3 x Levers to Making More Trading Profits

There really are only three ‘levers’ you can pull to make bigger trading profits.

Most traders when they first start trading begin running calculations through their head on how much money they could make, how many trades they will make and what they want or hope for.

This is normal right? Why would you start trading in the first place if you did not have some sort of expectation of a positive outcome.

Most traders will go down the lines of… if I can make just XX pips / dollars per day, or if I can increase my account by XX% every week I can become the richest person in the world 😁

Have you ever done this?

However; after everything is boiled down, calculated and has been cross checked, you have three options or levers to increase how to make more profit from your trading.

#1: Cut Your Losses

This is number 1,2 — 10.

It often takes a long time for traders to work out just how much their losses are hurting them and how many times they are repeating the same sorts of mistakes.

Yes; we need to make trades to make profits. However, more is not always more in the business of Forex.

More trading is not always more profits. More rubbish trades can equal more account losses and the skill of knowing when to trade and when to sit is CRUCIAL!

Your account balance and trading journal will show you what trades you have been taking of late.

Have a look at the winners and have a look at the losers.

Download a Free Trading Journal Here

Whilst many losing trades cannot be avoided and are just part of being a trader, how many trades do you have where you cringe when looking back?

How many trades do you have where you think “why did I even make that trade?”

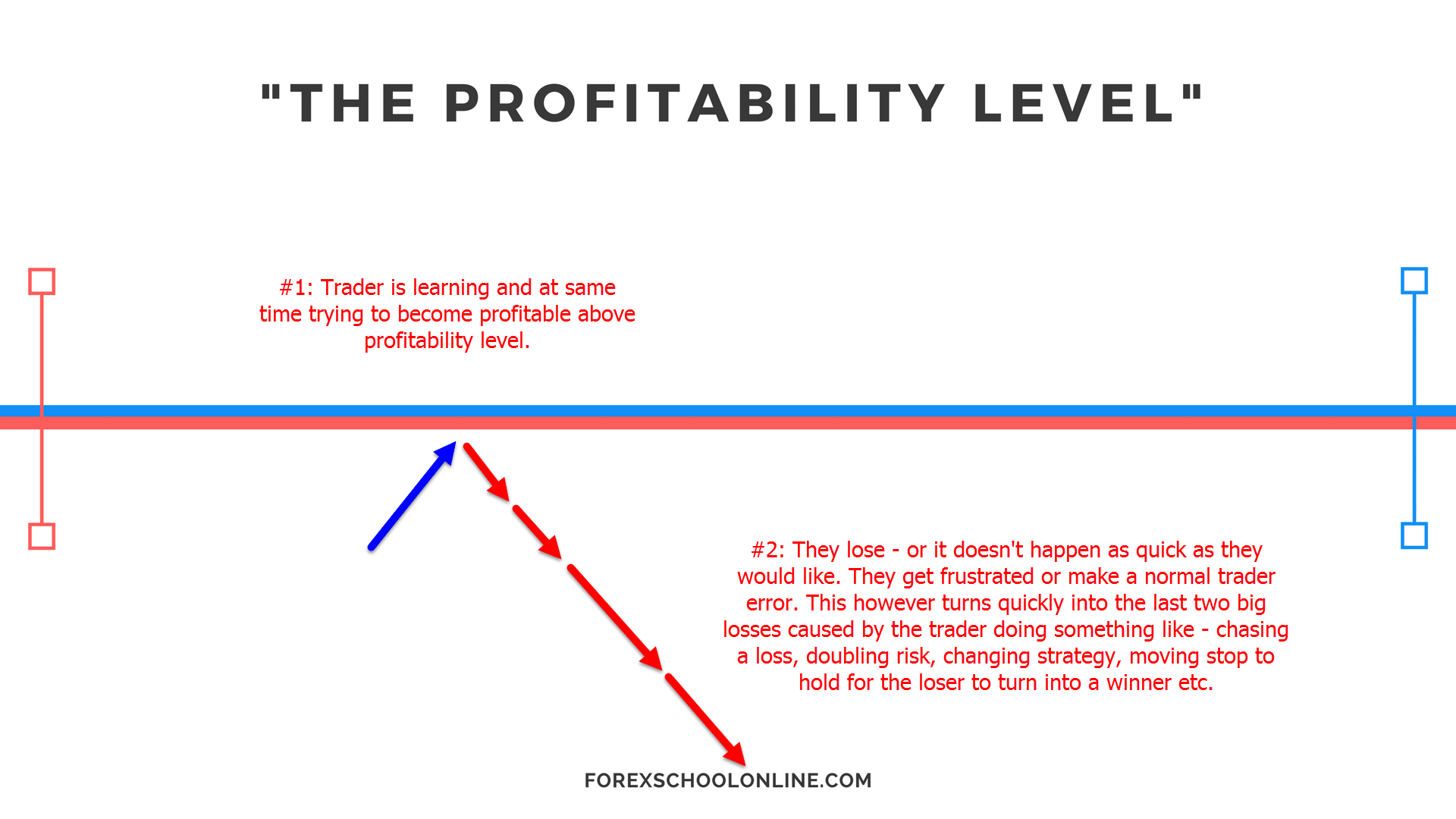

Profitability Level

When learning to trade consistently, trying to get above the profitability level is the biggest challenge.

A trader is faced with both learning many new skills and also going through a host of new frustrations including; not seeing their account increase as quickly as they would like, losing money and moving away from their goals instead of into them and not reaching their goals as quickly as they hoped.

This leads to more trading errors to get above the level, such as; chasing more trades, risking more money and revenge trading that leads further and further away with more and more losses.

Not all losing trades are bad – as long as we are making solid A+ trades every time.

It is the trades that we should never have made in the first place that really hurt our trading edge and account.

What leads to a lot of these losses? The expectations and hopes that you first start trading with.

The reason traders make too many trades, trade when they shouldn’t and risk more money than they know is logical is because they are trying to make a lot of money very quickly.

All traders know if you risk more money, then you can potentially make more money and if you trade more, you have the chance to make more profits.

However; making terrible trades that we never should be making will cost our accounts.

We may get away with it now, but it will always cost the account in the end.

Whether we are making another trade to try and get back money we just lost (revenge trading) or we are trading because we have not played a trade for a little while (and of course no trading means no profits!).

#2: Make More Winners

Once we cut the losses we can start adding the cream and more winners.

This is actually a lot easier than cutting losses.

It is always easy to find more trades. This is one of the biggest worries of a new trader (and most common questions); how many trades can they play and how often do they form!

Trades form over and over again.

Finding a strategy in a market is not difficult. Take a quick look on any Forex forum. There are people creating their own strategies every single day of the week!

Making profitable trades is the easy part. As we discussed when looking at FXCM study of 43 million trades, traders actually make more winning trades than they do losing trades.

This may be hard for some to believe, but as we are about to discuss in the following step, it is the large losses and small wins that hurt accounts.

Once you learn to trade and perfect one strategy and make profits, you can take that strategy and amplify it to make many more trades using more time frames, more markets and then adding other strategies to go with it.

In the lesson on small and regular profits we show how small regular profits can quickly become exponential gains if a trader stays profitable. We also show how this increases with small deposits along the way.

3: Make Bigger Winners (with the winning trades you are already making bigger, i,e; increase the risk reward).

This is the hardest step / lever and where the most skill is required.

The most advanced part of every strategy is managing trades. This is the same for stock traders entering shares and wondering whether to cash out when price goes up a little bit in their favor, or trading Forex when the market is making moves up and down every moment of the day.

You can increase your profits a lot by making bigger risk rewards on the winners you are already making, or you can do the opposite by stuffing up the trade management decisions consistently.

In the lesson discussing breakeven trading strategies we show how not taking full profit trades can really hurt your overall profitability and lead to disaster, even when making a lot of winning trades.

Cutting losses is absolutely critical, but losses will always be a part of trading. If you can increase the average amount you make when you make a winning trade it can boost your trading account substantially.

Once you have locked down your trading method you can begin to increase profits from your trading management and you can make a large increase to the way you account looks.

However; you need to keep the balance between losses and wins, and always watch that aiming for bigger wins is not affecting your win and profitability rate.

Tutorial: What Time Frames to Enter & Manage Trades on

High Reward or High Win Rate?

There is a fine line and not all traders will trade and manage their trades in the same manner.

You do not have to be a high reward / profit per trade trader, and you do not have to be a high win rate trader, but you must be one of them.

If you are a trader who makes regular and smaller profits, you are going to need to continue this consistency because losses will cut into your winning trades. You need to make sure that you have regular winners and a high enough win rate to cover the losses when they come.

If you are a large reward / profit per trade type trader, then you are typically going to have more losses. You will need to continue hitting those larger rewards to cover the extra losses that the smaller and regular profits type trader is not sustaining.

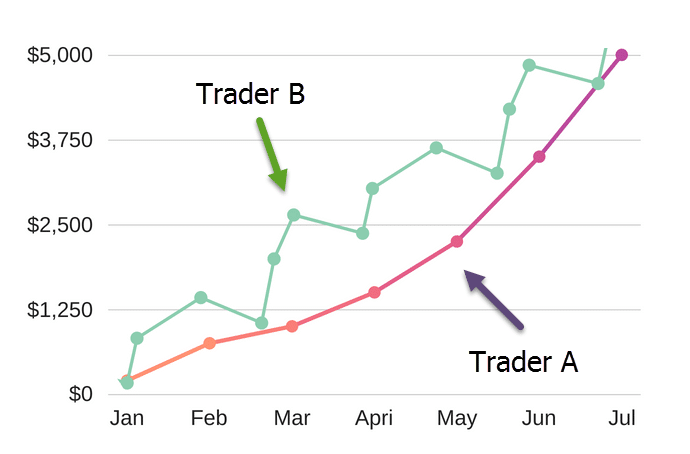

Are You Trader A or Trader B?

The graph below highlights two profitable traders who have made the same gains in their trading.

Trader A and Trader B. Trader A has smaller wins, but because they are going for smaller profits their losses are less and their equity curve smooth.

Trader B aims for bigger rewards and because of this takes on more losses and has a lower winning trade rate.

However, keep in mind for both; Trader A needs the regular wins to account for the losses when they occur and Trader B needs bigger winners because they are taking on more losses.

Higher risk reward is very good in theory as the more you make on your winners, the less and less winners you require to remain profitable.

However; because you are aiming for bigger rewards, there is more chance for price to turn around, whipsaw and stop you.

Neither method is better than the other, but you must find the balance.

It is no coincidence that some traders struggle and continue flipping from strategy to strategy, whilst others flourish.

This is why two traders can make the same entries and one will make profits and the other a loss.

Some traders no matter what their method or system will continually take profits before they should because of emotion. For the same reasons these traders will also hold losers hoping they turn around.

The fear of losing can be crushing and the fear of price turning around and you not cashing in on the profit whilst it is in front of you can be just as powerful.

Download a Free Trading Journal Here

Safe trading,

Johnathon

What a content!!

Full of information and lesson..

Looking forward for you next one.

Thanks Kara and good to have you.

Johnathon