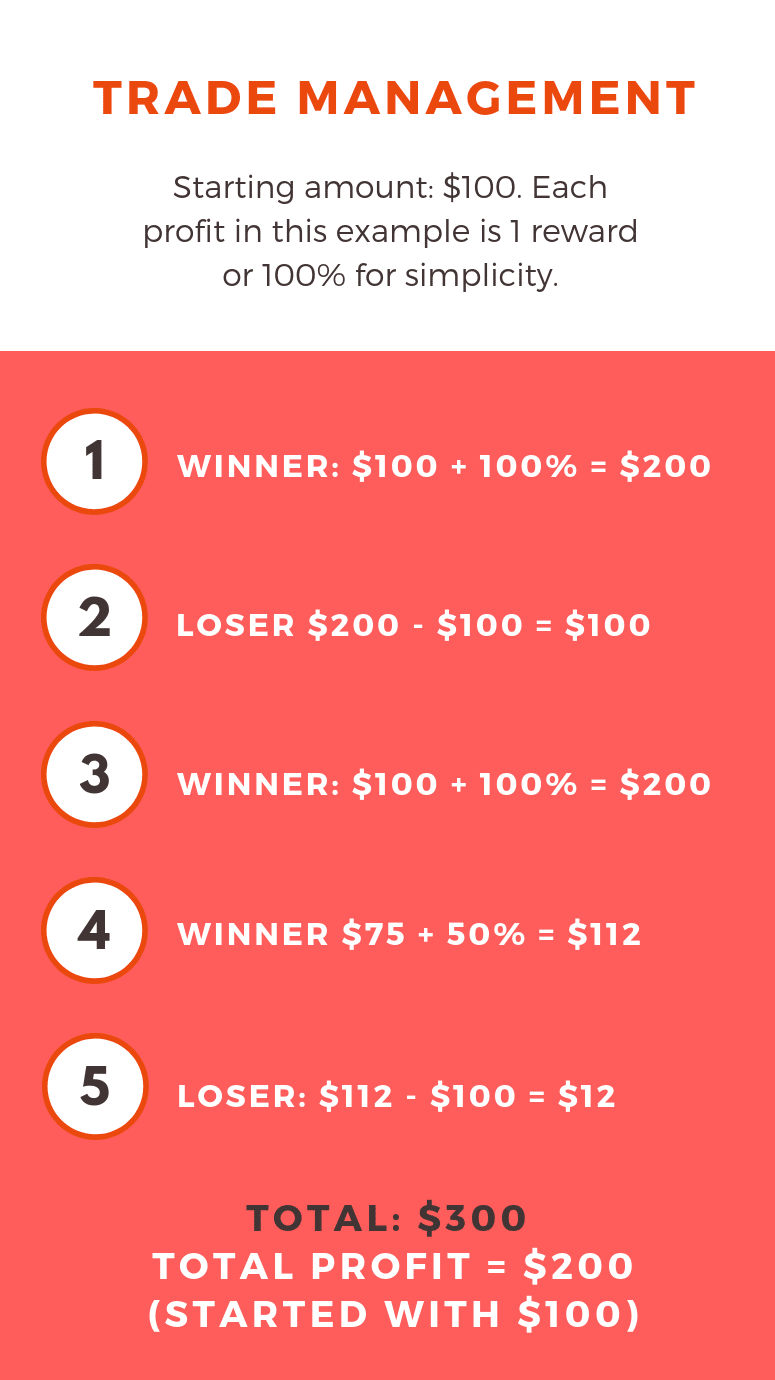

Do you know what really stands out massively from that last set of numbers? As I have highlighted below and also just discussed at length; when we lose, we get stopped for a 100%.

In our example scenarios above, what would happen if all you did is take full profit at the very first profit target instead of only 50% profit? That’s not much to ask right? We are not even shooting for bigger rewards.

There is a heck of a lot to factor in overall, but just say with these five trades, you just take profit at the first profit target at 1/1 RR. What then happens in the same scenario, how does it change?

Starting amount: $100. Each profit in this example is 1 reward or 100% for simplicity.

Start: $100

- Winner: $100 + 100% = $200

- Loser $200 – $100 = $100

- Winner: $100 + 100% = $200

- Winner $200 + 100% = $400

- Loser: $400 – $100 = $300

TOTAL = $300

Total Profit = $200 (started with $100)

Start: $100

- Winner: $100 + 100% = $200

- Winner: $200 + 100% = $400

- Loser: $400 – $100 = $300

- Loser: $300 – $100 = $200

- Winner: $200 + 100% = $400

TOTAL = $400

Total Profit = $300 (started with $100)

Small change, but huge difference with the same trades and method.

By not taking a different trigger for entry there can be a massive difference in either profit or loss.

Traders want to make money, but they get very jumpy when they are not doing it straight away or think they are missing out.

This is also why we put so much emphasis in the students advanced course on creating a trading edge and working on trading management.

#3: Do You Use Break-even Wisely?

I personally use break-even in my trading. However; a lot of traders do not use it correctly.

Instead of using it as a ‘free trade’ where a stop can be moved to let a trade continue to run, or to look for further profits where there is a potential for higher rewards, many traders use it as a psychological tool to shelter from losses.

This is regularly when it is placed too frequently, in the wrong market types and too close to the price.

Often traders have not practiced the strategy they are using to manage their trades and are instead in the live markets ‘hoping’ their management strategies will work.

On too many occasions to count I have seen traders get stopped at break-even and be really frustrated. The very next trade because they are frustrated, what do they do? They scrap their plan.

They throw out the plan they have built and known and instead of moving to break-even and taking profits where they normally do, they let their profits ride.

They do this because they are annoyed. The markets annoyed them. Like it is the market’s fault. As if the market was out to get them.

Have you seen this? Have you done this?

What Type of Trader are You?

Do you like bigger winners or a steadier account rise?

You need to know your trading flavor and you need to back-test, forward test and perfect it.

It is so important you do not go anywhere near a live account until you are 100% confident and you know your method back the front.

If you are getting stopped at break-even and you have 100% confidence and faith in your trade management method, then you will continue to pull the trigger on trades and will continue to manage your trades in a businesslike manner.

However; if you have real doubts and concerns, the next time you get stopped at break-even, all of a sudden you will question your method. You will ask whether you should be trading differently, if what you are doing works, if you should have entered a different trigger and on it goes.

Both the high reward and also high win rate are solid and logical methods of managing your trading money with positives and negatives.

The question you need to ask yourself when thinking about either trade management methods is;

- Do you want bigger winners with the downside being a far higher chance of more losing trades? Or,

- Do you want a potentially steadier rising equity curve from regular, but from smaller winners?

So what method is better between the two and what money management method are you going to be better off using in your own trading?

To answer that question I need to flip the question back over to you and ask you; what sort of personality do you have and what are you more comfortable with?

Don’t know what sort of trader you are or what flavor is for you? That’s okay. That exactly what you will come to work out as you start to make and also manage more and more trades.

Read about the Two Best Forex Money Management Methods That Actually Work Here

You Need to Practice the Hell Out of it!

The more trades you manage, the more of an understanding you will begin to get of your own trading personality.

It is absolutely amazing how trading has the ability to teach us things about ourselves and our personalities that we didn’t know existed because we are put into positions of stress, fear, greed and other emotional states that we would never be put into otherwise.

It is under these emotional extremes from the market that we really learn about ourselves and how we behave.

We learn what we like, we learn what we are prone to do when put under pressure and we especially learn what we will do when we are forced to act.

It is through all of these experiences we begin to really understand and workout our own trading personalities. Just as I like certain shades of blue and green, you may like the color red or purple because we see things differently and we behave slightly differently given the same scenario.

This is a good thing. To manage your trades for profits consistently over the long-term, you need to begin understanding your trading personality and your ‘flavor’.

You need to work with it, because if you are always looking to fight it, it will just become another thing you are trying to depress and work against, rather than use to your advantage.

The decision on the method you use to manage your trades is going to have a very large bearing on your trades outcome.

Lastly – You Can Change Methods or Flavors

Keep in mind that the type of trader you are is not fixed and set in stone.

By that I mean; if you are a high reward trader it does not mean that you are not able to make a change to becoming a high win rate trader.

HOWEVER; and I really want you to remember this = you cannot just flip from one trade management method to the next.

This will cause massive consequences within your trading.

If on one trade you were using one system as your edge and you decided that it was not working, so you stopped using it and then the very next trade you started using another system; that would cause massive differences and consequences.

Chopping and changing with your trade management will do the same.

You need to make sure that if you change your trade management method you go back to basics, practice it and give it time to work within the new plan.

DO NOT just flick over from one method to the next and stay on a live account. That would be account suicide.

Safe trading,

Johnathon

Please leave questions or comments in the comments section below;

I have read this and its soo nice.

Yesterday I was affected by the same.. lose my account was wiped hahaha… I wish I had read this before.. Thank you will try work on my style..

Hi Bernard,

sorry to hear that.

Let us know if you get questions.

Johnathon

Very informative and useful article

Thanks Malay!

Great, thank you Johnathon.

Great to have you Fred.

Johnathon