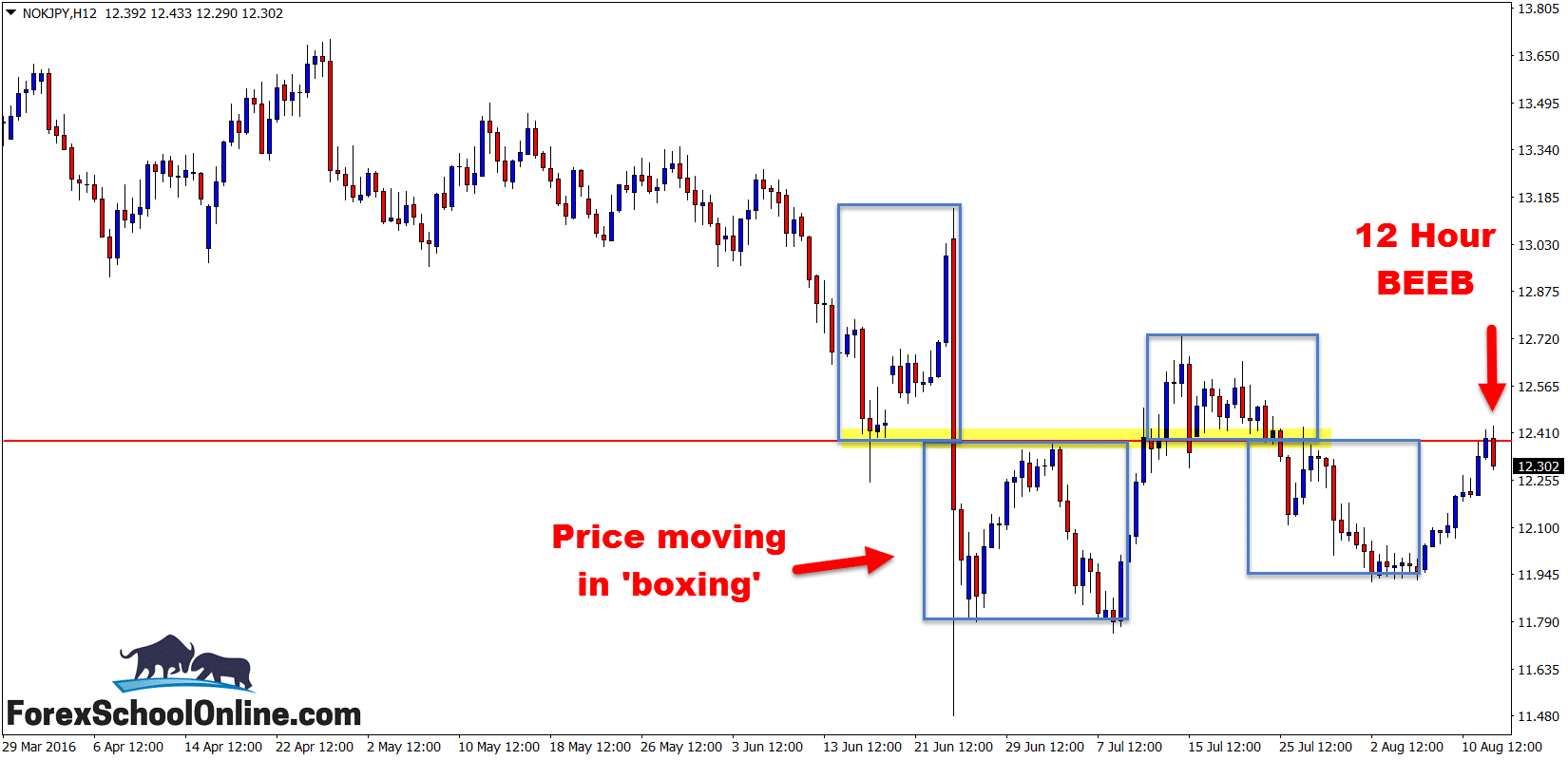

Price action has fired off a Bearish Engulfing Bar (“BEEB”) on the NOKJPY 12 hour chart as we move to finish for the week.

As you will see on the chart below, this 12 hour trade setup and reversal trigger signal was still in the middle of forming and the daily chart still had some ways to go until it was also complete. However, there is a lot to gain from looking at and analyzing this trigger setup.

As I posted the other day in the Daily Forex Price Action Trade Setups Blog, price action often throws up false setups – commonly known as ‘Sucker Setups’. You can read that post and quick lesson at:

Will the Pin Bar be Steamrolled, or Will we Get a Chance to Hunt Trend Trades?

You will NEVER EVER find either a method or system that is 100% profitable unless you are rigging the system. All you can do is find a profitable method where you have a mathematical and statistical edge of making money.

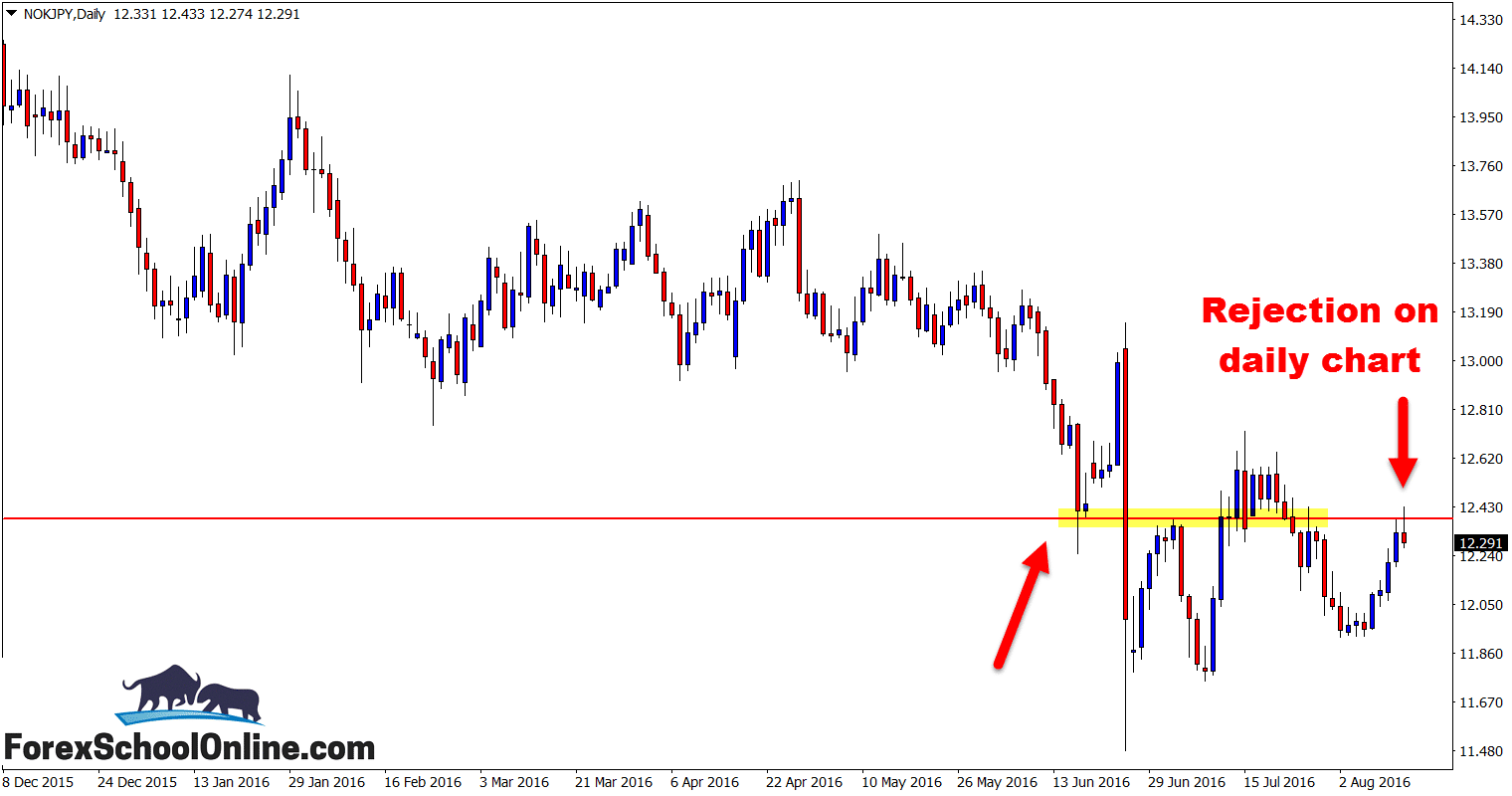

Price on this pair is making a large rejection of the daily resistance level. As the 12 hour chart shows, this market has been moving in a sideways and boxing period for a sustained period now.

What is interesting to note is that price has as yet been unable to break either higher or lower of the candle that was created with the BREXIT fiasco. If this candle’s highs or low were to give way not just on this pair, but on many pairs, it could act like a breakout does – i.e. with a lot of breakout traders and a huge amount of order flow just sitting and waiting to enter the market. It may be something for you to keep an eye on.

With this BEEB; it has not closed and it may finish great or it may close a dog and we move onto the next one. I’ll see you next week!

NOTE: If you want to make this 12 hour time frame chart on your MT4 charts or you want to make any time frame, from the 1 minute to the 2 hour to the 2 day, then read this lesson and grab the indicator to do it at:

Change Your MT4 Time Frame

Daily Chart

12 Hour Chart

Related Forex Trading Education

Leave a Reply