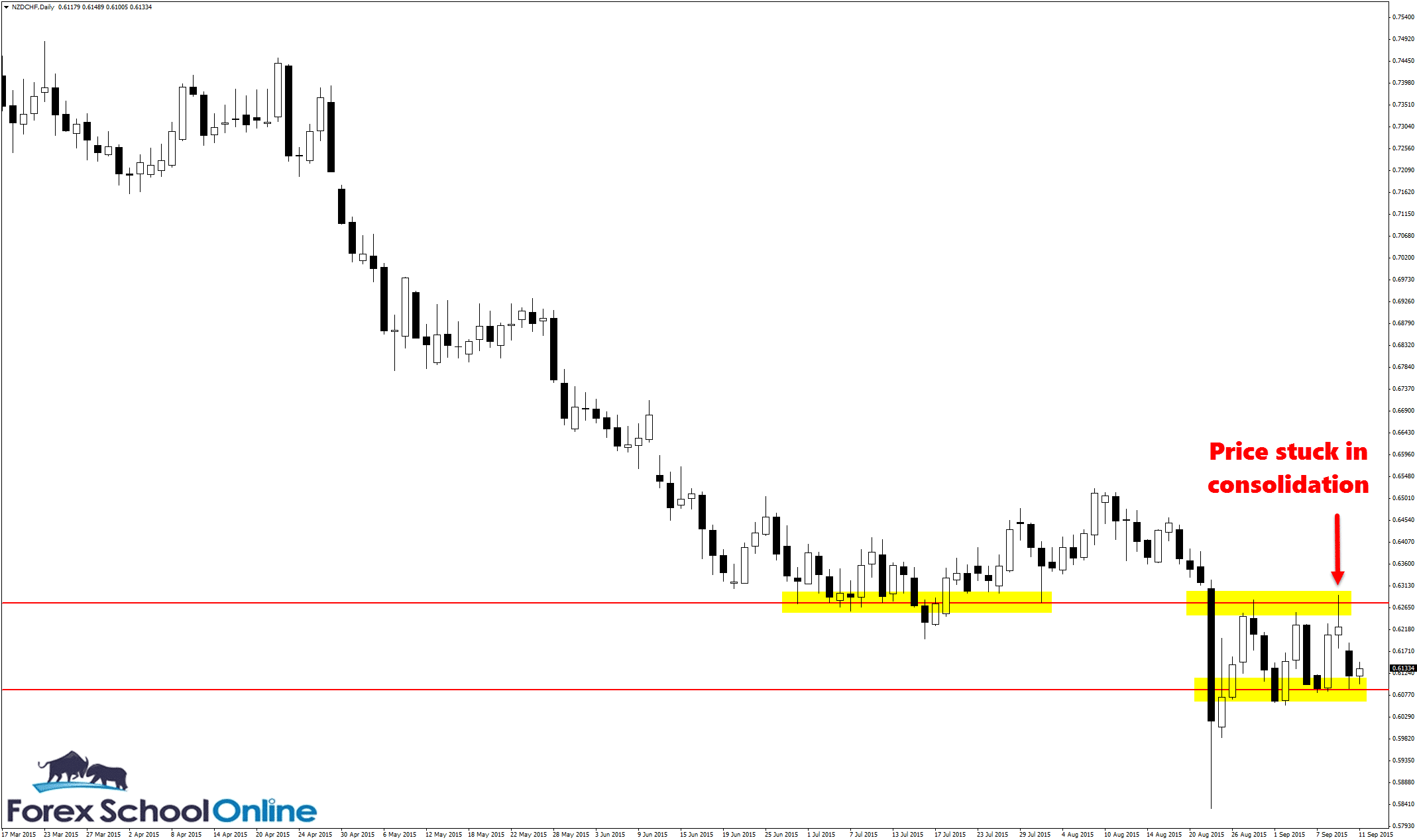

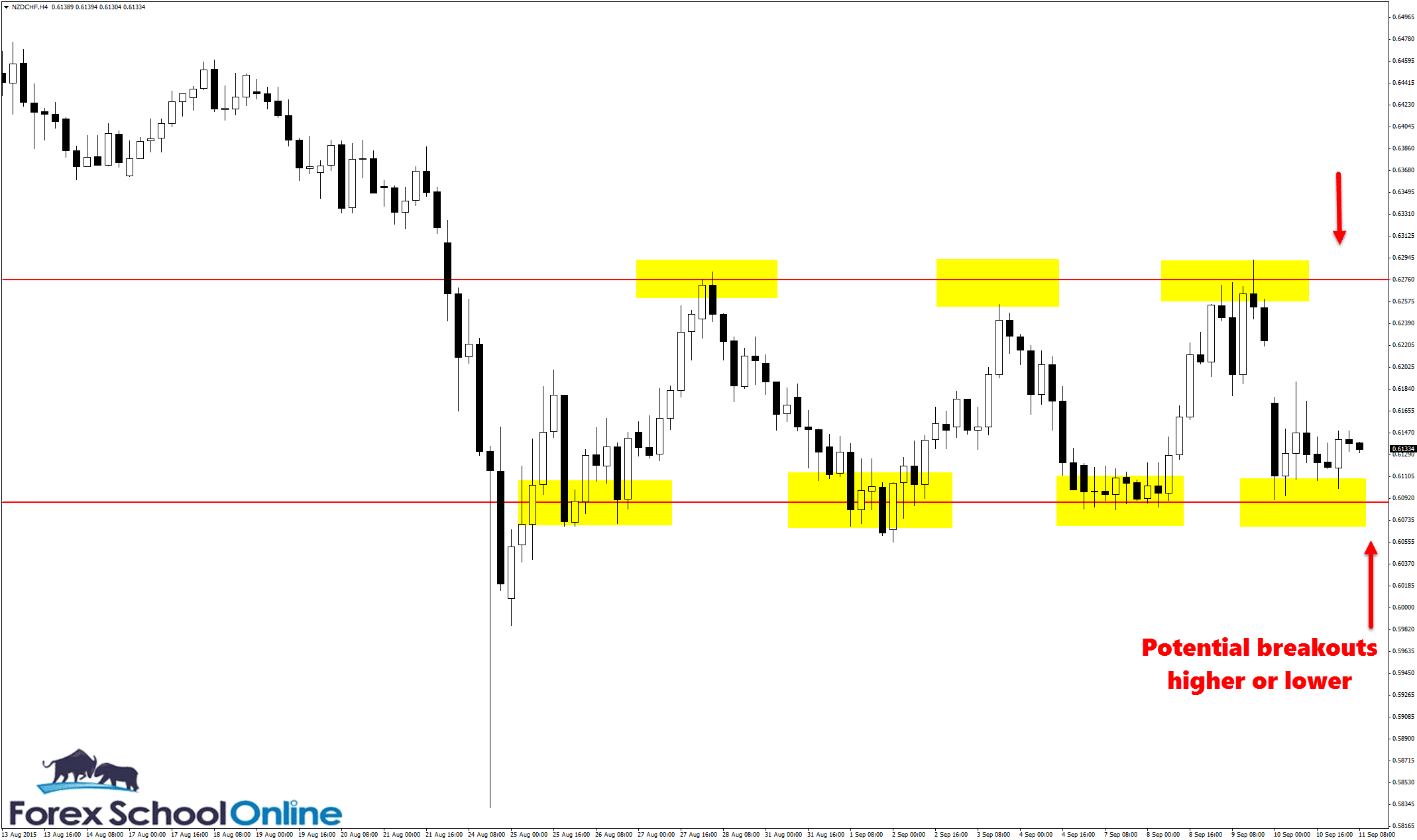

Price on the NZDCHF has moved into a tight consolidation phase with a really clearly defined high and low on the daily price action chart. As both the daily and 4 hour charts show below, after making a strong move lower, price has now moved into a sideways tight range, which is a very common market pattern.

How price breaks out of this phase could determine the next major move for this pair, and so it is going to be important to keep a close eye on the price action behavior of this pair. There could be potential high probability trade opportunities to find trade setups when price is breaking and quickly after the breakout.

Price had been in a solid down-trend before moving into this consolidation and sideways period. As the daily chart shows, price had been stepping lower with clear lower highs and lower lows, which is a clear indication of a lower trend in play.

Whilst price stays within this range area, you can continue to look for trades at the high and low of the range on smaller time frames, ensuring that you use high probability trigger signals, such as the ones taught in the Forex School Online Price Action Course for confirmation to get into trades.

If price can now breakout lower and through the support level of this range area, we would be looking for this trend to continue. This would be looking for a continuation play. You can see this pattern happening on every chart and every time frame where price makes a strong move – pauses and consolidates – and then continues.

If price does breakout lower, you could then look to get into a short setup with quick breakout and re-test trade setups. This would involve waiting for price to breakout lower and through the support level, and then looking for a quick re-test of the old support and new resistance area. I discuss in more depth how you can use this strategy in the lesson here:

Making High Probability Trade Entries at the First Test of Support & Resistance

Daily Chart

4 Hour Chart

Related Forex Trading Education

– Making High Probability Trade Entries at the First Test of Support & Resistance

Leave a Reply