5 Huge Market Crashes and What to Learn From Them

Throughout trading history there have been some spectacular market crashes.

Why is it even important to know about some of history’s biggest market crashes?

If we don’t learn from what has happened in the past, we are a chance to repeat the same mistakes.

There will be market crashes in the future and today we look at five of the biggest and what happens when a market crashes so we can learn from them and hopefully avoid the next major crash.

#1: Dutch Tulip Craze Boom and Bust – 1600s

One of the most famous market bubbles and ultimately crashes is known as ‘Tulip mania’.

You may have seen Gordon Gecko with the tulip photo in the film Wall Street where he talks about the boom and bust.

During the 1600s the value of tulips exploded to astounding prices on the back of speculative trading.

What was incredible about this boom was that at one point the most expensive tulip was worth six times the average person’s yearly salary.

After arriving in the 1500s, tulips quickly become a flower that the rich and affluent sort out. Soon the middle class followed suit and also wanted to have tulips in their gardens and the prices quickly began to increase.

The demand for tulips grew so strong that eventually they were listed on the Amsterdam stock exchange.

This only fueled the price with traders now speculating on the price using leverage.

People started taking out credit to buy tulips and not miss out on what was fast becoming a runaway market higher.

By the end of 1637 the bottom fell out of the market. Traders were caught out with their leveraged products and people were left with their loans trying to quickly sell. Price quickly crashed.

#2: The Wall Street Stock Market Crash 1929

In the 1920s there were massive changes happening in the United States. There was large social and economic growth occurring in a time where the world was also changing.

In October 1929 things quickly changed and the stock market experienced an almighty crash that would lead to what is known today as the great depression.

On what has since gone on to be known as black Thursday, October 24, 1929 saw stock market prices open 11% lower than the previous close.

Prices moved back over the following two days, but this was the calm before the storm.

Come Monday the markets began their fall with a 13% drop and another 12% drop the next day. The sell off lower continued until 1932.

Before the crash prices were rocketing higher, US unemployment was low and as other countries rebuilt from the war, US companies experienced great growth.

By the time the crash came, many thought it was due to the market being far too overvalued after price had skyrocketed.

#3: Black Monday Stock Market Crash 1987

On what has become known as ‘Black Monday’ October, 1987 saw the price of the Dow drop by 22%.

This market crash was not just isolated to the United States as stock exchanges around the globe such as London, Hong Kong and Australia saw huge falls.

Whilst price had been moving strongly higher in a bull market since 1982, there was little warning before the large crash.

At the time automated trading was quite new. As the automated trading programs began liquidating thousands of positions, prices began to spiral lower which led to stop losses being hit and price moving even lower.

Whilst there was little warning before the crash, there were some signals to a potential move lower. Growth was stalling across the board, whilst valuations were high and US exports were suffering due to a high US Dollar.

#4: Dotcom Bubble Bursts 2000s

The dotcom or the internet bubble of the 2000s is a textbook boom and bust cycle.

With the rise of the internet, every man and his dog were looking to make money from investing in internet companies.

Large investments were being made in tech companies that had no profits and in a lot of cases no earnings.

Prices for a lot of internet companies skyrocketed even though in a lot of cases they were not creating any returns.

In a spectacular market crash, the price of the Nasdaq fell to 1,139.90 from a high of 5,048.62. This would end up being a crash that took 15 years for prices to recover from.

#5: Cryptocurrency Crash – 2018

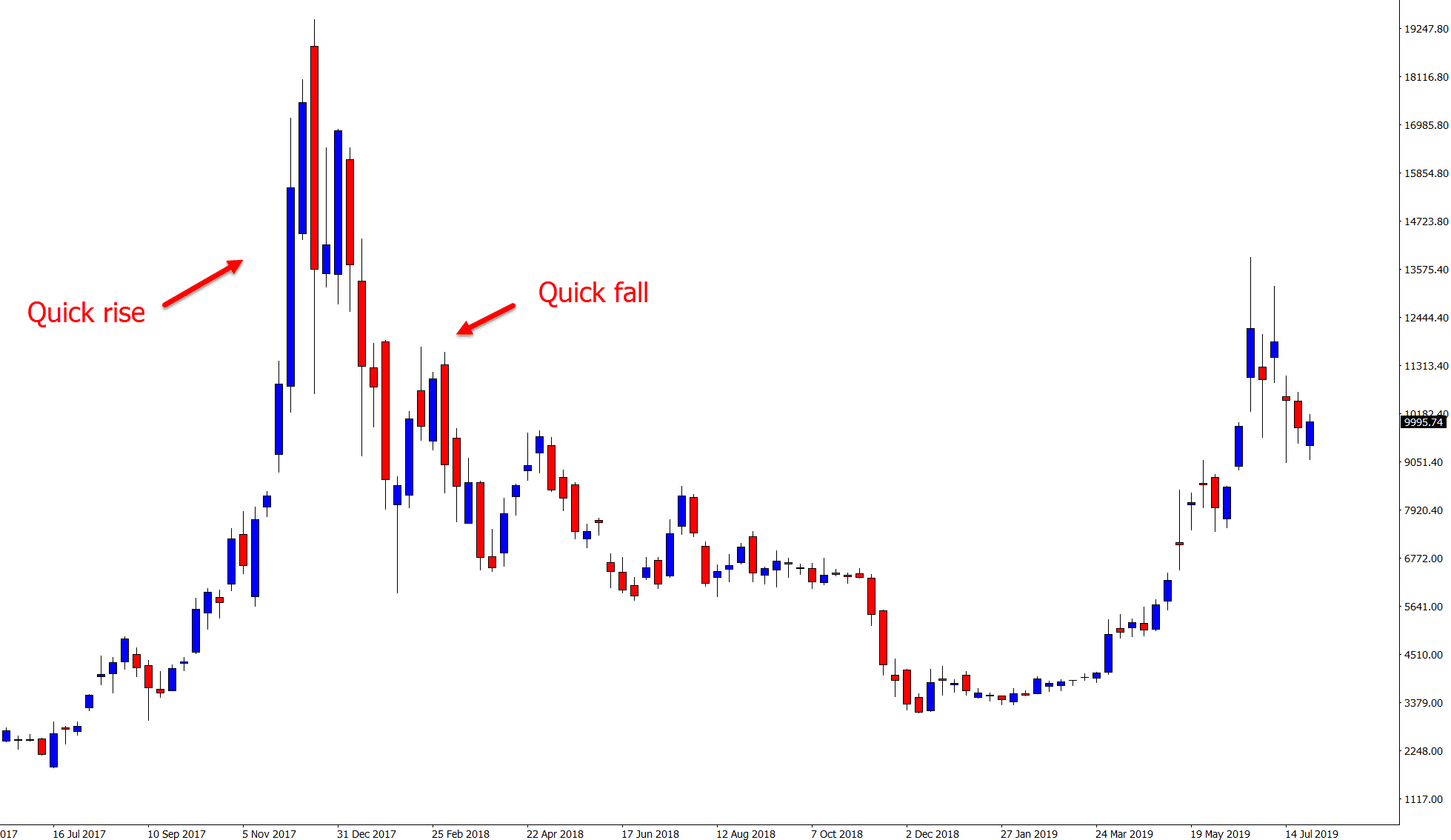

The recent rise, fall and rebound of the cryptocurrency market was no more spectacular than with the Bitcoin crash of 2018.

Price in Bitcoin went through an incredibly fast boom. After the price of Bitcoin grew over 2,700% to its peak in December 2017, it collapsed and lost 80% by December 2018.

The cryptocurrency markets went on to lose 342 billion US Dollars market cap in just the first quarter of 2018.

As the image shows below; whilst not yet recovering to its former peak, the price of Bitcoin has made a rapid rise back higher in 2019 to recover some of these losses.

Other Notable Market Crashes

Whilst the five market crashes just discussed are some of the most famous and well known, there have been a lot of crashes throughout history that have defined the market.

A few of these are;

- South Sea Bubble 1720

- Panic of 1873

- Asian Financial Crisis 1997

- Global Financial Crisis (GFC) of 2007–2008

What We Can Learn From These Market Crashes

Professional traders know and understand that you cannot prevent having losing trades.

You can minimize your risks using different strategies and you can minimize your downside.

You can also use a good broker that is tightly regulated to carry out your trading strategies quickly and effectively so that your orders are executed fast and they get you the best prices.